Threads for Almost Free with the Banana Republic Visa Card

I don’t buy clothes often. It seems like I buy less with every passing year. That’s partly because I’ve worn some of my favorite items for about 20 years, for better or worse. It’s also been nice forgetting about business attire for the past few years since quitting my job. Therefore, I wasn’t initially intrigued by a credit card that earns free clothing. After reflecting a bit more, I liked the idea of clothing my family for close to free. I recalled Shawn’s affinity for the Banana Republic Visa card a few years ago, and I noticed that the card still held solid benefits. Last year, I picked up the Banana Republic Visa card, and it’s been a fun ride earning and redeeming ever since. Here’s why!

Disclaimer: To be extra clear, Banana Republic Visa card rewards can only be redeemed for clothing and other items at the Gap family of stores.

Banana Republic Visa Card Highlights

The Banana Republic Visa card is issued by Synchrony Bank, a popular issuer of department store and other niche credit cards. They issue the Banana Republic store card and the Banana Republic Visa card, in addition to other flavors of cards within the Gap family of brands. Of course, the more versatile version of this card is the Visa which can also be used at merchants outside Banana Republic and the Gap family of stores.

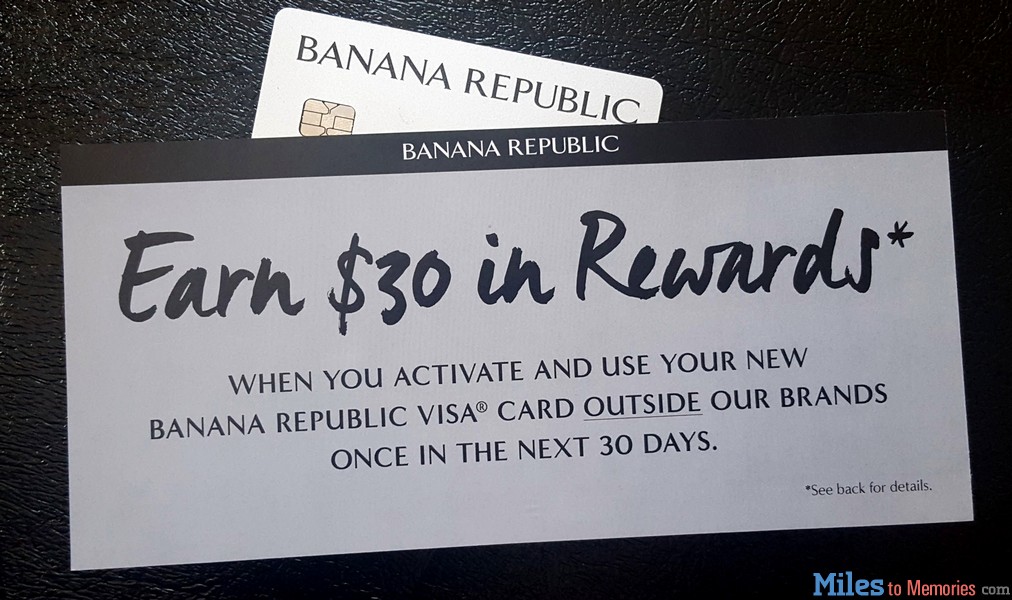

The Banana Republic Visa card earns 5 points per dollar spent at Banana Republic, Gap, Old Navy, Athleta, and Hill City stores. All other purchases normally earn 1 point per dollar spent. Each is worth one cent per point for redemption at these stores. Approval for a card does not generally include a welcome offer, but I received a $30 rewards certificate after first purchase when I obtained the card.

Elite Status

A cardholder can also obtain Banana Republic elite status with card spend. I’m not joking – it’s actually the only status I substantially benefit from other than Hilton Honors Diamond! A Banana Republic Visa cardholder obtains Luxe status with $5k spend in one calendar year. The primary benefit of Luxe is a 20% bonus on all earned points each quarter, in addition to free standard shipping, complimentary alterations, and a “choose your own sale” day (15% off).

This all sounds pretty mundane, though, right? Just wait…

Targeted, Ongoing Spend Offers

The Banana Republic Visa truly shines due to targeted spend offers on the card. Here’s just a sample of the offers since I obtained the card last year:

- Get a $50 reward after using the card 5 times outside their store brands.

- Earn 5 points per dollar on all spend at grocery stores, wholesale clubs, and dining.

- Earn 10 points per dollar on all spend at grocery stores and on recurring bills.

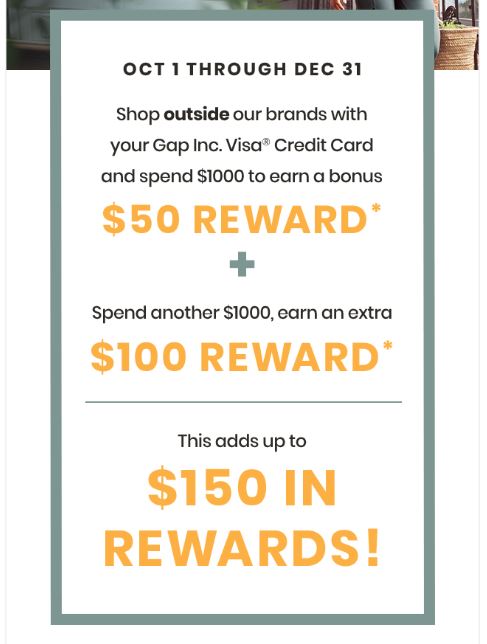

- My current offer: Spend $1k outside their brands and earn a $50 reward. Spend another $1k and earn another $100 reward.

Indeed, there are useful offers for both normal and very active spenders. For fun, I triggered the $50 reward offer with five purchases which totaled under $1. I loved that 5,000% rewards return. Active spenders have no problem earning substantial rewards by spending in useful categories. On top of these offers, Luxe bonus 20% earning is included, albeit only on the base point amount. Therefore, with Luxe status, I effectively earned 5.2 and 10.2 points on the 5x and 10x offers, respectively. Earning 5.2% and 10.2% in uncapped rewards is undeniably solid.

Offers Are Unpredictable

I don’t have any firm grasp on how or when any cardholder gets offers. I’ve talked to long-term cardholders who have never gotten targeted. For what it’s worth, since my wife and I have each held accounts, we’ve been targeted the majority of the time. We actively spend during the offer periods and achieve the thresholds for the offers, when required. However, we do not use the cards for any unbonused spend. I can’t definitively say spend “helps” to obtain more offers. But I do know we actively spend during offer periods, and we keep getting them! We’ll ride the wave as long as it lasts.

Redemption

I receive my rewards via paper certificates with my billing statements; they are also available in my online Banana Republic account. The certificates I was issued in September expire on 31 March 2021, so I have approximately six months to use them. Point earning is unlimited, but I’m only issued a maximum of $250 in rewards each statement period. Any extra points I accrue over that maximum are held in my account for the next statement period. Minimum certificate denomination is $5, and maximum is $50. I can redeem certificates online or in-person at stores. I can use up to three certificates per transaction in-person and up to five certificates in one online transaction.

The purchase value must be greater than the value of all certificates I redeem. I must use the Banana Republic Visa card to pay for the remainder of the transaction. If I return an item, the appropriate dollar amount converts back into points and returns to my Banana Republic account within 2 billing cycles.

Tips for Maximizing

Based on the redemption requirements, effectively using and maximizing these certificates can get tricky. First off, in order to satisfy redemption requirements while minimizing our cash outlay, we focus on our pre-tax purchase totaling just over the entire certificate amount we plan for one purchase. For instance, if we are applying three $50 certificates, we aim for our pre-tax purchase total to be at least $150.01 and as close to that amount as possible.

Another nice perk of these certificates is we do not pay sales tax on the portion of our purchase covered with certificates. For example, with a $52 purchase total using a $50 certificate, we pay a few cents of tax on $2, rather than a few dollars of tax on $52.

Online and store promo codes also stack with certificates.

And While We’re At It…

We track through a portal for our online orders – my favorite portal is the Membership Rewards version of Rakuten. Generally, Rakuten provides portal rewards only on the portion of the purchase not covered with certificates. However, I have randomly received portal rewards on the complete purchase (even the portion covered with certificates) on several occasions. That random occurrence isn’t something to rely on, but it’s a nice bonus if more rewards show up!

My Overall Take

I primarily consider this card a great option for fans of Banana Republic, Gap, Old Navy, Athleta, and/or Hill City. Also, it may be worth considering for those of you who aren’t brand loyal but are looking to decrease your clothing bills. Again, issued certificates max out at $250 per statement. To double our redemption capacity and chances for more targeted offers, my wife obtained the Banana Republic Visa a few months after I did.

These rewards have been great for my family’s clothing needs. My personal highlight has been redeeming rewards for some long-overdue replacements for my running attire (unfortunately, Hill City is permanently closing in January). No doubt, the rewards have been lucrative. But we also remind ourselves to focus on legitimate needs and a few wants with the remainder of rewards. As an FI individual, I’m hyperfocused on preventing lifestyle creep from setting in with these rewards.

Bottom Line: I consider the Banana Republic Visa an excellent card for everyday rewards by greatly reducing my family’s clothing costs.

Banana Republic Visa Card – Conclusion

The Banana Republic Visa card is definitely not for everybody. But if this card fits your lifestyle, you can potentially earn lucrative rewards. I know there are other flavors of Gap/Old Navy/etc cards; this article only speaks to the Banana Republic version of the Visa. Do you have the Banana Republic Visa card? How about a card from the other stores? How has your experience been?

I’ve had both cards for years, before I got into the points & miles game. I kind of forgot about them but then started getting those offers in the mail and now regularly rotate them to enjoy the free clothes! Gap card also gets the offers in the mail for extra certificates. great write up!

Lisa,

Thanks for reading and the DP on the Gap card!

Makes me want to pull out my Gap card and use it to see what they will offer…

TimD,

Yeah, why not put a bit of spending on the card to see if anything triggers new offers?

Do you earn 5x points at Gap Factory and BR Factory as well?

I don’t have firsthand knowledge since I don’t shop at either of those stores, but yes, that is my understanding.

Yes, great article! I remember hearing about this card before and completely forgot about it, it really does sound great if you can get some of the targeted spend offers.

My only question that you didn’t mention specifically in your write up (or I missed it), how long do you have before the certificates expire? Are they only good through the end of the next quarter?

Jason,

Great question. The certificates I was issued last month expire on 31 March 2021, so that’s approximately 6 months to use them.

Thanks for the great post, Benjy! Although I had been aware this card had great benefits, I had no idea how it exactly worked. This one is definitely going on my list.

Karen,

I hear you – it’s not exactly the most straightforward rewards system. But it’s definitely worth it for those who put the time in!

Great write up on this card, I plan to finally pull the trigger on it next month!

Larry,

Thanks for reading. Good luck on the targeted offers!

Totally agree!! I have had this card for 5 years now and here are the best benefits of the card and the store:

1. Great customer service from GAP…never had an issue that was unresolved

2. Easy & free returns

3. The Luxe card gives you free alterations and both cards give a birthday coupon.

4. Luxe card always gets free shipping

5. The whole store is almost always on sale.

6. They make almost everything in a Tall size as well — being 6’6″ I have the widest range of choices here when you combine Old Navy, GAP & BR.

7. I haven’t paid for clothes in 5 years using this card

And no Annual Fee!

Yes, good stuff all around!