No ATMs? No Problem! Send Money To Yourself Before Your Trip

Send money to yourself in advance when going to a destination where your ATM card might not work. Sounds crazy, but it’s actually an awesome plan. This comes as a follow-up from comments on a previous article: If You Don’t Have A No-Fee ATM Card, You’re Getting Ripped Off. Let’s look at when it’s a good idea to send money to yourself, plus the limitations to this strategy.

The Background

In my previous post, I talked about saving money by using ATMs at your destination, rather than exchanging money. You always lose money in the exchange, so try to avoid it. But what if using the ATM at your destination isn’t possible? That leaves bringing cash to exchange as the only option, right? Wrong!

When To Send Money To Yourself

I will admit that the idea of “send money to yourself in advance” is not an ‘all the time’ plan. You obviously won’t need this when visiting places that readily accept credit cards. If you’re going somewhere with lots of ATMs that accept cards from U.S. banks, you don’t need this. But what if you won’t be able to use the ATM at your destination? Maybe you’re going to Cuba, Angola, São Tomé & Principe, Eritrea, etc.? You can’t use your U.S.-backed ATM card in these and other countries.

And what if you’re stopping in other countries first? You don’t want to lug a bunch of US Dollars through other countries (customs officials don’t like things that look like trafficking). What if you don’t want to be seen as a foreigner at an ATM, making yourself a target for robbery at your destination? Maybe payday hits while you’re in country A before visiting country B, so you can’t take out a lot of cash before leaving home. However, A and B have different currencies, so withdrawing and exchanging again isn’t ideal. Enter the idea of sending money to yourself in advance! Western Union is the most famous, but there are others like TransferWise and Xoom from PayPal. (Make sure the one you choose has a pick-up location where you’re going)

Or On The Spot When…

Another good example of when this works is an experience my wife and I had in Suriname. We arrived late at night, and the first ATM at the airport was broken. The 2nd wouldn’t accept our cards and kept giving errors. We needed cash to pay at check-in at the B&B we’d booked online that was “cash only”. It was after midnight, and we didn’t want to run around looking for more ATMs. From my phone, we sent the money to the B&B owner via Western Union. She let us check-in after providing the receipt.

Use It As A Back-Up Plan, Even If You Might Not Need It

You also can do this before heading to places that are maybe a bit…sketchy. If you want a back-up plan in case of emergencies, this is another good time to send money to yourself in advance. You’ll pay the fees to send it. If you don’t need it after all, don’t pick it up. Once you have access to the internet again or return home, cancel the transfer. If the money transfer hasn’t been picked up, there’s no fee to cancel (at least with Western Union). Paying a couple bucks in fees to have cash waiting for you in case of an emergency is worth it for peace of mind.

This Isn’t Perfect

Granted, this isn’t perfect. Firstly, you will lose about 3% as an exchange fee. If you send $100 from the U.S., you’ll get about $97 worth of the local currency at pick-up. Also, if you’re going somewhere with an “official” and a separate “black market” exchange rate, you’ll get the government rate (read: worse rate). Picking up Western Union in Angola, for example, will get you only half the money you’d get exchanging cash on the street.

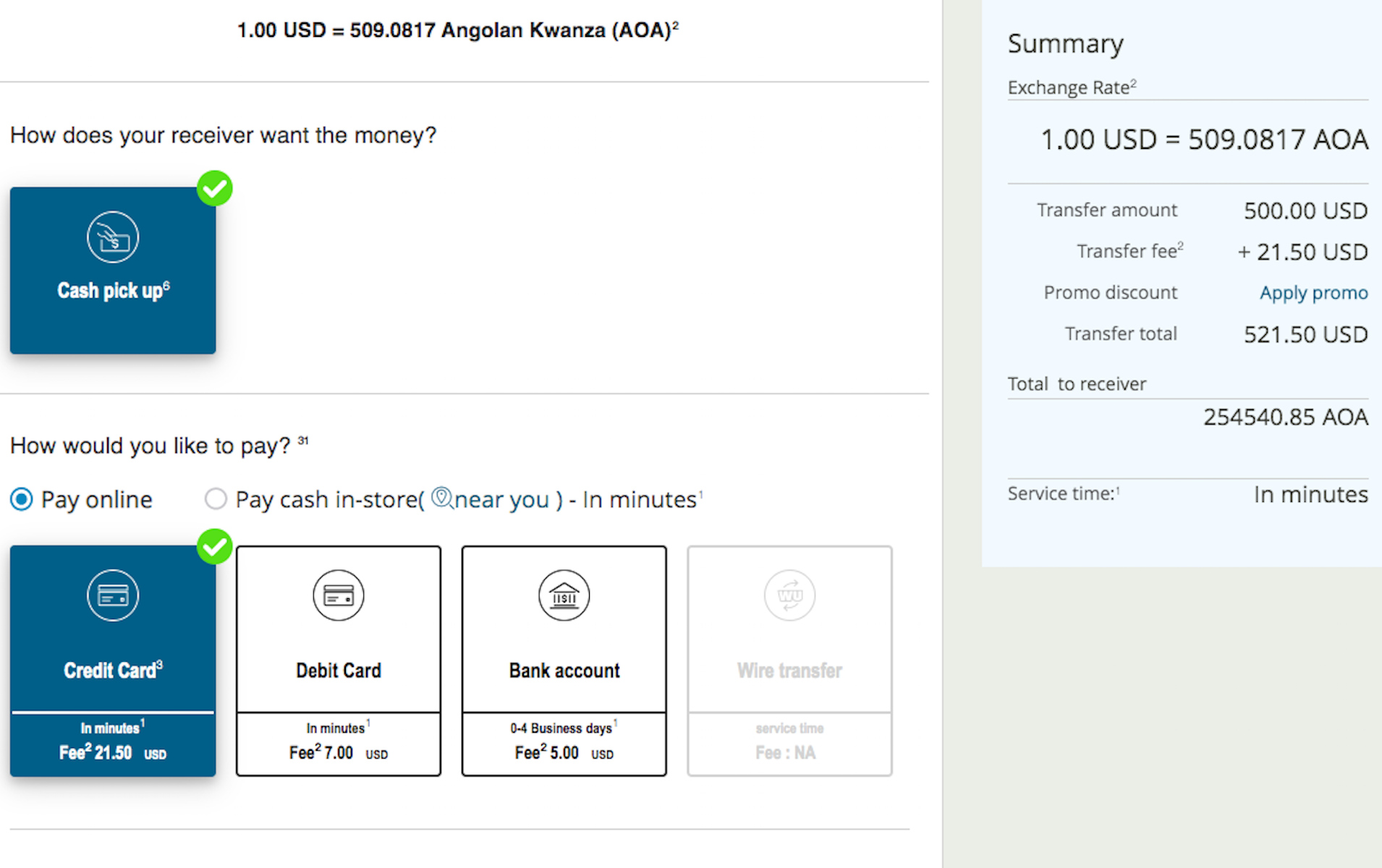

Secondly, you’ll pay anywhere from $4 to $25 in fees to create the transfer. Fees depend on your funding source, how you create the transfer, and destination country. You can pay with cash at an in-person location (fastest transfers & cheapest rates) or transfer online / via mobile app. You can even use a credit card, but watch out for huge fees, since this counts as a cash advance. Lastly, if you don’t spell your name exactly as it is in your passport (you need that + the confirmation number to pick up the money), expect huge headaches trying to retrieve the money. Make sure it matches perfectly, especially if you have a middle name in your passport!

It’s also worth noting that there can be a lot of paperwork involved if sending money to a country with Treasury Department sanctions. Countries with actions under the Office of Foreign Assets Control mean you not only can’t use your ATM card there but also need to explain why you’re sending money there. Case in point: before visiting Sudan, my hotel sent me at least 10 emails telling me to not log into my online banking/use bank apps/etc. while there or I’d likely have my accounts shut down for violating these laws. They also advised me to come with cash and not try to send money to the country. OFAC sanctions aren’t a joke, so think about this if sending money to a restricted location. If you can bring cash or send money to yourself at an earlier stop in your trip, it might reduce headaches.

Final Thoughts

It has limited applications, but you can send money to yourself before going into a situation where your options for getting cash are limited. If you can’t use the ATMs there, this can work like an ATM for you. If you can’t withdraw a bunch of money before leaving home, use a mobile app to send money to yourself once you’re ready. Also, you can use this as a way to cover yourself for emergencies. Knowing you have cash nearby that you could pick up provides some peace of mind.

Have you ever sent money to yourself? Now that I’ve brought up this idea, would you use it on a future trip?

Interesting. Thanks for the idea as I certainly would never have thought of that. You sure pick some highly unusual places to go on vacation. Surinam and Sudan aren’t even on my radar. Speaking for myself, I’d love to hear about those places, and think a lot of us might learn more than reading about travel to Ireland or some similarly well traveled destination.

Christian – great idea for an article on uncommon places that people should visit.