Visa Gift Card Fraud! What Happened & How to Protect Yourself

Recently, I was the victim of Visa Gift Card fraud. Big picture, I’m lucky this hasn’t happened earlier. While I do take many measures to ensure I’m not the victim of such fraud, I’m unable to completely avoid such a scam. Let’s get into what happened, the actions I took, resolution, and additional steps I plan to take to avoid Visa gift card fraud in the future.

RELATED: The Latest Visa Gift Card Scam Has A Very Elegant Plan

Buying the (Unknowingly) Damaged Visa Gift Card

In March, I purchased a Visa gift card (issued by US Bank) at Kroger during a normal grocery shopping trip. As always prior to purchasing, I inspected the gift card packaging. I ensured that the label enclosing the activation bar code had not been opened and that there were no other open or damaged areas to the gift card packaging. I then checked out with my groceries and gift card. During the checkout process and prior to paying, I examined the exposed portion of the activated gift card. Based on Joe’s experience with buying fraudulent gift cards, I knew to check the card for a plastic feeling (rather than paper). I felt the plastic, and all seemed fine. Finally, before leaving checkout, I ensured the activation receipt looked right.

Attempting to Use the Card

A few days later while picking up a few additional items at a different supermarket, I tried using the card. The card reader did not recognize the card. There wasn’t even an error message; it was as if there was no card swiped at all. The representative canceled the transaction. I planned to investigate once I got home.

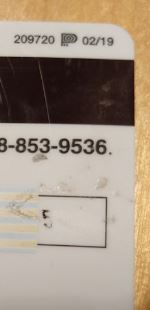

Spotting the Damage

When I got home, I checked the gift card’s balance. During this process, I noticed that the three digit CID was smudged. Upon further inspection, I saw that only one partial digit was on the card. The other two digits were totally removed (or were never there in the first place).

Reporting the Damage and Getting a Replacement Card

I called the gift card help line and quickly got through to a representative. She was very helpful, quickly agreeing this was a damaged card and it needed to be replaced. The representative stated that she was processing a new replacement card at no charge and I would receive it in about 10 business days. She stated my original card would remain active in the meantime, and I could use it online if the CID wasn’t needed for the purchase. I thanked her, and the call ended.

Receiving the Replacement Card and Another Surprise

About two weeks later, the replacement card showed up in the mail. The same day, I called to activate the card, then I chose the “check balance” option. The robotic voice stated, “Your current balance is $0.05.” I then went to the gift card website to get a better view of the card history. Just like during the call, the gift card balance was $0.05. On the lower region of the page, I reviewed the purchase history. Someone made a $499.95 charge at a store about four hours away from me. The info reflected that the original card data was used to make this purchase, and the purchase was made one day after I reported the original card damaged!

I then called the helpline, but their computers were down. I would need to call back later. Yay.

Reporting the Visa Gift Card Fraud

I do not recommend attempting to report gift card fraud during a global pandemic. Numerous calls the next day met with a variety of unsatisfactory endings. Here are the different responses I got to separate calls:

- I’m sorry, sir. The computers are still down. You’ll have to call back later.

- I’m sorry, sir. The fraud department isn’t answering when I try to connect you. You’ll have to call back later.

- Multiple Calls: After calling the phone number, the automated system doesn’t even pick up the call.

- Okay, sir, thank you for calling. I’m putting you on hold for the fraud department. [45 minute wait, then the phone disconnects.]

- Okay, sir, thank you for calling. I’m putting you on hold for the fraud department. [Over a two hour wait.] I want to go to bed, so I hang up.

The above is not an all-inclusive list, but you get the point. Representatives said they were working from home, and there had been some ongoing issues. Two days after my initial call to report the fraud, I finally got through to the fraud department.

After my experiences so far, I was happy at how efficient the call with the fraud department was. After describing the situation for what seemed like the 50th time, I answered a few of the representative’s questions. It seemed she was populating some report or form. She then told me I would receive a form in 3-5 days to complete and return. Finally, the representative told me it could take up to 90 days to resolve the issue, but quite often issues are resolved much faster than that.

Visa Gift Card Fraud Resolution

I received and completed the form, then returned it via mail. About a week later, I checked the balance on my replacement card. The card had a $500 balance! After only one week or so of mailing the form I had the money back. Of course, I then used the funds from this card ASAP. About one week later, I received a letter stating that the matter had been resolved, and the investigation was closed.

My Suspicions

Throughout this experience, I theorized on how this fraud could have happened. Do I find it coincidental that the damaged card was also the fraudulently used card? No. From my perspective, someone intentionally damaged the card so that physical use was difficult or impossible. In the meantime, the fraudsters would have more time to drain the card (via the card’s data) while it was active but unused.

Additional Protective Measures

I have taken on additional measures to protect myself and will continue to do so. I have become even more thorough while inspecting gift cards prior to purchase. At checkout, I pull the backing further so I can ensure the entire three-digit CID is present prior to any purchase. If I ever discover a damaged or missing CID, I plan to report the issue to store management.

Additionally, if I am ever unable to physically use a card and need a replacement, I will request that the original card is completely deactivated. That way, fraudsters wouldn’t be able to drain the original cards’ funds while I await the replacement card.

Final Thoughts

Experiencing Visa gift card fraud wasn’t fun but ended well. Also, I’m lucky that it hasn’t happened to me earlier. I underscored two main points even further during this process. First, I need to remain vigilant and do everything in my control to protect myself. Second, I need to be positive and determined as I work toward fraud resolution. Have you ever been the victim of Visa gift card fraud? How did you resolve it?

[…] Visa Gift Card Fraud! What Happened & How to Protect Yourself […]

I recently received a US bank VISA g card purchased at Kroger. I opened the packaging 2days after it was bought and when I tried to use it that day it was declined. I thought it was because the amount of purchase exceeded the card amount so I just paid and moved on. Tried to use it again 3 days later and declined again. After a HUGE run around by Kroger customer service, I finally found out the card balance had been drained the day after purchase at a King Sooper store in CO. I live in TX. I truly had no idea this kind of scam existed and was even possible. The Kroger guy basically called me an unlucky idiot and wished me luck getting the money back through US bank. The person who gave me the “Gift” card wishes he had handed me cash for my birthday. All I have now is an insult, a pile of aggravation and he paid a fee to give it to me.

Thanks Benjoy and M2M for sharing this harrowing experience. Will redouble my own self-protection efforts going forward. Good to know Visa had your back in the end, but wow, what a hassle.

ps: I also had a first time ever fraudulent experience recently with a visa debit card, as issues via my firstunion checking account….. I only occasionally use it, and via restaurant apps. (e.g. Wendy’s & BK) Am guessing somehow there was a data breach there, and some scoundrel was attempting to do multiple gc purchases with my debit card…. til visa fraud dept. caught it and froze it. They were good in having my back, but I wonder if they ever actually catch the perps….

Just Happened to me. i bought 4 cards from Harris Teeter in VA Yesterday around 745pm. Just read this article and got concerned . Never has this happened to me before. Exactly one of the card pin page was loose. and the 3 digit code is smudged. Got Nervous and started checking online and the card which was loose could not see it online. Called the customer service after 3 attempts. i got them .They tell me the card never got activated. surprising they will be sending me the new card. Later i check the card over the phone it tell me it has 500$. Fearful as they activated the card and left out in open.

[…] Visa Gift Card Fraud! What Happened & How to Protect Yourself by Miles to Memories. […]

Thanks for providing this detailed information. I have not purchased additional visa cards from Kroger since my unfortunate incident last year. We have enough repeat stories regarding these issues to make me hesitant to purchase cards from them in the future.

Very interesting read. I’ve learned to check the packaging, and MS into money orders before I even leave the store, but I’ve not heard about the fake bar codes. Will drag a fingernail across them from now on, and peel open further to check the security code. Thanks for the heads-up

This is an old scam. They go in a head of time and get cards and pins. Check balances every day. As soon as they see money, take almost entire balance. This way, you’ll see an active card. As a rule, I don’t buy gift cards, but if I did, I’d buy one from behind the counter, check it thoroughly, and register it in the parking lot with a new pin.

Does registering with a new PIN help? It seems they would still be able to drain the cards online without the PIN.

This is Deja Vu, I have discussed this with Shawn 4,5 years ago. Bought GC at Ralphs, cards are not readable at all no matter how you swipe it. It is so time comsuming. Cannot believe it is still happening.

DO NOT BUY US BANK-ISSUED GIFT CARDS, whether Visa or MC. I was surprised when I read the headline as I’ve used hundreds of Visa and MC GCs issued by MetaBank (like the gray one pictured) or Blackhawk, never an issue. The one time I bought a GC issued by U.S. Bank, it was drained a few days after purchase. It was a nightmare dealing with U.S. Bank – they insisted they listened to the recording of the scammer calling in and it matched my voice. I got the runaround for weeks. Finally I filed a CFPB complaint, and within a few days they sent a refund and a letter agreeing with all of the facts of the case as I’d stated. That was almost 3 years ago, seems they haven’t fixed their systems. So turn the gift card around and see which bank issues it. If U.S. Bank, stay the **** away whether it’s Visa or MC.

Is the PIN of MetaBank issued MC GC last 4 digits same as Visa? Or we have to call to register it?

Agree completely about USB gcs. Had this issue (along with others I know) with them 3-4 years ago and it is not a new one. PITA to get replacement and definitely put my $s/hr to less than a $/hr after hassles. Never had a problem with many metas.

you inspected the card prior and during the purchase but you dont bother to check the balance til 2 days later? I went through the same experience a yr ago but now, I check for balance and change pin right there in the parking lot before going home.

Agree with debit’s point #3, above. Set your own PIN as soon as possible. Takes a good bit of time if you have several VGCs but will help protect you significantly.

Yup my experience too. But in my case they took a few weeks.

Things that should make you suspicious:

1. The gum on the card is bad. It doesn’t peel off easily.

2. Card doesn’t activate on the first try

Don’t risk it. Just void the transaction.

3. Set your pin on the card immediately.

Most fraudulentb transactions are 499.95. Why do they leave the 5c? I think they buy money orders which means they need the pin. Setting your pin did take care of it.

Don’t buy VGC currently when money orders are down.

changing pin doesn’t really fully protect scammers as the fund can still be drained online; having the card registered & pin change would better protect fraud