My Credit Piggybacking Experience: Easy Money But Not Worth It.

I want to share some lessons learned and advice for others from my own credit piggybacking experience. What is “credit piggybacking”? Maybe you’ve never heard the term, but you probably know the concept. Here’s what credit piggybacking is, how it works, and some lessons I learned from it.

What Is Credit Piggybacking?

Credit piggybacking is essentially riding on someone else’s credit history to build your own credit score. In this post, I talked about how credit works in the U.S. and the factors that make up your credit score. Because you can boost your credit score by having 1) longer credit history and 2) more available credit, credit piggybacking becomes a thing. The most common example of credit piggybacking is adding a family member or a spouse to your credit cards and boosting their credit this way. However, there are services that charge big money for this.

How Does Credit Piggybacking Work?

Credit piggybacking works by boosting the credit score of the person who “piggybacks” onto the credit card history for the card you add them to. Here’s are 2 examples.

Person-To-Person

Most credit piggybacking is for family members. You add your spouse to a credit card as an authorized user. The card has a $15,000 credit limit, it’s 8 years old, and you’ve never missed a payment. In fact, you only charge $5-10 on it per month, since you’re using other cards. Your spouse’s “average age of credit” just got longer. The amount of credit the spouse is playing with just went up by $15k. To the banks, your spouse looks more responsible. Your spouse’s score just went up–anywhere from 10-30 points, depending on other factors.

Why does that matter? If you want to get a car loan, home loan, refinance your mortgage, etc. then credit scores really matter. A difference of 0.5% on a loan can add up to thousands of dollars across the life of the loan.

Paid Services

If this helps people save a bunch of money, of course there’s a market for it. There are numerous credit piggybacking services that charge consumers big bucks to help them become authorized users on someone’s credit card. People who need a boost to their credit score pay to be added as authorized users. The people adding them (credit card holders) are paid for the work.

Because the owner of the credit card adds the user and receives the card at home, the “piggybacker” can’t run up the bill on the card or even access it. Now that we understand how it works, here’s my credit piggybacking experience.

My Credit Piggybacking Experience

Different credit piggybacking services have different rules. I’m purposefully avoiding naming which service I participated in, due to non-disclosure rules that protect their operations. However, from speaking with other people, my credit piggybacking experiences seem pretty common. I’d like to share them with you for consideration, in case you’re thinking about getting paid to add users to your credit cards.

Rules

Each piggybacking service has different rules. The one I worked with accepted certain credit cards but not others (ex: Amex doesn’t list the account opening date but the date you get added, so this doesn’t really help boost your score via credit piggybacking, and most business cards don’t help, either). They also paid me more depending on much the credit limit on the card was. Older cards also paid more. I enrolled 2 credit cards for which people could pay to get added as authorized users.

The Card Issuers

Obviously, credit card issuers don’t tend to like this. The average person might add 1-2 authorized users in the lifetime of an account. If you’re adding a new user every 2-3 months and then removing that person 2-3 months later, they know you’re not a typical user. Different banks have rules about how many AUs you can have at one time, how often you can add them, the process of adding them, etc. The service I used knew these rules exactly and then added buffers to avoid problems/not break the rules. Plus, even though it’s technically not breaking any rules, banks can use that “we don’t want to do business with you” line to shut down your cards.

The Users I Added

I received a copy of personal documents whenever I got paid to add a user. This way, I had enough info to call the number on the back of my credit card and add the user. After adding the user, I got paid when the person pulled their credit report and saw the bump from being listed on my credit card. The cards came to my address and never went to the user, so there was no chance for that person to stick me with a bill. Your credit report (if you haven’t checked) doesn’t show the account numbers. There’s no way for the piggybacker to charge anything to my credit card.

Sounds Great, Right?

I participated in credit piggybacking for over a year. I made over $1,000 from my sofa. It took very little effort. It sounds great, right? So why did I stop? Because it’s not worth the risk, for me at least.

The 2 cards that I had enrolled in the service for people to piggyback on were my 2 oldest credit cards. Those are the cards that help my score the most. They help other people the most when paying for the service, but at the end of the day the person I really need to watch out for is myself. There is an inherent risk that the bank shuts down cards you are using for this service.

Because these are older cards, I rarely use them. I charge a few dollars every couple of months, in order to show signs of life. This avoids shutdowns for non-use of cards. I added and then removed many of the users before my “use old cards” reminder went off on the calendar. Thus, most of the AU cards were never used.

Capital One Fraud Department

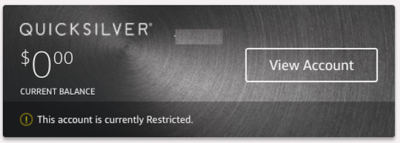

Enter the Capital One fraud department. I’ve had this card since 2012. It has no annual fee and a $17k credit limit. Great card for this hobby. Despite being well within the limits on maximum number / frequency of adding authorized users, Capital One didn’t like the fact that I had more users than the average client and that cards often went unused.

They contacted me asking for proof of identity for myself and a few of the users (they asked for specific names, but it wasn’t everyone). I had those from the website portal and sent the document as requested. 2 days later, I received a request for more documents from Capital One. By the time I gathered the documents, the link to upload them no longer worked. A phone call told me that the link was not working because they’d closed the case.

My account became “restricted”. I assumed that meant it was closed. The card can’t be used for any purchases. I can’t add any users. Luckily, though, I was surprised to see the account still listed as ‘active’ on my credit report last week. That means I still get the benefits of the account age and credit limit. However, I have no doubt that Capital One will eventually close this card for non-use. I’ve been lucky up to this point, since the card wasn’t shut down and didn’t report to the credit bureaus with anything negative. And it still reports for my wife as an AU, bumping her credit score, also. Others I’ve talked to weren’t so lucky.

I told the piggybacking service what happened and that I wanted to end my relationship with them. They admitted that “this happens sometimes”, which is also telling. Despite trying to play it safe with their frequency rates, shutdowns can and will still happen. They gave me $100 as a “sorry”, which surprised me.

Headaches From Creditors

The other down side is the unending cycle of creditors contacting me. Think about who would be willing to pay for help on their credit score. It’s probably someone who has bad credit due to not paying bills on time in the past. For example, the last person I added to one of my accounts currently has a credit card with a $5,000 credit line but a balance of $9,707.85 and a past-due balance of $1,324.00. How do I know?

Now that my address and phone number show up when creditors look for these people, I get both mail and phone calls for these people daily. Collections agencies, creditors with past-due bills, and even child support collectors have contacted me looking for these people. Statements, bills, warning letters and the like get mailed to me. Someone showed up trying to serve papers for a lawsuit against one of the people who had piggybacked on my credit. It takes recurring effort to get these creditors to stop sending me mail and calling me.

Lessons Learned

After this incident, I immediately removed my other account from the piggybacking service. The easy money was good, but it’s not worth losing my oldest accounts. In this hobby, we often suffer from a short ‘average credit age’, due to opening new accounts all the time. Having older accounts that can bump this up is a huge benefit. I can’t lose those, considering I only have 3 cards that are more than 3 years old. Here are the lessons learned from my credit piggybacking experience:

- Think long and hard. What are you risking? And are you willing to get constant contacts for these people?

- Do the benefits outweigh the risks? Easy money sounds good, but what negatives could come because of it?

- Definitely don’t use your oldest card if you do this.

- Don’t risk banking relationships. For example, if you have checking and business and mortgage accounts with Chase, using a Chase credit card for piggybacking is a bad idea. You could lose more than just that credit card.

- If you do it, make sure you use those AU cards. Beyond that, I’d even make sure the transactions aren’t all at the same place for the same dollar amount every time.

Final Thoughts On Credit Piggybacking

My credit piggybacking experience led to some easy money. Despite that, I no longer think it was worth it. I don’t have any cards I could enroll that I’m willing to risk losing. I’m not willing to have my oldest accounts shut down, and newer accounts usually are ineligible, because they don’t provide enough of a credit bump to be “worth it”.

I enrolled in a credit piggybacking service after a referral from someone I know. There’s definitely money to be made in referrals, as well. Credit piggybacking can provide easy money, but my experience says it’s not worth it if you’re in the points & miles hobby. Having “shutdown by card issuer” on your credit report is problematic. Losing your oldest cards is problematic. Those 2 risks outweigh the benefits in my eyes, so I stopped participating.

Update 11/14/2020:

The card was closed by Capital One due to non-use.

Do you know which banks report the original card opening date, as opposed to the date that the authorized user was added?

Amex is the only one I know for sure reports the AU’s add date and not the original account date.

How did you avoid getting involved in this lawsuit? “Someone showed up trying to serve papers for a lawsuit against one of the people who had piggybacked on my credit.”

It had nothing to do with me. “That person doesn’t live here. I have no idea where they are right now.” End of story.

I think you might have inadvertently aided and abetted synthetic identity fraud. That would explain the creditors looking to reach you because the authorized user doesn’t exist.

https://assets.equifax.com/assets/usis/synthetic_identity_fraud_look_behind_mask_wp.pdf

No. The users are real people, verified through several steps. “That would explain” – it doesn’t, because they aren’t connected logically, nor is it possible.

There are so many easier ways to make $1000.

This sort of thing is crazy. You know that you are getting on a list you do not want to be on, right? You think banks don’t trade names of people doing this? You realize you are jeopardizing years of standard credit card use hereby?

The CC companies have treated me fairly and generously for the most part. I try to do the same to them.

I disagree. I’ve opened numerous credit cards with numerous banks since this experience, so the theory I’m on a list and jeopardizing everything with other banks just doesn’t hold weight. There’s no evidence for this theory.

You are a young man. Decades ahead of you. Choose wisely.

I don’t see any reason for you to be condescending, since I haven’t been condescending towards you. Also, you have no idea how old I am. Let’s please stick to facts.

Seems incredibly dangerous. If they did somehow get the card number or a cash advance–maybe walking into a bank branch and doing a little social engineering–you’d be on the hook. Doubt you could plead fraud after the fact when you’ve explicitly authorized someone to use your card.

Theoretically possible but I don’t know of anyone who’s ever even heard a rumor of this happening, due to multiple security layers along the way. It would take multiple, massive failures.

Have a friend ask me if I could do something similar for him. Interesting enough CapOne is my oldest card as well. It’s a Venture with a 44.5k credit limit and I’ve had it for almost 9 years. At the time I knew nothing about and declined anyway. Glad I did. Would hate to loose that line as even though I don’t use my Venture for anything more than a few swipes a year for activity, I certainly don’t want to loose it…especially for something like this. The risk isn’t worth the reward.

I think adding 1 friend is very different than adding/removing people regularly.

The banks are ok with you adding people you actually know. It is when they think you are piggybacking for people that it’s a problem.

Yes, I clearly stated that.

Banks assess risk partly based on credit score. If you do this and credit scores increase but there are more defaults because those people aren’t truly reliable, then the banks will start to make interest rates higher to combat the risk involved.

Yup.

I am amazed at how incredibly selfish people are in this hobby and more generally in the US. If they are making money they don’t stop and think how it is affecting others. There is no free lunch as they say.