These Credit Cards Can Wait. Don’t Get Them If You’re Under 5/24.

In this hobby, there are some cards that you should get right now, and some credit cards can wait. Unfortunately, there are cards from the ‘wait’ category that people love to get at the wrong time. Don’t get these cards too early, because using the wrong long-term strategy means sacrificing points & miles. If you’re under 5/24, getting these cards is a mistake. It’s a common mistake, but it’s a mistake nonetheless.

How Do I Know Which Credit Cards Can Wait?

I previously talked about my mentality in deciding what card to get next. In my opinion, if you ask “Can I get this card later?” and the answer is “Yes”, you probably shouldn’t get that card. If you’re under 5/24, you probably shouldn’t get any personal cards that aren’t from Chase, unless some insane, once-in-a-lifetime, “best welcome offer of all time” type of deal comes around. Otherwise, if you’re under 5/24, I think you should focus on Chase. Anything else is…overrated. You can get it later when your “Can I get it later?” with Chase changes to “No”.

Exceptions

A good example of a card that can’t wait, even if you’re focusing on 5/24 with Chase, is the dream offer of 100,000 Membership Rewards points on the Platinum Card from American Express. You might never see that offer again, so you should grab it. A 2nd example of “it can’t wait” is when a credit card is going away or has a special welcome offer with outsized value (waiver of normal application rules, double the normal bonus points, etc.).

Common Credit Cards That People Get Too Early

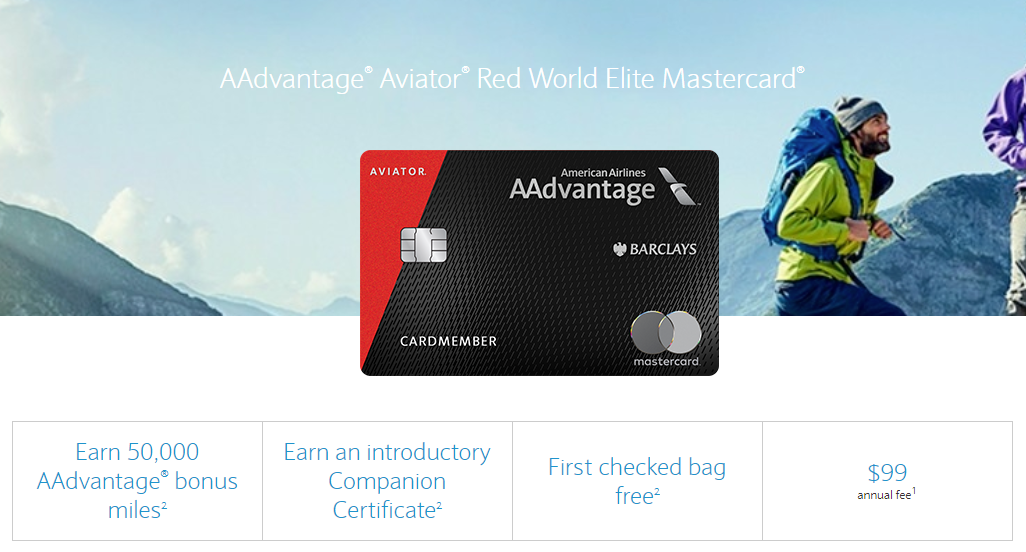

The 2 most common credit cards that can wait but people get them too early are these: the Barclays AAdvantage Aviator Red World Elite Mastercard and all Delta cards from American Express. Here’s what I mean by that.

Barclays AAdvantage Aviator Red World Elite Mastercard

In the list of which credit cards can wait, this is a popular card for people to get when they shouldn’t. Thus, they forfeit points and miles in the long run. This is THE easiest credit card welcome offer in the world to earn. Sign up, pay the annual fee, make 1 charge, and BOOM! 60,000 American Airlines miles are yours. That is a very easy offer.

The problem is that this offer is always available. You can get this card and this welcome offer nearly any day of the year, as long as you follow the application rules. Unfortunately, the easiness of it makes people think the card’s value is higher than it is. Plus, Barclays does some GREAT marketing on this card during American Airlines flights.

You can get this later, so don’t get distracted by “low-hanging fruit”. Remember: “Can I get this card later?” If you’re under 5/24 with Chase, you should focus on which cards you can’t get later. Get this card after you’ve passed 5/24.

Delta Cards From American Express

The same logic about seeing ads applies here. The Delta/Amex marketing team is phenomenal. You can’t check your Delta account online or take a Delta flight without seeing their ads, especially for the Delta SkyMiles Gold Card. However, the same thing applies as what I said above. These credit cards can wait.

Yes, we recently saw some fantastic bonuses and welcome offers on these cards. However, elevated welcome offers come around not infrequently on the Delta SkyMiles American Express cards. “Can I get this card later?” Yes. If you’re under 5/24 with Chase, you’ll give up on other cards to get this card, and that isn’t a good trade-off for most situations.

This Isn’t A Sprint

This hobby isn’t a sprint. Not everything that looks good now is good for the long term. Marketing is just that: marketing. Making something look awesome doesn’t mean it’s super valuable, and that’s the key takeaway here. If you ask “Can I get this card later?” and say “Yes, but I’m getting it anyway,” you just lost a chance at other cards.

Imagine you’re under 5/24 and get the Delta SkyMiles Gold card. Your friend gets a Chase card now and then gets the Amex card later. You can’t get that Chase card later, unless you wait to fall back under 5/24. Because of this, your friend has twice as many points and miles as you do. Marketing shouldn’t override our judgment on what’s best for the long term and pooling as many points & miles as possible.

When You should Get These Cards

Now that I’ve told you these credit cards can wait, here’s when you SHOULD get these cards.

You should get the Barclays AAdvantage Aviator Red World Elite Mastercard right after passing 5/24 with Chase. Why? Barclays is sensitive to the number of inquiries and new accounts on your credit report. Applying for this card before your numbers go higher increases your approval odds.

You can get the Delta Cards From American Express pretty often. The key is to wait for a great welcome offer to roll around. Don’t apply for these just any time, since American Express has ‘once in a lifetime’ language on their welcome offers. You want to get the highest number of miles possible when applying for these cards.

Other good cards to get right after passing 5/24 are the Capital One Venture Card or U.S. Bank Altitude Reserve. Why? Capital One is known for pulling all 3 bureaus for your credit report, and they are sometimes sensitive to inquiries. U.S. Bank is definitely sensitive to the number of new accounts and credit inquiries on your report. Before piling up too many cards, it can be smart to get something from Capital One or U.S. Bank. See our application rules here.

Final Thoughts

Thinking about the long game helps me a lot in this hobby. If in doubt, do the math on a credit card welcome offer before applying for it. What would you be giving up (if anything) to apply for this card? Can you get this card later? If you have to give up something to get this card, make sure what you’re giving up isn’t more valuable than what you’re getting in return.

In my opinion, these cards have incredible marketing that leads people to give up on/miss out on numerous other credit cards every year. However, the value proposition in doing that is a loss–not a gain. They’re not bad cards, and I’m not telling you not to get them. I have them. I’m just asking you to not overvalue them because of some good marketing. The Barclays AA and Delta Amex credit cards can wait until you’re over 5/24.

[…] be part of your plan to reach a travel goal, but this post from Miles to Memories is a reminder that there are some cards you want to get first and other than can wait, especially if you’re under Chase’s 5/24 […]

You are only talking about Personal cards, correct Nit Business versions.

Jim – I didn’t understand your comment. Can you explain the 2nd half?

I think he means “not business cards”

If so, then yes – personal cards should wait, so they don’t take up 5/24 slots.