What I’d Do With 2 Flight Reward Certificates – Maximizing the Chase Aeroplan Card

Now that the new Chase Aeroplan Credit Card has launched, I want to look at maximizing the card. We’ve looked at several other cards in this way, evaluating how to get the most “bang for your buck” and dreaming big with the welcome offer. If those 2 Flight Reward Certificates were mine, how would I use them? In this article, we’ll recap the perks and benefits of the new Chase Aeroplan Card and then discuss some ideas for maximizing the certificates from the welcome offer.

Chase Aeroplan Card Benefits

The Chase Aeroplan Credit Card is a new card on the market. Its welcome offer is a bit different than what we’re used to, so here are the details.

- Type of card: personal

- Card issuer: Chase

- Application rules to follow: cannot open this card if you have opened more than 5 credit cards in the last 24 months, no more than 2 credit cards in 30 days from Chase (see bank rules here)

- Spending requirements: $4,000 in 3 months

- Welcome offer: 2 Flight Reward Certificates, worth a maximum of 50,000 points each and valid for just one passenger each

- Annual fee: $95

- Learn More

Chase Aeroplan Card Benefits

- 3x Aeroplan points per dollar spent on dining, including takeout and eligible delivery services

- 3x Aeroplan points per dollar spent at grocery stores

- 3x Aeroplan points per dollar spent directly with Air Canada

- 1x Aeroplan point per dollar spent on all other purchases

- 500 bonus Aeroplan points for every $2,000 spent in a calendar month

- Maximum of 1,500 bonus Aeroplan points per month (requires $6,000 in spending)

- If you spent those $6,000 in 3x earning categories, you would finish the month with 19,500 Aeroplan points. That’s a 3.25x earning rate.

Other Benefits

- No foreign transaction fees.

- First checked bag is free on Air Canada flights for the primary cardmember and up to eight other travelers on the same itinerary.

- $100 credit towards Global Entry, TSA PreCheck, or NEXUS–available once every four years.

- World Elite Mastercard benefits.

- Travel protections for flight delays, baggage, and more.

- Aeroplan Elite 25K status for the remainder of the first calendar year in which you have the card, plus the following calendar year. This status includes perks like priority check-in, early boarding, upgrades, and more on Air Canada flights.

- Carbon offset benefit: Aeroplan will purchase carbon offsets when the cardmember redeems Aeroplan points for Air Canada flights.

- Earn Aeroplan Elite 25K status in ensuing years after spending $15,000 on the card in a calendar year.

- Earn Aeroplan Elite 35K status after spending $50,000 on the card in a calendar year.

- Spending milestones kick in at $100,000, $250,000, $500,000, and $750,000. These provide perks like 50% off Priority Rewards. The value of these perks will vary based on your elite status level. Elite 25K & Elite 35K members can use these for US and Canada economy flight redemptions. Super Elite members can use these rewards on business class awards worldwide.

- Anyone who spends $1 million on the card in a calendar can earn “GLOBAL+1”. This is a worldwide award-redemption-companion-pass hybrid. It offers a 100% return on all points redeemed in all cabins for the rest of the applicable year, plus the entire following year. This applies to the cardmember and a traveling companion. You need to spend a lot to earn this perk, but the value of getting a companion pass + all of your points back is huge.

- Learn More

Benefit Coming Soon – Pay Yourself Back

This perk is “coming soon”, but there’s no definite date that we know of at this time. Once active, you will be able to pay yourself back using Aeroplan points towards travel purchases from any airline, rental car, or hotel. Points redemptions will be at 1.25¢ per point. That’s a bit low for what Aeroplan points are normally worth, but flexibility is always good, and this may be useful for situations where you made a reservation in a way that didn’t allow for paying with points up front.

There’s a 50,000 points annual limit on this feature.

Just to be clear, this is not the typical Chase “Pay Yourself Back“. That program has different redemption categories and applies to cards that earn Chase Ultimate Rewards.

Thoughts on Maximizing the Benefits

I would open this card as early in the year as possible. Why? You get Aeroplan Elite 25K status (the lowest status level, equivalent to United’s silver status) for all of the year in which you open the account plus the full following year. If you would open this card in January, that’s essentially 2 years of status for 2 annual fees of $95. You’d also get 2 years of World Elite Mastercard benefits, like cell phone protection and travel protections.

What I Would Do With 2 Aeroplan Flight Reward Certificates

So…what would I do with 2 Flight Reward Certificates from the Chase Aeroplan Card? In order to really use these for maximum value, we need to understand the rules associated with the certificates:

- Each certificate has a maximum value of 50,000 points.

- You can only use the certificate once; if you use it for less than 50,000 points, you don’t get a voucher to use the rest later.

- If your itinerary costs more than 50,000 Aeroplan points, you can pay the difference in points from your account.

- The certificates do not expire, but you lose them if you close the credit card.

- Each certificate is only valid for one person, which offers the following redemption opportunities:

- One person flying an itinerary worth 50,000 points outbound and 50,000 points on the return.

- One passenger taking two trips, each worth 50,000 points round trip.

- Two people, using a certificate each, for an itinerary worth 50,000 points (per person) round trip.

- Two people flying “one way” on a trip worth 50,000 points per person.

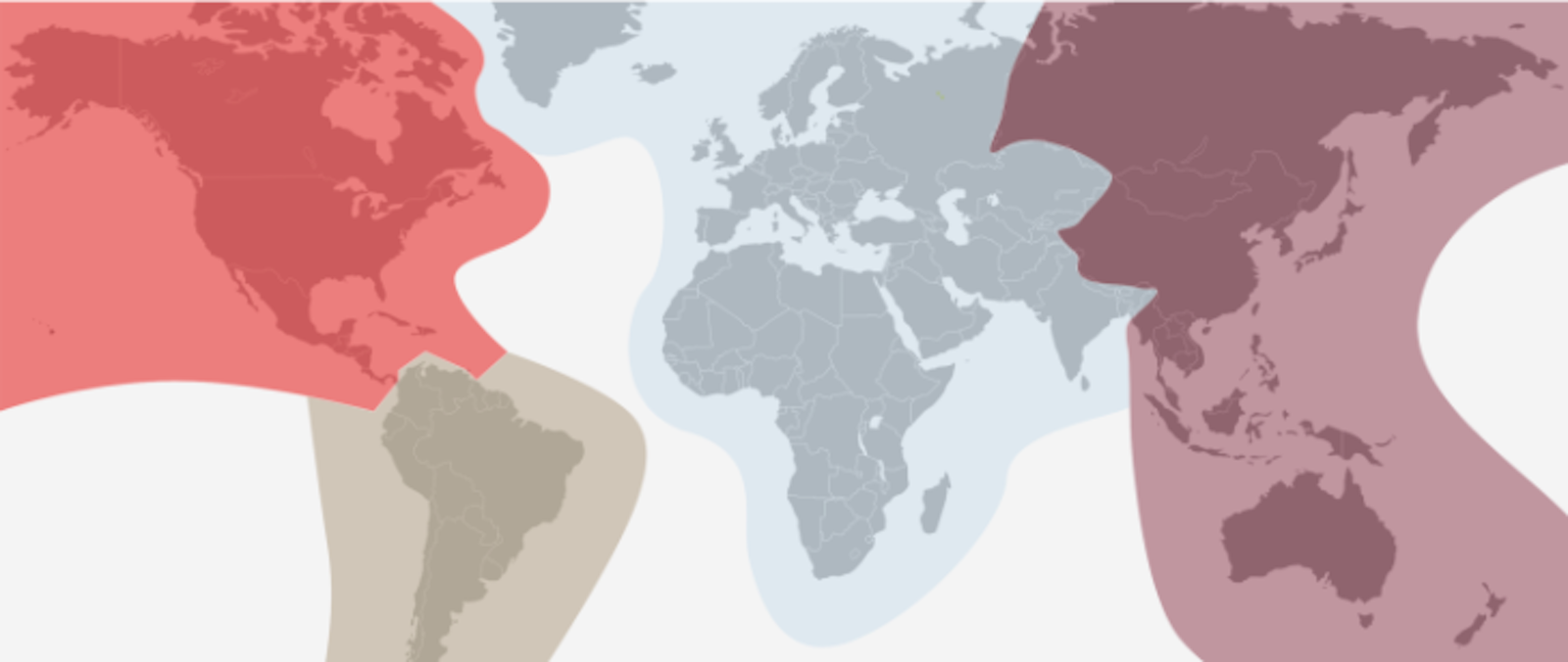

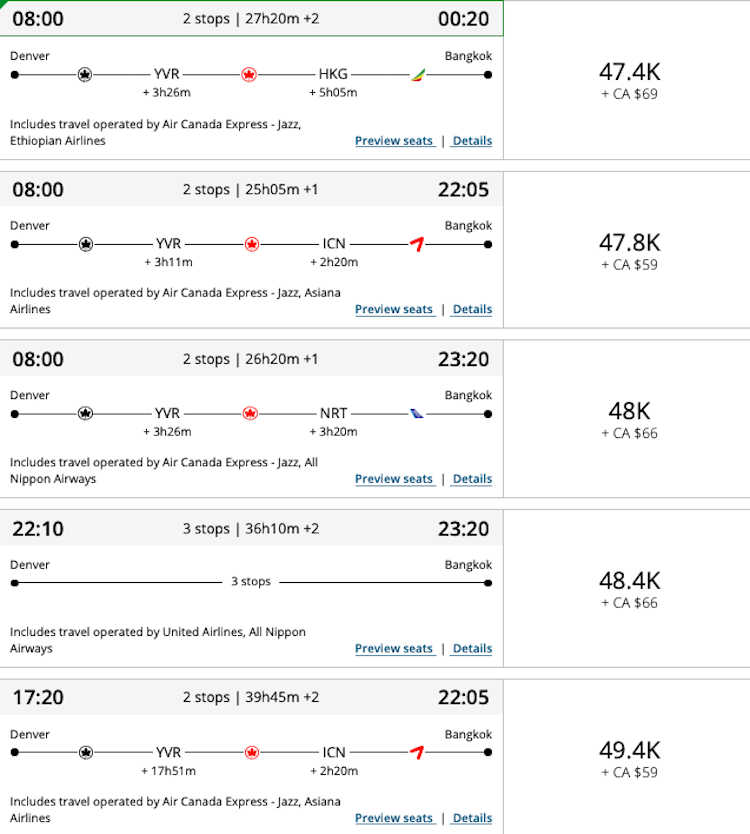

Aeroplan uses a zone-based + distance-based award chart. You can see the image above and consult the award charts here. You pay by which zone you’re flying from and to, and within that there are ranges of points, depending on the distance you fly. It’s important to note that you’ll pay $39 CAD (roughly $30 USD) for redemptions on partner airlines.

Starting in the US, here are some great vacation ideas that you could use to maximize the new Chase Aeroplan transfer availability.

Itinerary 1 – One person flying an itinerary worth 50,000 points outbound and 50,000 points on the return.

Saw my info about diving in the Galapagos and want to go? Carnival in Rio? Semana Santa festivals throughout South America? Go to Machu Picchu? Following Pablo Escobar sites after you watched Narcos? Tons of options for a round-trip business class flight to South America.

From North America to South America, you can spend 50k Aeroplan points in each direction if you keep the flight distance under 4,500 miles. Here’s a rough guide to what works:

- Southern half of US to middle or norther parts of South America

- Ft. Lauderdale to Buenos Aires or anywhere north of that

- Houston or LAX to Ecuador/Peru/Colombia

- Northern half of US to northern parts of South America

-

- DC and Chicago to anything north of the top of Chile

- Denver or Seattle to Ecuador/Peru/Colombia

-

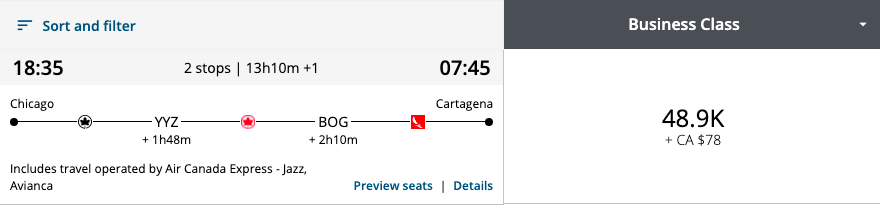

For under 100,000 points, fly round-trip to Cartagena on the northern coast of Colombia in business class. The overnight portion is in a lie-flat seat, so you can sleep well.

You’ll pay $132.50 US in taxes and fees for the round-trip booking. This includes the partner award booking fee.

Cartagena has a great Hyatt Regency with a really nice rooftop pool + bar area.

Itinerary 2 – One passenger taking two trips, each worth 50,000 points round trip.

Within the North America zone, no economy flights will cost more than 22,500 miles. That means you can book any round-trip itinerary within North America using a certificate. Unfortunately, you can’t get “there and back” for 50,000 points going to anywhere beyond North America.

Additionally, within North America, you could book a round-trip fare in premium economy or even business class if the flight distance is less than 2,750 miles. So, what can we do here?

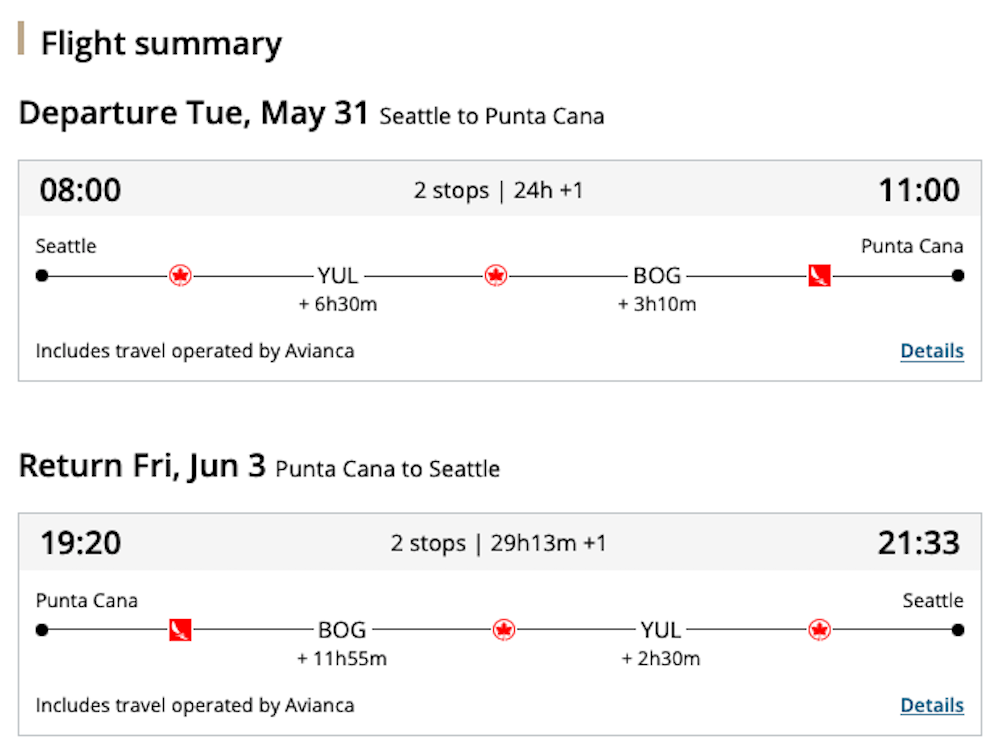

You can take a round-trip for some huge distances within North America, such as Seattle to Punta Cana, Dominican Republic and back. This could be one of your two trips.

Itinerary 3 – Two people, using a certificate each, for an itinerary worth 50,000 points (per person) round trip.

These same ideas would apply to two people traveling together, each using a certificate. While one person could do these two trips independently, two people traveling together could do the trip above or the trip below–choose one.

Itinerary 4 – Two people flying “one way” on a trip worth 50,000 points per person.

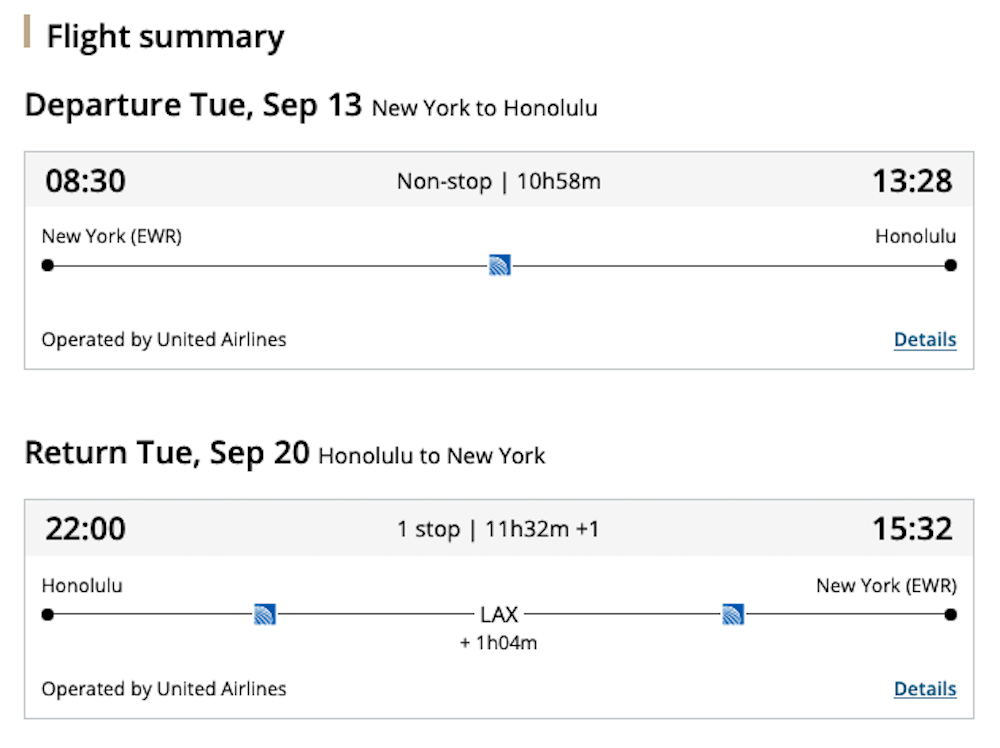

If this flight is part of a larger trip–of if you’ll use some other points to get home–you could use your certificates to go really far in one direction. Maximizing your certificates from the Chase Aeroplan Card would allow two people to fly in economy to the Pacific region. Just keep the flight distance under 7,500 miles.

As you see, there are a bunch of options for this itinerary–so you know it can really be done and isn’t a rarity.

You could also take the following flights in this “max distance” concept:

- North America to Atlantic region – flights under 6,000 miles are less than 50,000 points in economy

- North America to South America – all economy flights are less than 50,000 points per person

Final Thoughts

If you’re maximizing the Chase Aeroplan Card and its welcome offer of 2 Flight Reward Certificates, we looked at some ideas for how to use them. We also reviewed the many perks and benefits on this card. This welcome offer is different from what we’re used to, where you normally get a lump sum of points, so make sure you understand the rules around these certificates and use them in a valuable way.

What are your thoughts on these certificates as a welcome offer–better, worse, or indifferent?

So after spending 1 mil, you can essentially travel for free?