From January to late April 2013, my family and I spent three months backpacking & cruising through Central & Eastern Europe. Upon our return, it was naturally time to beef up our credit card portfolio in order to fatten our points balances.

Most of these cards recently had their annual fees hit, so it became time to evaluate each card to determine whether or not to keep it. Here are the results.

Cards

Most of the cards that were coming due with annual fees are my wife’s. We decided to make a call on each of them to see if there would be any retention offer or not. Here are the cards that were coming due:

- American Express Business Gold Rewards

- Citi Hilton Hhonors Reserve

- Chase Hyatt Card

- Chase United Explorer Card

- U.S. Bank Club Carlson Premier Rewards Visa Signature

Results

American Express Business Gold Rewards

This card originally came with 50,000 bonus Membership Rewards points. We used most of those to transfer to various airlines and only had about 8,000 left in the account. With a pretty steep annual fee of $175, we were pretty sure this was a card that was worth closing.

The Business Gold Rewards card does offer 2x points on gas and an impressive 3x points on airfare purchased directly through an airline, but that wasn’t enough to offset the fee for us. We don’t purchase too many tickets direct and we have other cards offering a better gas station bonus.

My wife had spent about $10,000 on the card in the past year. American Express didn’t make any retention offer so my wife went ahead and closed the account. I ended up transferring the 8,000 points into my British Airways Avios account in order to avoid losing them since I often use Avios for short flights within the United States on American Airlines.

Result: Closed

Citi Hilton Hhonors Reserve Card

The Citi Hilton Reserve Card has some wonderful perks including a sign up bonus of two free weekend nights at almost any Hilton property and Gold status. We used the two free nights on our Maui trip last year to stay at the Grand Wailea. Rooms were going for about $600 per night for the two nights we were there, so the value for us was tremendous.

This card has a $95 annual fee which is arguably worth it given the Hhonors Gold status, but it isn’t a no-brainer. Since Citi has waived the annual fees on some of our other cards, we decided to call and see what they said. After a brief call with reconsideration, we were offered only 5,000 Hhonors points after $2,000 in spend.

While this offer isn’t good, it is better than nothing since we were already leaning towards keeping the card. One of the other benefits of the Reserve card is a free weekend night if you spend $10,000 on the card in the previous year. I had made sure to do that, so for our $95 second year annual fee, we are keeping Gold status,receiving a free weekend night and padding our account with 5,000 points.

Result: Kept open with retention bonus.

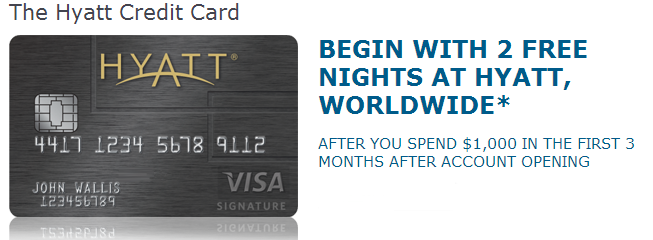

Chase Hyatt Card

The Chase Hyatt Card is not a good one for everyday spend. We only really used the card to meet the minimum spend bonus in order to earn the bonus of two free nights. We used those two nights on our recent trip to Japan for a suite at the Park Hyatt Tokyo. (Review coming very soon.) With an annual fee of $75, we weren’t sure if this was a keeper.

This card does offer an annual bonus of a free night at any Category 1-4 Hyatt worldwide. Depending on how that is used, it is easily worth more than the $75 annual fee. My wife made a quick call to Chase and wasn’t offered any sort of bonus to keep the card. She decided to think about it.

A couple of weeks later she called again and was once again offered nothing. Since we have more free nights then we have been able to use, we decided to cancel the card after shifting the credit line to another card. The interesting thing is that the annual free night had already posted to her account and is still available to use. Hmmm.

Result: Closed

Chase United Explorer

I got this card last year because it was offering a 55,000 mile bonus and I couldn’t pass that up. The card also comes with two United Club passes each year as well. I used the miles earned from this card to fly home from Bali last year in Business Class on Singapore Air, ANA & United.

This card gives a free checked bag, but I don’t value that since I am 99.9% carry-on only. The only major benefit of the Explorer card is that it has primary auto insurance. I always used it when renting a car since it would cover any damage to the vehicle without the need to use my own insurance.

Since I had only spent a couple of thousand dollars on the card, I was pretty sure that Chase wasn’t going to offer me anything to keep it open. Just as expected, I wasn’t given a retention offer and I closed the card after transferring the credit line to another card. While the primary insurance is nice, I don’t see it as worth the annual fee of $95. Additionally, the lounge passes had already arrived, so they are mine to keep.

Result: Closed

U.S. Bank Club Carlson Premier Rewards Visa Signature

I will just start by saying that this is a fantastic card. It gives Club Carlson Gold status and a bonus award night on stays of two nights or longer. The only reason we considered closing it is because we each have one and are sitting on plenty of Club Carlson points.

For the $75 annual fee, U.S. Bank throws in 40,000 bonus points per year. This is actually a fantastic deal when combined with the bonus award night. Since we were not sure what to do, Jasmine called up to see what they said.

The original agent said that nothing could be done, but that a manager would call my wife back. (She never complained or asked to speak to a supervisor.) The next day a supervisor called and offered her an additional 7,500 points to keep the card. When my card comes due, I think I will just forego the call and keep it since this became much more of a deal then it needed to be.

Result: Kept open with a retention bonus.

Conclusion

In the end, we have closed down three cards and kept two more open. For the two cards that were kept open, we were offered very small retention bonuses. Those bonuses honestly didn’t sway us too much. It was the annual and ongoing bonuses on those cards that were the ultimate deciding factor.

We did get a few more no annual fee cards during that application spree last year and have decided to keep those for now. In the end we are happy with the shedding of a few cards since we are now open to replace them with new shinier models!

Hi Shawn: Thanks for the post. With regards to the Chase Hyatt Card, you mention at the end of the section that you transferred the credit line to another card. Is that something you asked Chase to do, as in, “Please move this credit line from Chase card X that I am closing to Chase card Y that I am keeping?” If that is the case, what advantage does that give you?

Yes when you close the card, you simply ask the representative to shift the credit to another card. In most cases, Chase will not shift the entire line, just in case you have pending charges coming in. In the case of the Hyatt card, they shifted $2,000 of the $3,000 line to a Freedom card.

The main advantage is just keeping the available credit with Chase. If you apply for another card later and Chase doesn’t want to extend you more credit, often times they will shift credit from other cards. Essentially, it is just keeping that line “in play” so to speak so you can use it as leverage for later applications.