What Credit Card Should I Get Next? Here’s How to Make the Best Decision.

“What credit card should I get next?” It’s a common question, especially for people starting in this hobby. We see it a lot in our Facebook group. You want to get the best card possible when opening your next credit card, but there are so many. Which one is the right one? Which one is “the best”? Today, I want to look at how I make this decision when it’s time for my next credit card application. We’ll look at where to find credit card offers, how to evaluate them, and then making a decision based on the information.

Where to Find Credit Card Offers

Before deciding which card to apply for, I need to know what’s out there. What cards are available? Do any of them have an increased welcome offer right now? Finding the offers is the first step.

Not to toot our own horn too much, but I go through posts from other writers here pretty frequently. If someone finds a great offer for a new card or an elevated welcome offer bonus on a card, we’ve probably mentioned it.

Another great site I like to check out is TravelFreely. Every month, they post cards by “best of___” categories. Best cash back, hotel card, airline card, etc. What kind of card are you looking for? You can find the best of that category.

Targeted Offers

Another great place to get offers is when they come looking for you. Easy! However, take these with a grain of salt. Not all points are created equal, so 150,000 Hilton points isn’t as amazing as 150,000 points for other hotel brands or for airlines, etc. Another reason to take these with a grain of salt is that many of these will come around again, whether in your mail, email, or on a website. A great example of this is Delta cards from American Express. These offers come around multiple times a year, so don’t kill yourself to take them today. You’ll probably see that same offer again later, so it’s OK if you don’t get it today.

Deciding On a Card to Apply For

There are numerous factors at play when thinking about “What credit card should I get next?” Card type, card benefits, and the bank it comes from (plus that bank’s application rules) all play a major role. However, none of these are the most important factor, which I’ll discuss later. Let’s look at these other factors first.

What Kind of Card I Want

One way to look at this is what type of card you want. Do you need a particular benefit for an upcoming trip, like rental car insurance? Are you looking only for an airline card or looking for something that has double points in a certain category? This can be a way to make the decision.

What Bank I Want a Card From

Another way to decide what card to get is what bank you want to apply from. This makes sense for several reasons:

- Applying for too many cards too fast from the same bank can get your accounts shut down, and you don’t want to deal with this.

- Not focusing on one bank can avoid shutdowns and also help you have different types of points to maximize your options when booking a trip.

- Because of bank application rules, maybe you’re not eligible for a new card with bank A or B right now, so you want something from C or D.

Evaluating the Offers

Now that you’ve thought through these factors, you can look at the offers out there that make sense. However, there’s one more factor, and I think it’s absolutely the most important: what is the best for the long term? The single most important question is what’s best long-term. You can also put it this way: “Can I get this card later?”

I’ve seen numerous people recommending cards to those new in this hobby that are actually terrible advice if you consider “Can I get this card later?” in the equation. Here’s an example.

New Points & Miles Hobbyist A

Someone new to this hobby hears a little bit of information, and this person jumps in. That person gets some cards that seem nice, many coming from advertisements at the airport, etc. That person gets these cards:

Some Of These Offers Have Ended Or Changed

- Chase Sapphire Reserve – Exciting for the 50,000 Chase Ultimate Rewards Points you earn after spending $4,000 within the first 3 months. And for the Priority Pass membership.

- Barclays AAdvantage Aviator Red Card – Earn 60,000 AA miles after 1 purchase and paying the $99 annual fee. Easy!

- American Express Delta Gold Card – Earn 60,000 Delta SkyMiles miles after spending $2,000 within 3 months.

- Chase Marriott Bonvoy Boundless – Earn 100,000 Marriott points after spending $5,000 within the first 3 months.

- Capital One Venture Card – Get 50,000 points after spending $3,000 within the first 3 months. Use these as purchase erasers or transfer to travel programs.

We’re done! This person has just passed the Chase 5/24 limit, which is one of the most important rules in this hobby. This person has opened 5 credit cards within the last 24 months and cannot get any more credit cards from Chase. Many of these are cards this person could get later, but they showed up in simple offers via email or at the airport. They were low-hanging fruit, as the saying goes.

These aren’t bad cards, but this person cannot get any more Chase cards now, such as the World of Hyatt credit card, United℠ Explorer Card credit card, or even business cards like the Ink Preferred and Ink Cash. This person also can’t open any cards to pursue the Southwest Companion Pass.

This person has earned the following currencies from the welcome offers:

- 50,000 Ultimate Rewards points

- 60,000 American Airlines miles

- 60,000 Delta SkyMiles

- 100,000 Marriott points

- 50,000 Venture miles

New Points & Miles Hobbyist B

In contrast, this person studies the rules at play and thinks about the long game. This person asks “Can I get this card later?” and knows that those cards from Barclays and American Express will still be there in the future. This person knows that passing 5 cards on her/his credit report will end the ability to get cards from Chase, so this person goes for the following cards:

Some Of These Offers Have Ended Or Changed

- Chase Sapphire Reserve – Exciting for the 50,000 Chase Ultimate Rewards Points you earn after spending $4,000 within the first 3 months. And for the Priority Pass membership.

- Chase Marriott Bonvoy Boundless – Earn 100,000 Marriott points after spending $5,000 within the first 3 months.

Taking a break from Chase, this person has a side hobby that counts as a business reselling stuff on eBay, so s/he opens the

- Bank of America Alaska Airlines Business card – Get 40,000 Alaska miles after spending $2,000 in 90 days.

It won’t show up on the credit report, so this person keeps going with Chase.

- Chase Ink Business Preferred – Get 80,00 Ultimate Rewards points after spending $5,000 within the first 3 months. This does not count towards Chase 5/24.

- Chase United MileagePlus Explorer – Get 60,000 miles after spending $3,000 in 90 days.

It’s time for another pause on Chase, so this person gets…

- American Express Marriott Bonvoy Business Card – Get 75,000 Marriott points after spending $3,000 in the first 3 months.

After a several months, it’s time for

7. Chase Ink Cash – Get 50,000 Ultimate Rewards points after spending $3,000 in 3 months.

8. Chase British Airways Visa Signature Card – Get 50,000 Avios after spending $3,000 in 3 months.

After waiting several more months they decide they should get…

- CitiBusiness AAdvantage Platinum Card – Get 65,000 AA miles after spending $4,000 in 4 months.

- Chase World of Hyatt Card – Earn 50,000 Hyatt points after spending $6,000 in 6 months.

Finished. This person is now at 5/24 and can’t get any more cards from Chase. By thinking about “what cards can I get later?” Person B made decisions looking at the long game and was able to maximize their return. This person didn’t rush with Chase and stretched out their 5/24 time by focusing on business cards that won’t show up on her/his credit report. This person has earned the following:

- 180,000 Ultimate Rewards points

- 175,000 Marriott points

- 40,000 Alaska miles

- 40,000 United miles

- 50,000 British Airways Avios

- 70,000 AA miles

- 50,000 Hyatt points

Results

Compare Person B to Person A. The first person left a lot of value on the table by not properly planning. This hobby is a marathon, not a sprint. Person B knew this and maximized their return.

Sure, Person B didn’t get cards 2, 3, and 5 that Person A got, but you know what? Person B can go get them later. See all those cards that Person B got but A didn’t? Person A can’t get any of them without going into a cooling off period. Person B knows “What credit card should I get next?” doesn’t include grabbing just anything that sounds nice. Person B was thoughtful.

What Credit Card Should I Get Next? Here’s Mine.

Now that we know the right way to think about cards and the right way to make the decisions, we’re now ready to decide on a card. We know what’s out there, and we know which ones we should wait on because those are cards we can get later. Also, we know what we can’t get later if we don’t get it now, and we know the rules for the banks to not cause problems or get rejected. It’s time.

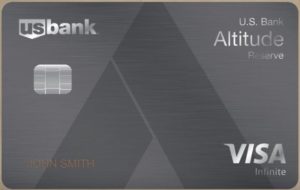

“What credit card should I get next?” For me, I want the U.S. Bank Altitude Reserve. Here’s why.

Deciding Factors:

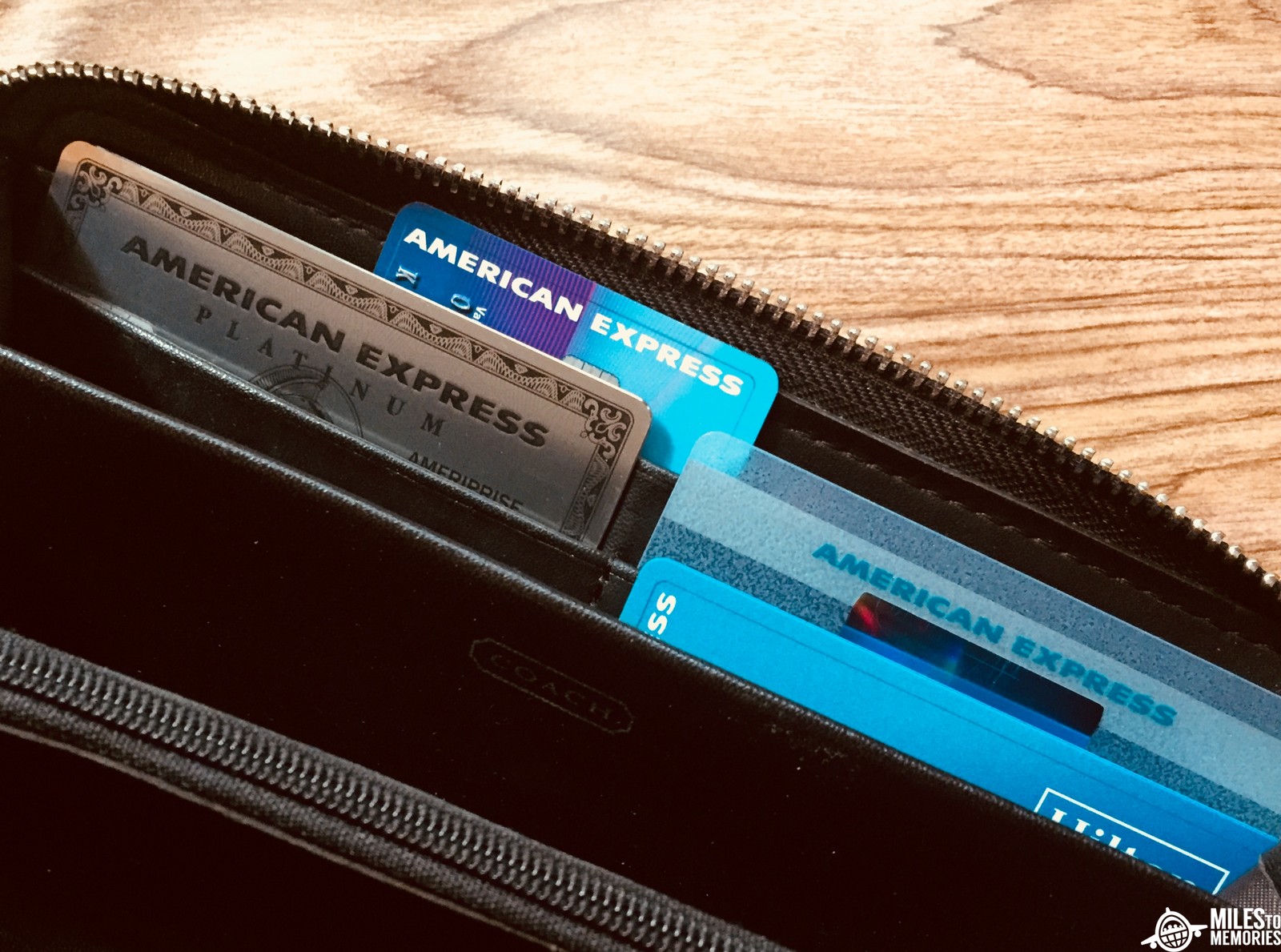

- I have my maximum number of credit cards with American Express right now and can’t get anything else for a while. I’ll need to close a card and wait a bit.

- Since I am past 5/24, I can’t get anything from Chase.

- I am on a blacklist from Bank of America for personal cards and don’t meet their application rules anyway. I’d probably get rejected for a business card from them.

- I’ve had a Barclays card within the last 6 months, so they will not approve my application.

- I have have a bone to pick with Citi and am taking a break with them.

See all of those things to consider? There isn’t as much work when people are new, but they’re worthwhile to think about as you stay in this hobby longer. Since I knew I’d be applying for a U.S. Bank card soon, I followed some recommended advice from Doctor of Credit and opened a checking account with the bank. I’ve been using it for 4 months now and depositing money every month.

I was denied a different U.S. Bank credit card for “too many recent inquiries on your credit report” when I opened the checking account. How am I fixing this? I’m not going to apply for any new credit cards for the next few months. Several of my inquiries will fall off my credit report and some cards will have some more age on them. Also, I’ll have a longer banking relationship with them to lean on if I need to make a reconsideration call.

Final Thoughts

As I said, this hobby isn’t a sprint. It’s fun, exciting, and even a bit overwhelming at the beginning, but falling for “low-hanging fruit” or even the “shiny object” traps lead to less value overall. When thinking about “What credit card should I get next?” you should always always always consider the long run. Don’t get a card now that you can get in the future if doing so means sacrificing a card you can’t get later. In my opinion, there’s only 1 personal card that’s not from Chase that anyone should get while under 5/24.

If you get targeted for the 100,000 points American Express Platinum Card offer, that’s the only time to use a 5/24 spot for something that’s not Chase. Otherwise, all those cards Person A got will be there later. Don’t get now what you can get later. Get what you can’t get later and think about the long-term plan.

I hope this provides some better insights on how to plan ahead for the long-term and get as much value as possible. I hope it helps you understand the best way to decide “What credit card should I get next?” Just because an offer looks nice doesn’t mean you need to get it right now.