Move Amex Credit Limit Online

Cardholders are presented a variety of bank policies for shifting their existing credit limits. Shifting Chase and Barclays limits has been easy, in my experience; Citi, not so much. If you want to move Amex credit limit, though, it’s easier than you may think. Even better, you can do it online instead of calling. Today, I’m showing you how to move Amex credit limit online in just a few steps. But first, let’s review a few items to keep in mind prior to moving Amex credit limit online.

Good Stuff to Know

- Moving Amex credit limit doesn’t involve a hard or soft credit pull.

- Cardholders can only transfer credit limit as follows:

- Between personal cards

- Between business cards

- Personal to business cards

- Cardholders cannot transfer credit limit from business to personal cards.

- If you want to transfer credit limit between two cards, they must be attached to the same Amex online profile.

- Amex may throttle how much you can use this online transfer method. This may involve the age of the card account and how often you’ve previously used the online method.

How to Move Amex Credit Limit Online

Step #1: Log In To Amex…

…through this link. You’ll then be immediately directed to the Transfer Available Credit page.

Step #2: Review Your Options

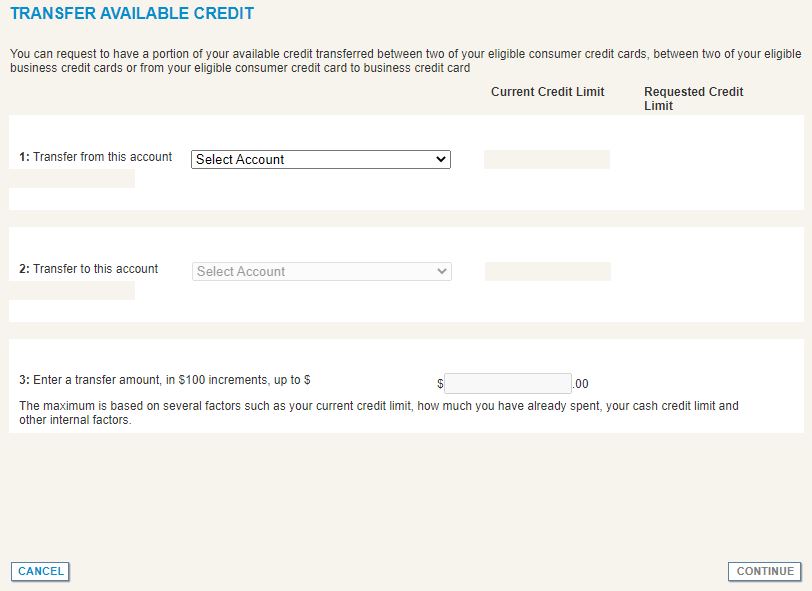

The Transfer Available Credit page looks like above upon logging in. Review the drop down menu in the first section, where you can see from which cards you can transfer credit limit. Based on this selection, you’ll see to which cards you can transfer credit limit.

Step #3: Make Your Selections

Finalize your “Transfer From” and “Transfer To” decisions, then decide how much credit limit you want to transfer (in multiples of $100). Click Continue.

Step #4: Final Review

After clicking Continue, a new window will pop up, prompting you to review. Ensure everything looks right, and click Submit.

Step #5: Review the Outcome

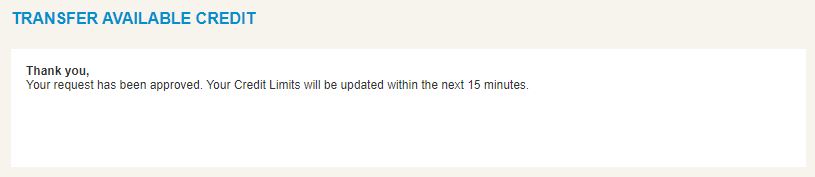

If your request is approved after you submit it, you’ll receive a window like above. If you receive an error, that means moving credit limit probably isn’t possible. You can call Amex for more info, if you’d like.

Conclusion

This article is the first time I’ve ever had reason enough to bother with transferring Amex credit limit online. It couldn’t have been simpler! But with such an easy method, I’ll be careful to think over potential moves and amounts prior to actually following through with future requests. Based on the potential limitations I described earlier, I encourage you to do the same. Beyond that, enjoy maximizing the credit limits of all your Amex cards in pursuit of bigger, better, and more meaningful rewards. How has moving Amex credit limit online worked out for you?

I recently was trying to shift credit around on a few of my amex cards and was having to adhere to a “1 reallocation allowed every 30 days” rule one of the phone CSR’s told me about. I’m not sure if they apply the same limit to this online method, but it may be worth keeping that in mind.

Interesting – I hope someone can chime in and see if this gets around that or if it was a made up rule by a rep.

Just chatted w/ an Amex rep who said that: (a) there is no limit to the total number of credit line reallocations that can be performed and (b) 1 reallocation can be done every 30 days.

Mark R.,

Thanks for sharing this great data point!