4th Quarter Bonus – 5% Rotating Cash Back Credit Cards

4th Quarter Bonus – 5% Rotating Cash Back Credit Cards

It is now October 1, which means it is the beginning of the 4th quarter. For many that is the start of the holiday season, however for us crazies it means new 4th Quarter 5% bonus categories on some of our favorite credit cards. Currently there are 3 major cards which offer 5% rotating bonus categories, Discover It, Chase Freedom & Citi Dividend.

Before I take you through the bonus categories, it is important to note that I do have the Discover It and Chase Freedom cards, however I do not have the Citi Dividend. Opening credit cards is a personal decision and one which should not be taken lightly. Even with a 5% bonus, the interest on credit cards wipes away any rewards benefits. Never carry any debt on credit cards!

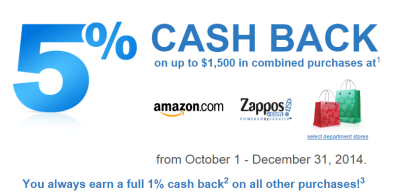

Chase Freedom – 4th Quarter Bonus

The Chase Freedom card is perhaps the most popular of the three cards on this list. Cardmembers receive their “cash back” in the form of points. Each point is worth $.01 in most cases. The real value of the Freedom is that you can transfer those points to a premium card such as the Sapphire Preferred or Chase Ink. From the premium card the points can then be transferred to travel partners such as United, Hyatt or Southwest Airlines. When doing this the value is often more than $.01.

Chase offers different 5% categories and pays the bonus on up to $1,500 in spend. This means that you can earn a total of 7,500 bonus Ultimate Rewards points by maximizing out the category bonuses. Depending on the categories, some quarters this is easier to do than others.

4th Quarter Bonus Categories

During the 4th Quarter the Freedom bonus categories are:

- Zappos.com

- Amazon.com

- Select Department Stores (Full list)

You must activate the 4th quarter bonus by December 14, 2014 to earn the 5%. Even if you activate later on, the bonus does apply retroactively. With that said, it is best to register as soon as possible so you don’t forget. Register here.

Discover It – 4th Quarter Bonus

The Discover It is a great card. If you search the internet, sometimes you can find a $150 sign up bonus for the card. My main reason for getting it wasn’t the sign up bonus. I signed up for the 5% rotating cash back categories and access to the Shop Discover portal.

There were many times when I was doing online shopping that I saw Shop Discover had the best cash back rates. Finally I got sick of seeing this and signed up for the card. Between Shop Discover and the 5% bonus categories, this no annual fee card has definitely earned a permanent place in my wallet.

4th Quarter Bonus Categories

During the 4th Quarter the Discover bonus categories are:

- Online Shopping

- Department Stores

Like the other cards here, Discover caps the bonus at $1,500 in spend or $75 cash back per quarter. You can find a full description of what qualifies in each of those categories along with registration information on the Discover website. Unlike Chase who pays the bonus retroactively, Discover will not pay 5% on purchases made before you activate the 4th quarter bonus. This means that you should do it right away since it is so easy to forget!

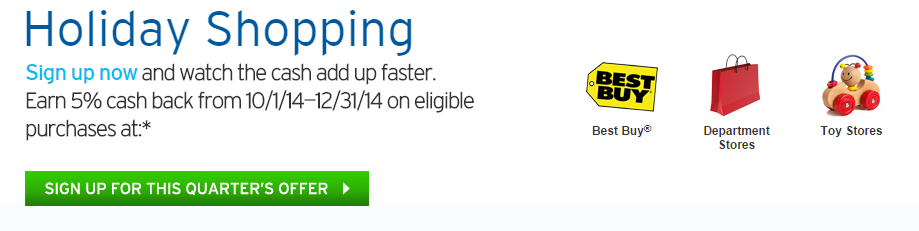

Citi Dividend – 4th Quarter Bonus

The Citi Dividend card has unfortunately been discontinued in favor of their new Double Cash card. If you currently do not have the card then I am not aware of a way to get it. Thankfully if you do have a card, it still works just like before and you do still get 5% bonus categories on up to $1,500 in spend per quarter.

4th Quarter Bonus Categories

During the 4th Quarter the Discover bonus categories are:

- Best Buy

- Department Stores

- Toy Stores

Just like Discover you must activate the 4th quarter bonus before it will count. Citi does not pay 5% retroactively like Chase. For the full details and to activate the bonus visit the Citi website.

Conclusion

Hopefully you have already clicked through and activated your 4th quarter bonus for the relevant cards. With the holiday season upon us, you can see the emphasis is with online and department stores, meaning that it should be relatively easy to max out your bonus categories! Happy shopping!

[…] Freedom is a no annual fee card which pays 1% cash back on all purchases. Additionally they have rotating categories each quarter which pay 5% cash back up to $1,500 in spend. I currently have two Freedom cards and […]

[…] is a good quarter to get the card since it pays 5% cash back for all online purchases and there is another choose a store 5% […]

[…] of the stores in their Shop Discover portal. These increased holiday bonuses are in addition to the 5% cashback you receive by using your Discover card for online purchases in the 4th quarter. (5% paid on up to […]

[…] up bonus (other than 0% APR), so this may be good for someone looking to get a Discover It for the 4th quarter bonus. From time to time Discover does have a cash bonus offer (up to $150) for signing up, however it […]

[…] are currently three cash back cards with 5% rotating categories. Last week I covered in detail the 4th quarter bonus categories on the Chase Freedom, Citi Dividend & Discover It. Each of these cards have different […]

As of a few weeks ago, you could still ‘downgrade’ (actually upgrade) another Citi card to the Dividend, even though no new applications were available. http://saverocity.com/miles4more/downgrade-citi-card/