Credit Score Dropped 100 Points

I recently did something dumb and my credit score dropped 100 points overnight. It was a complete lapse of judgment, a failure of organizational skills. And, wouldn’t you know that it involves Citi too, kind of fitting, although it really has nothing to do with them. It was completely my fault, well, besides them giving me a puny credit limit I guess.

Credit Score Drop Details

So what happened? A few weeks ago Meijer had a profitable gift card promo around these parts for resellers. So, I pulled out my Citi Premier card, which earns 3X at grocery stores, and went to town. I mean, it took me 2 years to get the dang thing so I was gonna use it!

Before I knew it my promo spending pushed me over my puny $4,600 credit limit. Citi loves to give out random credit limits, don’t they? My plan was to pay off the card before the statement period closed. Then it would not register that I went over my credit limit with the credit bureaus. A big part of maintaining a good credit score is to be under 30% utilization (amount owed / credit limit on the card) on all of your cards. I thought I had a bit longer to make my payment, plus I was waiting for my payment on the gift cards I sold. Well, the day before I received the payment my statement closed on the card. I started getting the your credit score dropped emails almost immediately.

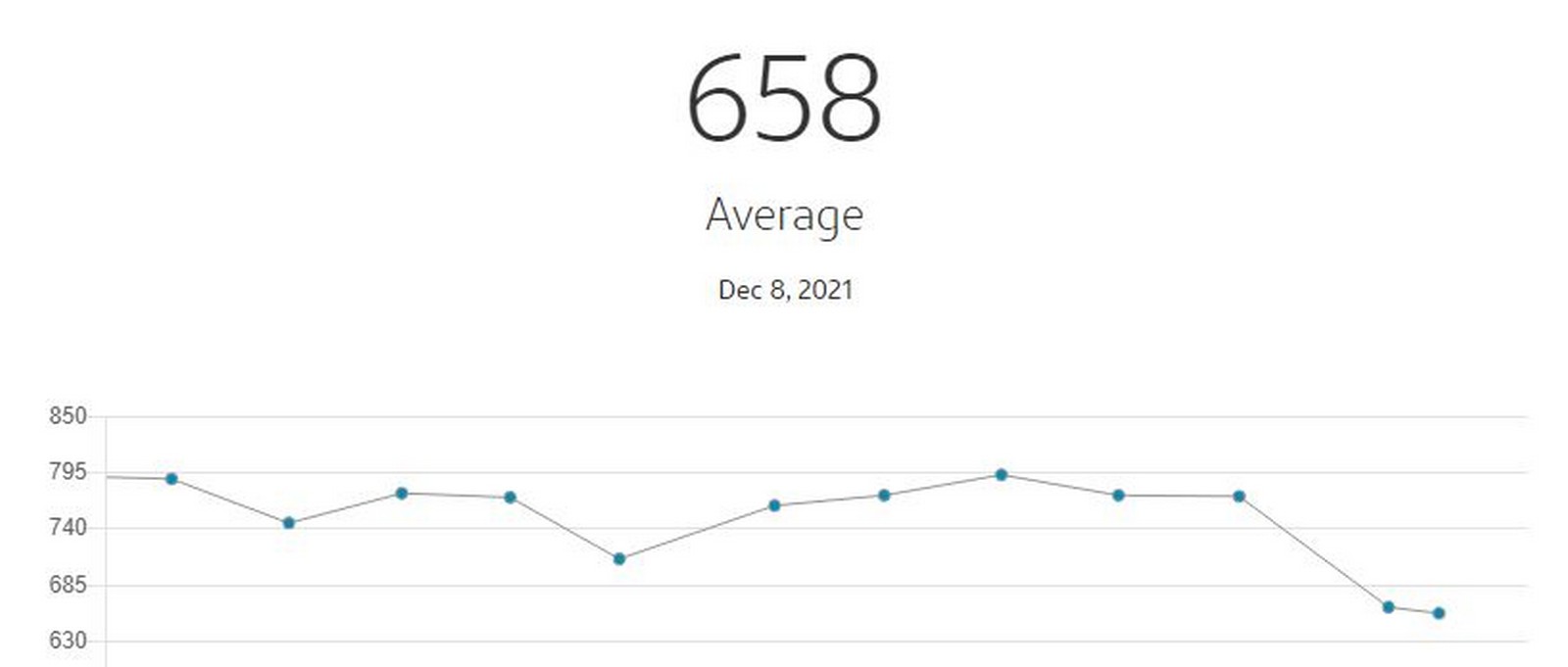

My score went from 772 to 664 almost over night. It has dropped a bit further to 658 as I am writing this today. I find this all pretty crazy when I really think about it. I didn’t miss a payment, and the amount of $5,000 is basically nothing compared to my total credit limit from all banks. My utilization across all cards when combined is only a two or three percent. That doesn’t matter though. Our imperfect credit model can dock you 100+ points overnight for a relatively small bill, simply because it is over the limit of one particular card.

I paid the card off the next day and should hopefully see a rebound over the next month or two.

What I Should Have Done Differently, Paid Down My Credit Card

How could this have been avoided? Don’t run up a card to its limit, or above, for one dummy! Well sure, but that still wouldn’t have mattered if I had played it right. Plus, this is the only card with a grocery bonus left until January 1st. You know I wasn’t leaving bonus points on the table!

What I should have done is paid at least enough to get my utilization rate on the card to a reasonable level. Then when the statement cut the report to the credit bureaus would have looked like I had only spent $1500 on my card etc. that month.

Once I realized I was over the limit I didn’t plan on using the card any more anyway. Even if I had paid it off and Citi cleared my credit limit quickly, which they do, I would not have spent any more on it that statement period. If I had that would be cycling the credit limit (using the card’s limit, paying it off and then using it again). Credit card issuers frown upon this practice. Many people have had their accounts completely shut down from doing this so be cautious of it.

Silver Lining, Offer To Increase My Credit Limit

The kind of crazy / silver lining of this all is Citi sent me an email the other day offering a credit increase to me. If you call in and ask for one they will often do a hard pull to make it work but when it comes via email, or invite, they don’t pull your credit. Weird, I know! I submitted my request and I was bumped up to a credit limit of $6,900 (another weird amount). It isn’t a ton but it is something. Hopefully as I keep spending on the card, but remember to pay it off early, I get more credit limit increase offers.

My Credit Score Dropped 100 Points – Final Thoughts

If you wanna play the credit card, miles and points game to the fullest you definitely need to be on top of things. You wouldn’t think having a $5,000 balance on a card would send your credit score into a nose dive, but it really depends which card you have it on. That makes absolutely no sense to me but the rules are the rules. If you see yourself drifting up above that 50% mark on one of your cards then be sure to pay it down before your statement closes. Just don’t reuse that paid off credit limit because that would be cycling. Cycling can cause you all types of trouble with many lenders.

Hopefully I continue to see credit limit increases on my Citi Premier so I won’t need to play this game any more. This is something I need to remember at the end of each calendar year when the Citi Premier is the only good option I have left. From what I have heard it should only take a month or two to see my score rebound. Let’s hope that holds true at least.

I’m in the exact same boat. How long did it take you to recover to the previous score?

A couple of months

As Dave Ramsey likes to say: STOP WORSHIPING AT THE GREAT ALTER OF FICO.

credit cards, credit scores, and rewards points are STUPID. and you DO NOT need them. Don’t believe me? Listen to his podcasts and actually do the math and you’ll see just why they don’t work. You do NOT need a good credit score to lock in a great mortgage rate.

So sorry to hear this happened to Mark, but agree with your comment…Ramsey calls it the I love to be in debt score. I mean really, why is the score so heavily based on the amount of debt you carry but then called your ‘credit’ score. And why do so many people (lenders, car dealers landlords, etc) demand/depend on your score before doing business with you? The score goes down very fast, but climbs back up like a snail. Ugh.

I have earned $50K plus of free travel from rewards points so I would have to say I don’t agree with Dave Ramsey there very much lol

I agree Mark. It all comes down to spend and payment discipline. Only get into this hobby if you have the ability to pay your balance off monthly when the payment comes due and only use the card for purchasing things you were going to anyway.

I have been to Europe several times and traveled all over the U.S. using only points and miles. Over the past 20 years, that equates to over $200K worth of travel, hardly STUPID at all unless you would rather pay out of your own pocket.

A word of caution on paying early… at least if you have an AMEX with Plan It open. We bought tickets to Oz and wanted that off the card balance before we applied for a HELOC. We made the extra payment and saw that it was applied to the outstanding Plan It! AMEX was nice enough to refund the added payment and reinstate the Plan It for us, but it’s been a long process with a number of phone calls.

Read the fine print on your card for how early payments are processed.

We were offered $0 fee 0% interest Plan It… will always happily use other peoples money!

Something to be aware of for sure – thanks Bruce

I agree with the comments here. As a frequent traveler, I often charge large amounts to my card. When the card cycles, my credit score drops from 820 to 770. Then I pay the full balance and the score goes back to 820. This happens almost every month. It seems to me that this type of charging behaviour should be rewarded rather than penalized.

It does seem strange to me as well Scott. I would think overall portfolio of balances would play a larger role.

Here is another recent example of a credit score drop. I charged over $11,000 on my card to pay for a big trip in February and my score just dropped 105 points from 813 to 708. When I pay off the balance in full in a couple weeks, the score will go back up to 800+. BTW, this charge only represents about 10% of my total credit lines across all cards.

This happens to us fairly frequently, especially Q4. Vantage score is basically garbage. If you look at your actual Experian FICO 8/9 it usually only drops a few points.

Bigger picture, this is a massive failing of the credit scoring models. Charging a lot to card and then paying it off on time would seem to be responsible management of credit. Yet your score drops when you do that compared to paying your cards off a day before statement close. How many people out there aren’t savvy enough to know the difference and incur higher loan rates due to lower scores? I don’t pay my utilities a day early so the bill closes at $0. But if I don’t pay my cc bills before they close I’m deemed riskier from a credit standpoint. BS.

It does seem awfully punitive.

Is it a big deal if your not planning to have your credit run? My score goes up and down all of the time between 844 to 780. I do many gift card runs at time having up to 90% utilization across all of my cards. All my cards are set up on auto pay and I never pay them off early. Only if I plan to have my credit run for something I will go in to manual payment mode to keep the score up. I actually think having large charges post, then paying them off after the statement close make your score stronger as it shows your able to manage large amounts of credit. It does drops temporarily but next month it jump right back up and many time higher score then before it dropped. I look at it like working out you have to pump that credit to make it stronger. It probably only dropped so much because it’s not normal for you and you hit muscle credit failure 🙂

I think having it close over the allotted credit limit is what did the most damage.

Before the Simons GC & WM Money order fun came to a crashing end, I used to max out about 3-5 of my cards all with just $5 or less credit limit to spare many times charging up to $60k per week running hard with that for nearly 2 years. I was doing split payments on my cards having to check the remaining credit limit before I made my next swipe to avoid busting it, I would just take my credit limit -$5 and swipe 🙂 During that time my score for sure hovered at the lowest ever around 730-750 but the month after I stopped it shoot right back up to strong 800’s. I use Credit Karma to watch my score and thought it was funny because they send you a bunch of stuff acting as if they are responsible for helping you increase your score.

Citi gave you $4.6K on the Premier? When I got mine, all the comments seemed to indicate my $2.1K limit was standard (so I quit being outraged). That’s after 16 years with a Citi card, and a $17K limit on what’s now a Double Cash card. Just meeting minimum spend with that limit dinged my credit a few points, very short term. I’m thinking they don’t want me to actually use the card, definitely not for a big trip. And you seem to be saying that they reward you if you run over. Citi is soooo strange!

I know someone product changed their DC (with a big limit) to a Premier and then changed their other Premier to a DC as a work around since Citi wouldn’t move credit between the cards. Not sure how that makes sense for Citi but there is your work around 🙂

Perfect time to apply for another C1 card?

I should have done this before I got denied on the Venture X! 🙂

I blame it on Citi. I can never get a reasonable CL from them on cards they issue. The only exception is the Sears card they took over. I had a generous limit on that and when I ran it up close I asked for more and they gave it to me! I’m running that card consistently over 85% because the offers are so good and my score has been great. My DC cards are always over 50% because of the low limits. Everything gets paid off each month unless at 0% so I have a history to show any lenders who question them.

I know some folks have bad luck buying G/C with AMEX, but I use my BC, Everyday and soon Gold cards for grocery points. YMMV

They do seem to give strange and low limits on their cards

The only CiTi card I have is my Costco card and funny I just checked it has a $23K limit and I never asked for that. I never use this card at all the only charge it gets is the Costco annual membership 1 x per year. After reading this post I have no interest in apply for any other Citi card with such low limits.

Business Charge cards, run it to the moon.

I need a biz card with a grocery bonus 🙂

Mark, funny timing of your post. Just yesterday I used my new Citi Premier (been waiting a couple years to finally get approved!) to pay property taxes. I went to check the payment status at Citi and saw my $3,000 payment was pending, but my card had only a $2,000 limit! (And my three other Citi cards have over $10,000 each limits.) So I was able to make a same-day payment and get myself out of the hot zone for exceeding my credit limit. Hope that doesn’t get my dinged by Citi, but come on, such a tiny credit limit. And when I called yesterday to raise the limit, of course they unlike Chase don’t allow transfers of credit limits among accounts, so I had to do the hard pull credit request. Hope I don’t get into trouble and that this 80,000 ThankYou point minimum spend (which I have now hit) will be worth it!

It is pretty bizarre that they won’t shift credit between your accounts.

Unless you are trying to apply for a mortgage right now, who cares? It will bounce back up when you pay it off and the next statement closes.

Just more of a heads up for people where it does matter. I tried for an Amazon card after it dropped (not under 5/24) and was denied because of my score so it did hurt me a bit 🙁

Easy to avoid don’t game the system by purchasing large quantities of gift cards. Stay under 50% of limit, 30% is better, and 10% is ideal. Transfer from other cards (if allowed – Chase and Amex do) if you need to

100 points seems excessive – mine dropped 20-30 when I added some new cards and 0% promo balances, but recovered just as fast as the bills were paid off.

10% of $4600 is basically nothing and not worth mine, or anyone else’s time 🙂