Cash Is Not King

I have long been an advocate against personal debt. In prior posts people have called me out, saying that debt is good in certain situations. As someone with a background in business and finance I know this to be true, yet my stance remains the same.

When I say that debt is evil, I am talking about personal debt. Businesses need debt in order to grow. That is a much different beast. Personal debt on the other hand, so negatively impacts people’s lives that it isn’t beneficial in 99% of situations.

When Is Personal Debt Acceptable

With that said, I consider there to be two big exceptions to the “no debt” rule. The first comes in regards to real estate. Since most people don’t have enough capital to buy real estate out right, getting a mortgage can be a positive move, if done responsibly. I do firmly believe in paying off a mortgage as soon as possible on a primary home. Just because it is a 30 year loan doesn’t mean you should wait 30 years to pay it off! Investment properties fall into the business category in my thinking.

The second kind of debt that I personally consider alright is short term float. Short term float is the debt that you incur by using credit cards and paying them off on their due date without paying any interest. In reality this isn’t a true debt, but strictly speaking it is. Technically as soon as you swipe that card, you are in “debt”.

Short Term Float Is Smart

Not only is short term float an acceptable debt in my opinion, it is a smart one. I believe that you should almost ALWAYS use credit cards when paying for things. You may be asking why this is.

Those of us who love miles & points use credit cards to earn rewards. In truth, the banks are paying us a rebate. They charge the merchants a fee (usually around 3%) and thus kick back a portion of that money to cardholders.

Don’t Miss Out On The Rebate

What happens when you pay cash then? Well about 99% of merchants factor in the credit card fee when calculating their prices and most don’t offer a cash discount. This means that you are paying the same price up front, but not receiving a rebate on the back end.

While the amounts and forms of rebates vary (cash and/or points), a pretty good starting points to calculate your CASH LOSS is 2%. 2% is the rebate on a few cash back cards such as the Fidelity Amex, Barclay’s Arrival Plus & the new Citi Double Cash. (Non-affiliate links.)

You Are Overpaying & Losing Big

By not using one of those cards, you are overpaying by at least 2% on EVERY SINGLE CASH PURCHASE. While that may not make a huge difference on a small transaction, over time it adds up. Spend $20,000 a year on various things and you are giving up $400 each and every year. (Many people spend much more than that!)

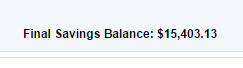

While I personally earn rewards in a variety of currencies and thus have a strategy, what if you were to just use one of those cards to earn 2% in order to simplify your life? What if you invested those $400 every year and didn’t touch them. How much money would you have then?

If you saved the $400 per year and earned a conservative 6% rate of interest, in 20 years you would have $15,403.13. Pay cash and you have $0. It is as simple as that.

Debit Is The Same As Cash

Don’t let the banks suck you in with non-rewards earning debit cards either. Paying with a debit card that doesn’t earn rewards is the same as paying with cash. You are paying 2% more for everything and sometimes merchants even charge a debit card fee.

There are of course situations where it makes sense to pay cash. Many gas stations offer a cash discount for example. In a situation where a merchant offers a discount, calculate it in the terms of a percentage of total cost. Is the discount more than the rebate you are receiving on your card? If it is, then you should pay with cash, but in my experience it usually isn’t.

I started this article by talking about how no one should go into debt. You absolutely should not purchase things that you cannot afford on credit. I believe that is the worry of most people who shun credit cards. They are worried they will somehow spend more money than they would otherwise. It does take discipline, but if you have good credit and no debt, then you are obviously already disciplined.

Earn More than 2%

If you are willing to put some effort in, then you can often earn more than 2% back on certain purchases. By utilizing my Chase Ink card for example, I earn 5x Ultimate Rewards points on my internet, tv and cell phone bills each month.

Ultimate Rewards points can be redeemed at 1% for cash, which means at a base level I am getting 5% back for those transactions. The reality though is that I get between $.02-$.03 on average when redeeming those points with transfer partners. That means I am getting a 10-15% rebate on those expenses every month.

I also have the Old Amex Blue card which pays 5% cash back at gas, grocery & drug stores after the first $6500 in a year. I spend a lot, so this card makes sense to me, but the regular Amex Blue Cash Preferred earns 6% on grocery purchases up to $6,000 per year for smaller spenders. By shifting my spending in certain categories to cards with bonuses, I am now earning greater than 2% overall.

I estimate that between the 2.2% I get back on my Barclay’s Arrival and the higher return I get back on cards with bonus categories, I essentially earn about a 3% rebate averaged across all of my purchases. The Chase Ink does have an annual fee, as does the Arrival, however the Citi Double Cash & Fidelity Amex 2% cards do not, making it possible to earn 2% back with no fee.

Conclusion

Perhaps you thought that using cash was a good thing. A way to stay out of debt. At the very least you felt that you were being fiscally responsible. Well paying cash for everything may be responsible, but so is using credit cards and paying them off at the end of the month.

There is simply no way to deny that you are throwing away money when paying with cash. No matter if you choose to use a card that pays you a rebate in points or cash, getting no rebate at all is not the best financial decision in my opinion. I pay the same amount of interest that you do each year, but the banks pay me to do it!

[…] Shawn did a nice piece a while back discussing why you should never pay with cash for anything. It is definitely worth a read and it ties in nicely with this piece. […]

I could beat ’em with a stick and it would do as much good ( most of my friends ) . I did the complete account presentation for one friend who is in Australia right now . I provided the numbers , the cards to get , links for those cards and links for award travel schedules . His Fico is 800+ and he’s traveling on purchased tickets . What are ya gonna do ?

[…] Before getting into the miles and points hobby, I used to pay cash for everything – but Miles to Memories tells us why you should almost never do that. […]

[…] Why You Should ALMOST NEVER Pay With Cash – 9/4/2014 […]

Of course for anyone reading this who is not already a member of the choir you’re preaching to, EVERY dollar spent should go toward a signup bonus and be earning anywhere from 6 (SPG at 25K) to 81 (IHG at 80K) miles, points or cents per dollar spent. After doing that for a couple years, you might run low on available offers and settle for 2 cents for a while…

That is generally true. Many people are not comfortable with having a lot of credit cards though. At least those people can earn the 2% very easily.

Thanks Kenny.

Good post for beginners, Shawn. I was one not too long ago, or at least only had a 2% card.

When I discuss this matter of personal finance with friends, I always start with a few “before you even think about starting” key points. 1) You must have good credit to go after many cards (or else you must start slow and build up your credit). 2) You must pay your cards off in-full every month. 3) You must be convinced that you and your spouse will not fall prey to changing your consumer behavior in ANY way because of having the credit cards.

I’ve had people argue point #3 with me before. Some people think that it is impossible to truly not change your consumer behavior. Subconsciously you spend more. Whether it’s because it’s easier to pull out a card than spend cash, or you are “chasing points.” I don’t buy this argument, but it is an interesting viewpoint.

I think the other hurdle I face when talking to newbies is helping them to understand the implications on their credit score(s). Notably, most people assume that more cards equates to a worse credit score. Which shouldn’t be the case, if you are smart about it. Yet one does have to consider the impact of lots of card apps on a potential mortgage loan.