My Thoughts on the Current Best Offers

Offers are constantly changing for different cards at different banks, so I thought it would be a good idea to go over what I think is the current best offer at each of the major banks and why. I haven’t done this since last September, so I think it is about time to update things. As always, this is just my opinion and in no way is it financial advice.

Today I’ll look at the best offerings from Chase, Amex, Bank of America, Citi, US Bank and Barclaycard.

Bank of America

For many Bank of America is an after thought, but it shouldn’t be. They have a decent travel rewards credit card that earns up to 2.625%, but for most people it will only pay 1.5%. (If you have enough for the 2.625% that is the best card though.) That means the best overall card offer is a no-brainer for me.

Best BofA Offer: Alaska Airlines Visa Signature

The Offer: 30K miles and a $100 statement credit after $1K in spend during the first 3 months. $75 annual fee not waived. (Note: You may be approved for a lesser version of the card with a smaller bonus.)

My Mini Review

This offer has been 25K for a long time, however Bank of America recently redesigned the card and upped the bonus. I was the first to discover that you could get a $100 statement credit as well. Alaska Airlines miles are valuable and with their many partners can get you rather far. The statement credit more than offsets the annual fee, making it even better.

Barclaycard

Barclaycard and I have a strange past. They used to love me and then for a period of time wouldn’t approve me for anything. That has recently changed and while they have some interesting products such as the Wyndham Rewards credit card, one product still stands tall in their lineup.

Best Barclaycard Offer: Arrival Plus Mastercard

The Offer: 40K miles after $3K spend in 3 months. $89 annual fee is waived the first year.

My Mini Review

I rather publicly broke up with my Arrival Plus card last year after they made some very negative changes. Yes, the card isn’t what it once was, but the sign-up bonus is still worth ~$420 worth of free travel. The Arrival Plus also has chip & pin for those pesky kiosks in Europe, so that may earn it a spot in your wallet while traveling internationally.

As I mentioned in my breakup post, I do love the sign-up bonus on this card, but with all of the changes I am not sure it is something to keep long term. It just doesn’t offer enough benefit to justify the high annual fee. Thankfully this card is somewhat churnable (post on that coming soon) and the valuable bonus plus the fact that Barclaycard generally pulls from Transunion make this a winner for me. I recently picked up a new one myself.

Citibank

Citi has recently made some strange moves and has removed public bonuses from their ThankYou Premier and Preferred cards. (There is a Premier 40K zombie link.) The last time I did this post, the Premier won the day with its then 50K bonus, but now there is a new king in town.

Best Citi Offer: AT&T Access More

The Offer: Spend $2,000 in purchases with your AT&T Access More Card within 3 months of account opening.

Use your card, now or later, to buy a new phone from AT&T, at full price (up to $650) and with no annual contract. $95 annual fee not waived.

My Mini Review

This is a card that I used to struggle to recommend, but it has been so valuable for me that I think everyone should have it. Yes, if you aren’t an AT&T customer then you may incur a second credit hit to get the phone since you would need to start service briefly, but it may be worth that given its 3X earning structure for online purchases.

A few weeks ago I wrote about how the AT&T card combined with the Citi Prestige is a powerful combination of 3X earning and 1.6 cents per point redemptions on American Airlines. That alone is a reason to consider this card. If you do a lot of online shopping, then it is a must have in my opinion. My household recently picked up a second one.

American Express

Picking the best American Express offer is tough since they have had so many good ones. For many the SPG cards are good, but I expect them to go back up to 30K this Summer so I would wait for the higher bonus if possible. There are also some incognito tricks to get better offers on many cards that you should look at.

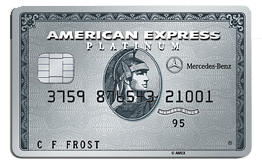

Best Amex Offer: Platinum Card® from American Express Exclusively for Mercedes-Benz

The Offer: 75K Membership Rewards points after $3K spend in 3 months. $475 annual fee not waived.

My Mini Review

I personally feel the Platinum card is worth having given its long list of benefits and especially since you get a $200 airline credit each calendar year. This means that in the first year with a card, you can get that credit twice which almost fully offsets the annual fee. Add in lounge access along with various hotel and car rental statuses and you have a winner.

There are many versions of the Amex Platinum card, but this Mercedes Benz version is the only one currently with an increased bonus. With that said, people are targeted with 100K offers on the regular Platinum sometimes, so you may want to look out for one of those offers. While you can only get a bonus on each product once per lifetime, the good news is that each Amex Platinum flavor is considered its own.

US Bank

The last time I did this style of post I chose the Club Carlson Visa Signature despite the loss of the Bonus Award Night. While that card does give an 85K sign-up bonus which is worth looking at for some, I continue to be underwhelmed with the selection of properties and overall value of the program.

Best US Bank Offer: U.S. Bank FlexPerks® Travel Rewards Visa

The Offer: 20K points after $3.5K spend in 4 months. $49 annual fee is waived the first year.

My Mini Review

While I still contend that the FlexPerks program is overly complicated, the points can be worth up to 2 cents each and there is enough potential value that this program is worthy of a look. Add in the ability to earn 3X on charitable donations and 2X on the bonus category in which you spend the most and the earnings potential is nice. After the first year you can even use FlexPoints to offset the annual fee which is a nice option.

If you don’t currently have any US Bank cards, then you will learn they aren’t the easiest bank to deal with when applying, but once you are in, then you get some nice perks like free checking.

Chase

Most of you know about the Chase 5/24 rule and I have covered the rumors of its recent expansion. At this point we don’t know how it affects all cards, but if you have opened more than 5 new accounts in the past 24 months across all banks, that there is a chance of you being denied for “too many new accounts”. I suggest doing your research before applying.

Best Chase UR Offer: Chase Ink Plus

The Offer: 60K Ultimate Rewards points after $5K spend in 3 months. $95 annual fee not waived the first year. (You may be able to get 70K and/or the annual fee waived in-branch.)

My Mini Review

I honestly believe the Chase Ink Plus is the most valuable card to carry in your wallet. Both my wife and I have multiple Inks for our businesses. Between the bonus categories and the ability to transfer points to partners, it is the card to get in my opinion.

This 60K offer seems to be the new norm and if you are willing to spend an hour or so in-branch then you can possibly do even better. Ultimate Rewards points are very valuable and while you may not shop at office supply stores often, buying gift cards can trigger 5X and don’t forget your internet and cell phones bills earn 5X as well.

Best Other Chase Offer: Hyatt Visa Signature

The Offer: 2 Free nights after $1K spend in 3 months + 5,000 points for adding an authorized user. $75 annual fee waived the first year.

My Mini Review

Choosing a best co-branded offer is tough. Perhaps this choice shows my Hyatt bias, but as long as you have a decent use for the free night certs, I still think this sign-up has the best overall value given the waived annual fee and 5,000 point bonus. If the United MileagePlus Explorer 75K + $50 offer was public and not targeted, that would have been my choice, but that isn’t the case.

The Hyatt Visa not only has a very good sign-up bonus, but it gives you Platinum status. While that isn’t terribly good, it does allow you to also match to Mlife Gold status which can get you some perks in Vegas. Overall, this isn’t a card to use for normal spending if you have an Ultimate Rewards card since those points can also transfer to Hyatt, but the bonus is solid.

Conclusion

When choosing the best card or cards to apply for, there are many tough decisions to be made. Banks like Chase and Citi have so many good offers that it is hard to pick the best one. As always, when choosing which cards to apply for, I recommend taking a good luck at your overall goals and making a plan to achieve them. I also highly recommend not biting off more than you can chew, so stay within your comfort zone and have a plan to meet the minimum spend on all cards.

Do you disagree with any of my picks above? Let me know what you would have chosen and why!

I have been seeing in Amex cards terms and conditions that purchase of gift cards or other cash equivalents won’t be considered to fulfill minimum spend. Has anybody had luck with triggering the sign on bonus with Amex cards buying visa gift cards from gift cards.com

[…] The Best Credit Card Offer from each of the Major Banks – June, 2016 […]

sub

What are your thoughts on a PC from Citi American Airlines Plat card to the AT%T? I won’t be switching to AT&T and definitely don’t want to hard pulls so I’m wiling to forgo the sign up bonus. I’m 12 months into the Citi American Airlines Plat card so could turn that in 12 months if I hang tight. I didn’t get a retention so that’s why I’m considering the change.

I think it is a good move if it makes sense for you. If you don’t care about the bonus, then simply getting the 3X for online purchases is big. I definitely think the AT&T Access More is better than an AA Platinum card.