DISCLAIMER: Miles to Memories & the author are not credit providers and do not provide personal financial or professional advice or credit assistance. The information published on this site/page is of a general nature only and does not consider your personal objectives, financial situation or particular needs. All information published here is my own personal opinion and comes from personal experience. The information published on this site/page should not be relied upon as a substitute for personal financial or professional advice. Miles To Memories and the author strongly recommend that you seek independent advice before you apply for any product or service, which is described on the site/page.

Your Questions Answered

For the past week I have been asking readers to send in their questions so I can answer them. Here are the related posts:

- Your Questions Answered – Most Common Points & Miles Acronyms

- Credit History with Converted Accounts, Max Number of Amex AUs, Money Orders at Walmart & More

- Ink Bold or Plus, Paying for Someone Else’s Global Entry & Shopping Portal Clawbacks after Returns

- Credit Card Churning – How to Decide Which Cards Stay & Which Cards Go

- Parking Money in Bluebird, Personal Expenses on a Business Card & Funding Checking Accounts with a Credit Card

- How Business Cards Affect Credit & Avoiding a Chase & Amex Shutdown from MS

- Which Points & Credit Cards for Which Airlines, Hotel Free Night Expiration Dates & AA Miles to Hawaii

This will be the last of the Q&A posts for a short while. This has definitely been popular, so I am going to look at making it a weekly series or perhaps bringing it back for a week every once in awhile. Thank you to everyone who has written in and asked a question and let me know in the comments if you have enjoyed it.

Question 1

Our first question comes from Henry:

Hey Shawn! I was recently approved for the AMEX Platinum card (first year fee waived) and am considering cancelling my Premier Rewards Gold Card. Problem is, my Gold card is my oldest and most established account (30+ years). Will cancelling the Gold Card hurt my credit? Thx!

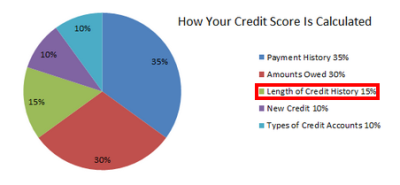

This is a really great question and sort of ties into what we talked about the other day with average age of accounts. The quick answer is that it will have some effect on your credit in the long term, since the length of your credit history represents 15% of your FICO score calculation.

Thankfully that impact will not be felt right away. If you close your Gold card, that account will remain on your credit for up to 10 years. While it will not get any older, it will still be a 30 year old account which will continue to help your average age calculation overall. Once it drops off, your average age will drop, but hopefully you will have other cards to help with that calculation by then.

If I was answering this question a few months ago, I would have told you something different. American Express used to backdate new credit card accounts to the date you got your first card with them. In that case, your new American Express Platinum card would have shown as a 30 year old card! Unfortunately back in March they supposedly ended this practice.

My best advice is to do what is right for you. Average age of accounts is only 15% of your credit score and you most likely have other older accounts as well. Since the Gold card will remain on your credit for up to 10 years, you shouldn’t feel too much of an impact if any at all. Of course there are a ton of other factors to consider, so the answer to this one lies solely with you.

Update: As PDXDealsGuy points out in the comments, Henry should absolutely try to see if Amex will downgrade it to a no annual fee card like the Everyday. When doing this, make sure the account number and history will remain in tact though, as a few people have reported receiving new account numbers while doing conversions in the past.

Question 2

Our second question comes from John:

One friend asked me this question, but I have no idea. Is there a tool we can use to find out how many miles we need for redeeming a ticket from point a to point b on a certain day for all the major airlines?

This is a great question, because it can be difficult to figure out which miles currency to use for your trip. Yesterday I talked about the Transfer Partner Master List which helps to show you which flexible points currencies transfer to which airlines. That can be helpful, but there are a couple of other quick tools.

First off, Dan from Points with a Crew has designed the Mile Matrix. This tool allows you to type in an origin and destination region and it shows you how many miles it will cost on most of the major U.S. Airlines. It works really well and even separates the amounts by class of service.

If the airline you are looking for isn’t listed, there is another resource. Travel Is Free has almost every major airline award chart in one place for you to view. While this isn’t automated, it keeps you from having to track down award charts on different websites. (Shameless plug, I have a similar page with Hotel Award charts.)

Unfortunately neither of these are the complete all-in-one solution your were looking for, but they both work well and help to take some of the work out of it. A website called Miles.Biz did a lot of what you are looking for, but it unfortunately seems to be offline.

Question 3

Our third question comes from R Hirsch:

I used to have serve. i would load via cc. transfer money to bank account. pay cc. and get my minimum spend and my miles. Then that died. So i was just about to start redbird’ing. Then that died. I NEVER spend that much per month to meet minimum spend. So how, these days, do you suggest meeting minimum spend requirements, not via normal daily expenses, but in ways similar to how i used to do it via serve?

The easiest way to do this is to purchase pin-enabled gift cards and load them to REDbird or Serve. I have written about various ways pretty extensively on Miles to Memories, so you should be able to find a lot of content on the matter. If you are looking for the simplest way, it would probably be to buy them at GiftCardMall.

This is also a good place to start looking: Where To Buy Pin-Enabled Gift Cards for Manufactured Spend

Conclusion

At this point I have worked through most of the questions on the original post. If I didn’t answer your question it is because I didn’t feel it fit well within the scope of these posts. I am going to be emailing the authors of the few questions left that are unanswered to go over my advice. As always, if you have a question or comment feel free to email anytime at shawn@milestomemories.com!

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

|---|

No, I called up specifically to ask about that when I opened the account, and the rep said no problem, they would backdate the card to 1997 to match my Platinum which has been open since then. Maybe it’s a Platinum benefit that they did it for me? Still, they did do it.

Thanks for sharing and I’m glad to hear that!

With regard to your answer to #1, I just got a brand new PRG two days ago, and Amex backdated it to 1997 for me. Not sure who said they stopped doing that in March, but thankfully it appears they haven’t!

I’m not talking about the “Member Since” date on the card, but rather the account opening date on your credit report.

Here’s a few more well known, yet rarely discussed ways to meet minimum spend: Kiva loans, and funding new bank accounts (that you sign up for to get the bonus).

Shawn – in your reply, you mention about having written extensively about how to meet minimum spend. Is there a way for you to link back to such information in your answers? A few of the bloggers do this – linking back to their own content, and I find it extremely useful when researching how to keep this hobby alive. Others would probably find it super helpful as well.

Thx Shawn (and everyone else) for your helpful comments. Since the Platinum card fee is waived for the first year and earns no MR multiple, I’ll just keep it for a year and max out on airline credits, Global Entry or TSA Pre fees, etc. before cancelling it next Spring. Paying the $95 net to keep the Gold PRC open, maximizing the MR earning multiple and preserving my history sounds like the best strategy. Thx again and keep up the great work!

Thanks Shawn for answering my question!

Regarding question#1, I also have a 12 year old Citi AAdvantage credit card that cost me $95 in annual fee and I haven’t used it in the last 7 years. Not once!!! However, I always have the concern to cancel it since it is my oldest one. I asked Citi if they could convert that card in another one with no annual fee and they said no. Thus, one side of me wants to cancel but the other is concerned about losing all those years in my credit report.

Definitely worth HUCA (hang up and call again – maybe a few times). Or, if you decide to keep it, definitely worth trying to see if they will waive the annual fee or give you some sort of retention bonus (a certain amount of AA miles for doing a certain amount of spending in a specified amount of time). The fact that you haven’t used the card at all might hurt your chances, but worth a try (or three!). But, at the end of the day, if none of that works, I think I’d get rid of it rather than paying $95/year.

Have you tried calling back? As far as I know there shouldn’t be any issue converting it to a ThankYou Preferred, Double Cash or Dividend. (Keep in mind you may not be able to get a bonus on the ThankYou Preferred for 18 months if you switch to it.) I converted an AAdvantage Platinum within the past year and just converted an AAdvantage Executive about a month ago.

I asked twice and did not get any luck. I am now working to reach my minimum spend on both Citi Prestige and Premier so won’t bother with the old card now. Once I get all the Thank You points I will call them again and ask. My biggest problem with Citi is that not always what they tell you is what happens. For example, I had a Prestige issued with Mastercard and when I decided to apply for the Premier I called and asked if that could be issued with a Visa. They said no problem. I applied and guess what? I got another Mastercard card. I called them back and was told they cannot convert it to a Visa. Also, they said 95% of Citi’s cards are issued by Mastercard and it is rare to have a Citi Visa. At the same time Citi announced couple months ago they will be the issuers of all Costco cards together with Visa. Go figure!!!

Quick thought on #1. Maybe it’s possible for him to downgrade the gold card to a no-fee card?

Good point and definitely something to try. He may be able to downgrade to an Everyday card, but I have heard mixed things about whether the account number stays in tact. Definitely something to try first. It really is too bad that Amex no longer backdates.

I know the downgrading and keeping the same account number will work with Amex business cards (having recently downgraded a business Delta card to a business SimplyCash), but not certain about personal Amex cards.

The PRG is a charge card while the Everydays are credit cards. Therefore I would be surprised if you could even keep the same account number since these are different card product types (charge vs. credit).

When I upgraded my Gold to Plat, the account number stayed the same but these are the same product family.

Yes and that is why I mentioned it in the post. I have heard varying accounts if this is possible. Some people say yes and some say no. Another consideration is if you change to another product like the Everyday, you are foregoing ever getting a bonus on that product under Amex’s new personal card bonus policy.