Why You May Want To Redeem Point at $.01 Each

There has been a lot of discussion lately about redeeming flexible points such as Ultimate Rewards for cash instead of transferring them to partners. A few weeks ago I wrote about the Staples Conundrum where I detailed how you could earn Ultimate Rewards points for the cost of nothing more than your time.

Matt from Saverocity challenged my post with some good points and a great story, although I still think the $0 cost option is a good idea for some people.

I also recently read a post from Scott at Travel Codex discussing possible future redemption options for Amex Platinum cardholders. One proposed option is being able to redeem those points for 1.2 cents each. He asserts that you should never redeem your points for cash.

Scott also infers that you should use cash back cards if your single aim is to cash in points at $.01 each. He is right of course, but what if you run into a situation where it pays to redeem at $.01? We don’t live in a perfect world and thus there is no perfect solution or answer.

A Real World Example

This past weekend I stayed at the Grand Hyatt Washington. The hotel is a category 5 Gold Passport property, meaning that it costs 20,000 points per night. During busy convention season this hotel goes for more than $400 per night, justifying the points cost.

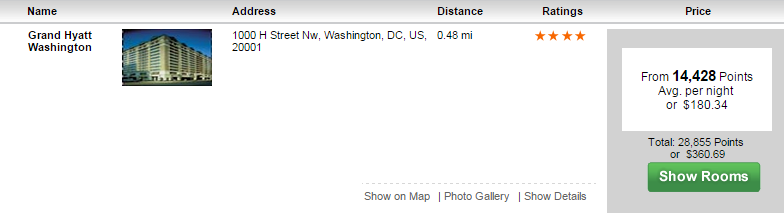

Fortunately I was staying on a weekend in low season, meaning the nightly rate was $150. When checking the Ultimate Rewards portal’s pay with points option, I learned I could redeem 28,885 points for two nights in the hotel. That is less than the 40,000 points it would take directly through Hyatt. (My main source of Hyatt points is Ultimate Rewards.)

Pay With Points – Not So Fast

Sounds like a win right? Well there were two problems. The Chase portal was charging a higher rate than the Hyatt website and I am eligible for the “My Elite” rate which is 20% off, meaning I could book the hotel for $119.20 per night plus tax or $272 all in for two nights.

Considering my cash price would be $272, if I utilized Chase’s pay with points and spent 28,885 points, I would essentially be redeeming my points for .94 cents each ($.0094). That is NOT GOOD!

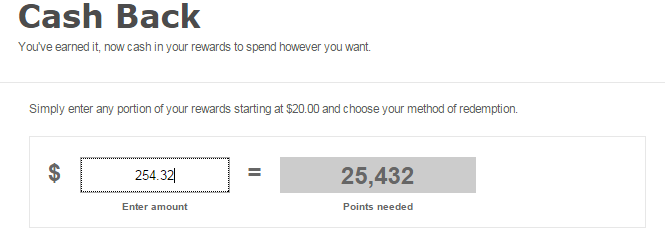

Then I thought of a third option. I could pay cash for the booking and repay myself back with Ultimate Rewards points at $.01 each. That option would cost me 27,200 points and I would earn points and could use one of my suite upgrades which is going to expire soon.

Doing the Math

Hyatt Gold Passport members earn 5 points per dollar spent plus Diamond members get a 30% bonus. That means that my booking would earn 1550 points. Since I transfer Ultimate Rewards points to Hyatt all of the time, I will subtract those from my cost. My cost now is 25,650 points.

So to do a quick recap, I could transfer UR points to Hyatt and pay 40,000 for two nights, book through the Chase site for 28,885 points or book directly and pay myself back for 25,650 and stay in a suite! I chose option 3.

A Few Caveats

Now before I go any further, I know there are more efficient ways to do this, like pay for the stay with an Arrival card and use those miles to pay myself back, but I use the Arrival for so many other travel expenses that I don’t feel it is the best option for me.

I actually did pay with my Arrival as a backup though, so that option is still on the table. It is also important to note that I also get rewards on the credit card used to book, where I would not when paying with points.

Hyatt Gift certificates are also currently 10% off as well, which would mean additional savings. I will leave credit card rewards & gift certificate savings out of the calculations for simplicity.

I could also stay in a different hotel, but the lounge access and other Diamond amenities make that a less than ideal option.

The final option is to pay the cash out of pocket, but I earn miles/points to travel for free/cheap. Why would I pay cash when I have an abundance of points sitting around? That isn’t very efficient. (Although I know some people would disagree with that assertion.)

What Constitutes Value

When you talk about points and their value, it is hard to take into account all of the possible discounts and other factors going into that calculation. For example, booking through Chase I was getting a 1.2 cent per point value, but their cost was higher.

So my $.01 direct redemption is worth more than booking for 1.2 cents via Chase. It is also significantly higher than the $.068 redemption value directly through Hyatt.

Conclusion

Should you accumulate Membership Rewards, Ultimate Rewards and other flexible points currencies to transfer them for a $.01 per point value? Absolutely not! With that said, there are situations like this where I may be redeeming at 1%, but my actual value gained is higher than that. Maybe I can’t exactly calculate the dollar amount of that value, but it is definitely higher.

I know posts like this can be hard to follow, but hopefully it gives you another perspective on deals, miles/points and travel in general. All rules in life have exceptions, including the one that you should never redeem flexible points for cash at $.01!

So what do you think? Am I way off here? What would you do? I know some people will have issues with my logic. Let me know in the comments!

I have two things to comment on:

1. You are making what I have just coined “The Pretentious Tarts Folly” that is that you look at the Hyatt, think that is good value relative to the what you could otherwise get it for (either using cash or points) and therefore see an ‘opportunity’. However, you don’t NEED to stay at the Hyatt, you need to stay in a hotel. So don’t allow the Hyatt to frame the value calculation. Only Pretentious Tarts will claim they simply MUST stay at a particular property when there are alternative options, and by doing so forgo the bigger market pricing.

2. You should pay with points at 0.1 cents valuation if it keeps your cash in your pocket. Cash is king. The ONLY thing to think about is that if you ever need those points for something in the future, such as a United flight, or whatever it is, and you don’t have them because you squandered them at 0.1cents each, you now lose out.

So you need to look at your travel needs and match your point acquisition strategy to that.

I chose that hotel because it was going for a great rate (better than comparable hotels of the quality) and combined with my Diamond status it provided the best value to us. That is the base of the argument.

In other news, you didn’t go to spam this time! We are making progress.

How do you have Diamond status, does your employer pay for your travel, or did you earn it by spending your own money?

I did the Diamond challenge and paid for the stays myself using cash + points. I used Barclay’s Arrival miles to pay the cash portion.