Profitable Hacked Mexican Car Rental

A few years ago I pulled off the ultimate hack. Or at least it was one of the more entertaining experiences I have had while in this hobby. I noticed that rates to rent cars in Cancun were very cheap, but upon further investigation I discovered the reason for this was because of a rental car “scam”. Here is how I described it:

The rental companies made it nearly impossible to rent without buying their overpriced insurance. Unsuspecting consumers show up for their “cheap” rental and end up paying far more than they expected.

Avoid Costly Mexican Car Rental Insurance

At the time I discovered a good rate that included basic insurance, however it was very misleading. A low price would show through the booking but the confirmation email said extra insurance was required. There was a loophole though. Putting a deposit on a credit card (I have plenty of those) and bringing proof of that card’s insurance coverage was enough to avoid this charge.

Let’s just say the Hertz reps were not used to someone showing up with a printed insurance declaration from a credit card along with the knowledge of how all of the rules work. While you can check out the full story here, the clear highlight for me was the rep, who was an older gentleman, slamming his hands down in anger as he finally realized he wasn’t getting a commission on my sale. He gave me a hard time and it involved many rounds of conflict, but in the end I got my $31 out the door car rental which I thought was a good deal…until now.

How My Car Rental Unexpectedly Became Profitable

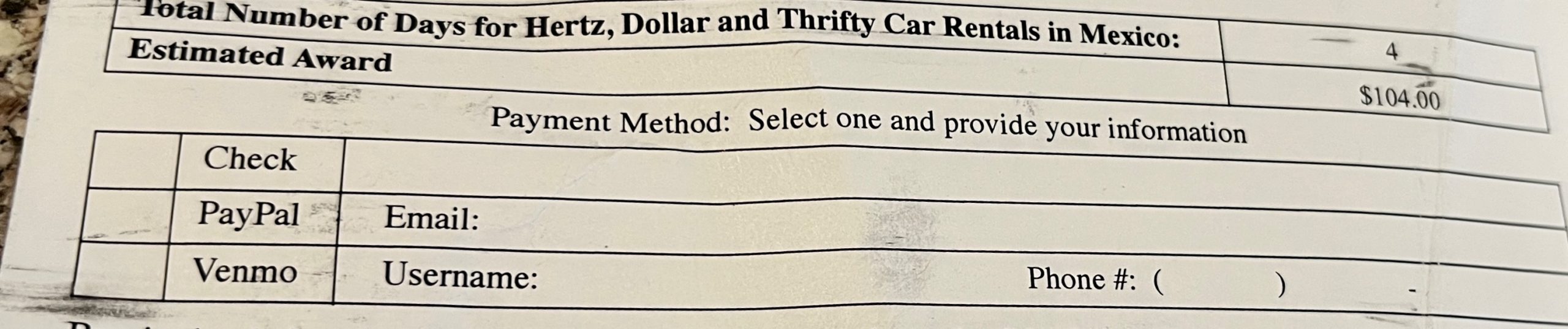

While that deal was amazing and we enjoyed that trip to Mexico several years ago now, the rental actually ended up becoming profitable. As in I MADE money off of it thanks to our old friend the class action lawsuit. Apparently Hertz got in a little trouble for the sales practices I described (and others no doubt) at their locations in Mexico. A class action lawsuit came about as they do and everyone who rented gets a payment. How much you ask? Well for my 4 day $31 rental the amount I will receive is…… $104.

So not only did I “hack” my Mexican car rental to avoid the insurance “requirement”, but the entire rental ended up being $73 profitable.

Best Tips for International Car Rentals

I’ll use this post as a good reminder that it is always a good idea to be diligent when renting a car, especially in another country. Don’t just show up without knowing the landscape, what is expected as far as insurance and what you are going to do. While I like to avoid costly rental car insurance like I did in Mexico, at the very least I want to know what to expect going in. For example, I did a similar thing in Panama, except I determined my best option was to pay for the insurance and I was expecting the extra charge.

Renting in other countries should also come with a slightly greater level of diligence than compared to the U.S. in other areas as well. While I’ve never had any issues, laws are different and thus “being as safe as possible” is a good strategy in my opinion. DOCUMENT EVERYTHING, check the car carefully, verify fuel levels and don’t forget once again to make sure to DOCUMENT EVERYTHING both with video and photos but also on the car rental paperwork. It is much harder to get help once you have left the lot.

Profitable Hacked Mexican Car Rental – Bottom Line

Sometimes this hobby takes us in directions that don’t always bear fruit. Other times knowing the rules and winning at “the game” can be incredibly rewarding. In this case avoiding the insurance fees, watching the rep’s anger and then getting this payout years later is definitely fun. Have I tried similar things at other times which amounted to nothing but frustration? Sure, but let me have this win! 🙂

Have you received your settlement from Hertz yet? My car rental in Mexico was part of the lawsuit and I filed my claim well before the due date, but I’ve yet to receive what is due to me. Do you have any information on when funds will be distributed?

We travel to Mexico a good bit and always have this issue including our trip to Cancun 2 weeks ago. My wife is Mexican also, but that doesn’t help our case at all. I also come prepared with the credit card letter and everything. The only time I had it work internationally was in Costa Rica one time. This was our fourth trip to Cancun and it’s always the same hassle. They say they can’t accept the credit card insurance as it isn’t an authorized provider from the Mexican insurance agency. In the past twice they were able to charge the full cost of the car to my credit card as a damage deposit (about $15k) and refund it when I return. If something happened the credit card insurance would pay me directly. Other times I’ve just finally been able to negotiate a “cheap” package insurance rate and just buy the insurance. Last week they wouldn’t do the full car deposit option and I had to buy something if i wanted the car. After about 30 minutes I told him just to give me the cheapest thing they had and be done with it. It was about $150 extra for CDW and PLI. Others there had the same problem and a lot were just walking away, including those with credit card letters, as it was going to be like $500 extra or more. I even called the credit card benefits provider prior to our trip to discuss with them since it’s always an issue. The lady was very nice and had never heard of that issue before. She was curious herself and followed up with her supervisor and called me back several days later. She confirmed what I told her and basically yeah the credit card insurance isn’t recognized by the Mexican government so buying the car rental insurance or putting full damage deposit on card, if possible, is the only way to go. The credit card companies need to investigate this more and if in fact Mexico is not allowed it needs to be stated on the benefit form as an exclusion just like the handful of other countries as it creates so much headache for everyone when they go with the credit card form and keep getting denied and have to argue. Our dilemma was always with Europcar, but this time was Keddy, which was owned by Europcar. However, the actual check in office was Fox car rental which is also owned by Europcar. I haven’t tried any of the bigger USA companies like Hertz or Avis in Mexico, but curious if they put up a fight also or will accept the credit card insurance. I did rent from Hertz awhile back, but can’t remember what I did about the insurance at the time, but probably bought theirs not knowing about credit card insurance. I also got the letter about the class action suit and submitted it, but don’t know anything about the payout yet.

Good info. Thanks Mike! It’s such a complicated mess.

I just tried this old way at every rental car agency at the Mexico city airport. And a few off airport locations. They seem to have gotten smart now. I have found a work around that will not allow them to force you to buy insurance. Buy or reserve on the rental car companies Mexico website. At least as of two weeks ago. The prices between booking sites in Canada and the states. Was very similar to booking direct. Know that was not always the case. But it was when I tried. Also on the Mexican sites. It specifically says 3rd party insurance included.

Great info! Thanks Dustin.

Congratulations. Out of curiosity, why did you pay up in Panama? I’d have thought that the circumstances would have been pretty close to identical.

Because it ended up being less than $20 a day all-in and I was less familiar driving there plus I was with a friend so we split it. I also had a rate in Mexico that included some insurance and then the CC insurance combined with it was enough. In Panama my rate was car only and the insurance cost wasn’t very high.