What I’d Do With 80,000 Ultimate Rewards

The Chase Sapphire Preferred‘s increased offer is back, so here’s a look at what I’d do with the offer’s 80,000 Ultimate Rewards points. We’ll also look at maximizing this credit card – what are its key perks and benefits? What’s the best way to spend those 80,000 Ultimate Rewards points? In this article, we’ll take a deep dive on the Chase Sapphire Preferred to look at the ins and outs, what makes this card a favorite in this hobby, and also that great welcome offer. After we get to know the card, I’ll show you how I would use those 80,000 Ultimate Rewards points.

Update 5/31/22: The 80K offer ends tomorrow, 6/1/22, at 6 PM EST.

Chase Sapphire Preferred Credit Card Benefits

The Chase Sapphire Preferred is a favorite in this hobby, and that’s with good reason. High up on the list of reasons for people loving this card is the welcome offer. Here are the important details of the increased welcome offer:

- Type of card: personal

- Card issuer: Chase

- Application rules to follow: cannot open this card if you have opened more than 5 credit cards in the last 24 months, no more than 2 credit cards in 30 days from Chase (see more here)

- Spending requirements: $4,000 in 3 months

- Welcome offer: 80,000 Ultimate Rewards points

- Annual fee: $95

- Learn More

Chase Sapphire Preferred Credit Card Benefits

- 2X Points on travel (flights, buses, hotels, etc.)

- 2X Points at restaurants.

- 1X Points on everything else.

- 25% additional value on redemptions through the Chase travel portal (redeem points at 1.25 cents each, instead of just 1 cent).

- “Pay yourself back” at 25% extra value when using points on purchases from grocery, restaurant & home improvement stores, as well as charity donations.

- Limited time offer of 2X on grocery purchases up to $1,000 per month. This runs from 11/1/20-4/30/21.

Other Benefits

- 5X Points on Lyft rides

- $0 delivery fees by signing up for DashPass with DoorDash

- Additional cards at no additional cost

- Additional protections like trip insurance, extended warranty, purchase protection, and rental car insurance.

- No foreign transaction fees

- Learn More

What I Would Do With 80,000 Ultimate Rewards Points

So…what would I do with 80,000 Chase Ultimate Rewards? Technically, you’re going to have more than that. After spending $4,000 on the Chase Sapphire Preferred credit card, you’re going to have a minimum of 84,000 miles in your account. I’m going to use 84,000 points for trip planning.

The best thing about Ultimate Rewards is their flexibility. Unlike earning miles with an airline or a hotel, your points aren’t locked into that program. If I earn Marriott hotel points, I can’t send those points to a different hotel program or transfer them to an airline program of my choice. With Chase Ultimate Rewards, I can do a lot. That’s why they’re so great.

There are 10 different airline programs and 3 different hotel programs you can transfer to. See our guide to Ultimate Rewards here. From our research on uses of Ultimate Rewards points, we find they are worth 2.9 cents per point on average. With that in mind, what can we do if the goal is maximizing the Chase Sapphire Preferred card? Here we go.

Couple’s Long Weekend In Savannah

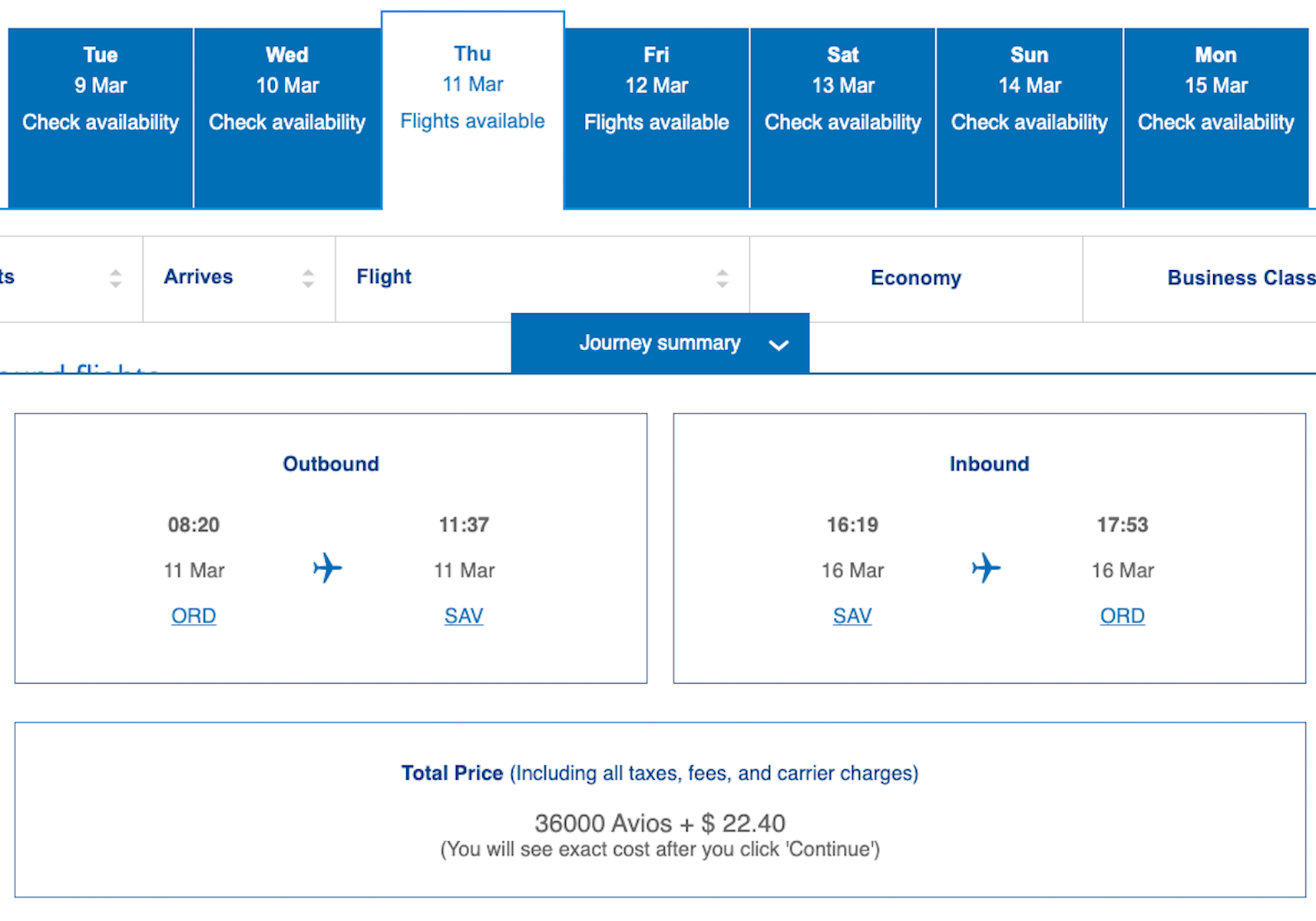

Want to get away as a couple? Take a long weekend away to somewhere beautiful like Savannah, GA. If you live in Chicago, you could fly directly to Savannah with American Airlines. To make this booking cheaply, you’ll transfer your Chase Ultimate Rewards points to British Airways Flying Club. You’ll pay 36,000 miles and $22.40 in taxes for the 2 of you to fly round-trip in economy. Even though we’re using miles from British Airways, we’ll actually fly on American Airlines.

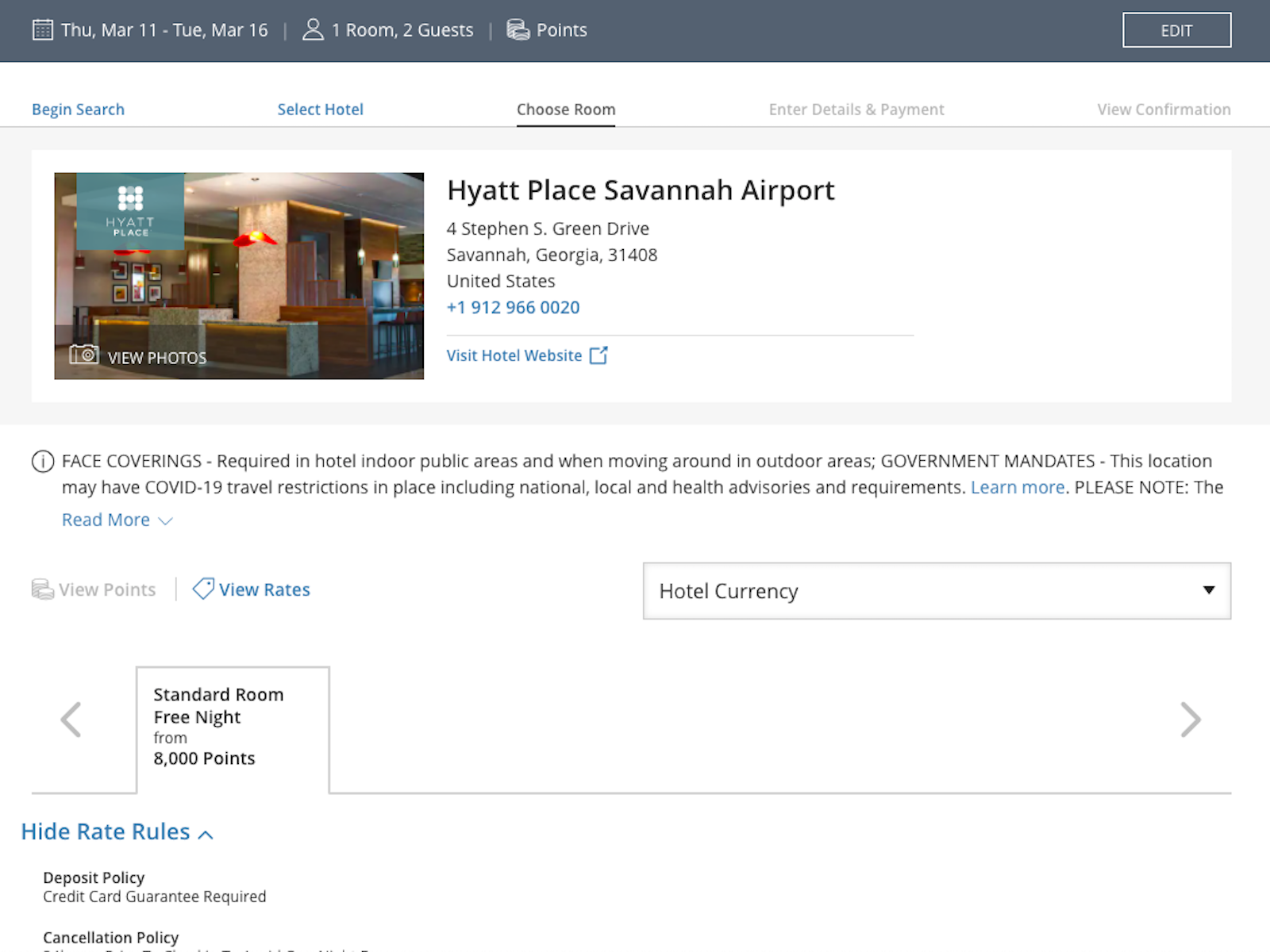

As for the hotel, you can use 8,000 points per night with World of Hyatt. You can transfer points from Chase to Hyatt at 1:1, so 5 nights means 40,000 points. From our 84,000 Chase Ultimate Rewards points, we’ve now used 40,000 for the hotel and 36,000 for the flights. We still have 8,000 left!

Business Class To Various Caribbean Options

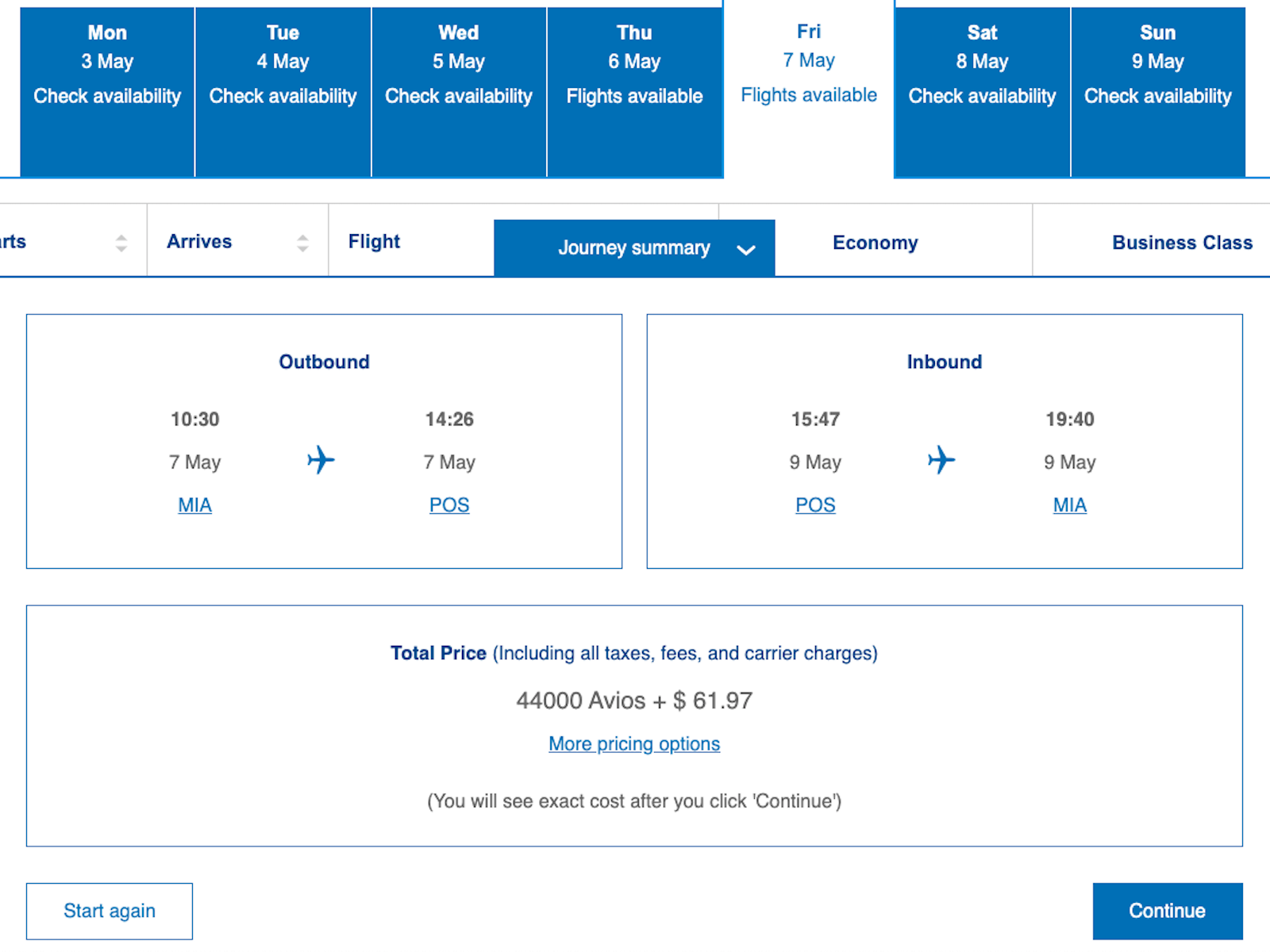

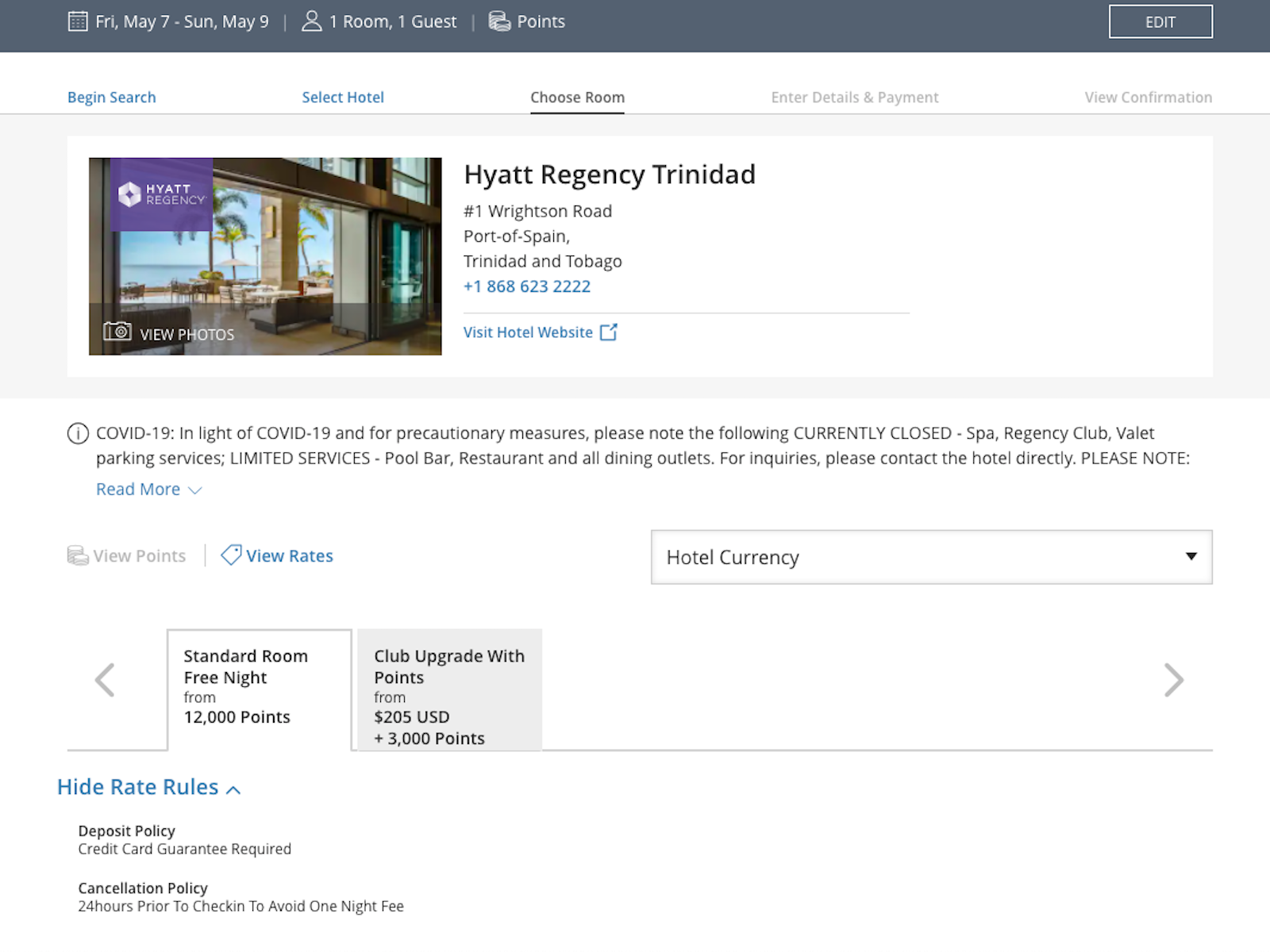

Options abound for a getaway to the Caribbean. Your 80,000 Chase Ultimate Rewards points can put you on a beach or on a hike through jungles. Again, the best bet for this trip is using British Airways Avios. We’ll fly business class to Port of Spain, Trinidad. Other options could include Jamaica, Turks & Caicos, Puerto Rico, Aruba & more. In this example, the best redemption is again with Hyatt. I priced this for one person, because maybe you’re going with friends and not paying for a couple this time around.

Stay at the Hyatt Regency for 12,000 points per night. You can transfer your points from Chase to Hyatt and book that way. Depending on the cash price of the room for the nights you’re going, don’t forget to check Travel.Chase.com to see if “buying” your hotel room with points is a better deal.

In this example, we used 80,000 Chase Ultimate Rewards points for a trip to the Caribbean. Flying first class and staying a couple nights at a hotel left us with 4,000 points remaining.

First Class

So, you want to fly in style? You can use the 80,000 Chase Ultimate Rewards from your welcome offer to fly on the famous Lufthansa First Class out of Frankfurt, Germany. You’ll have enough miles for an 11-hour, one-way flight in their luxurious first class to Johannesburg, South Africa.

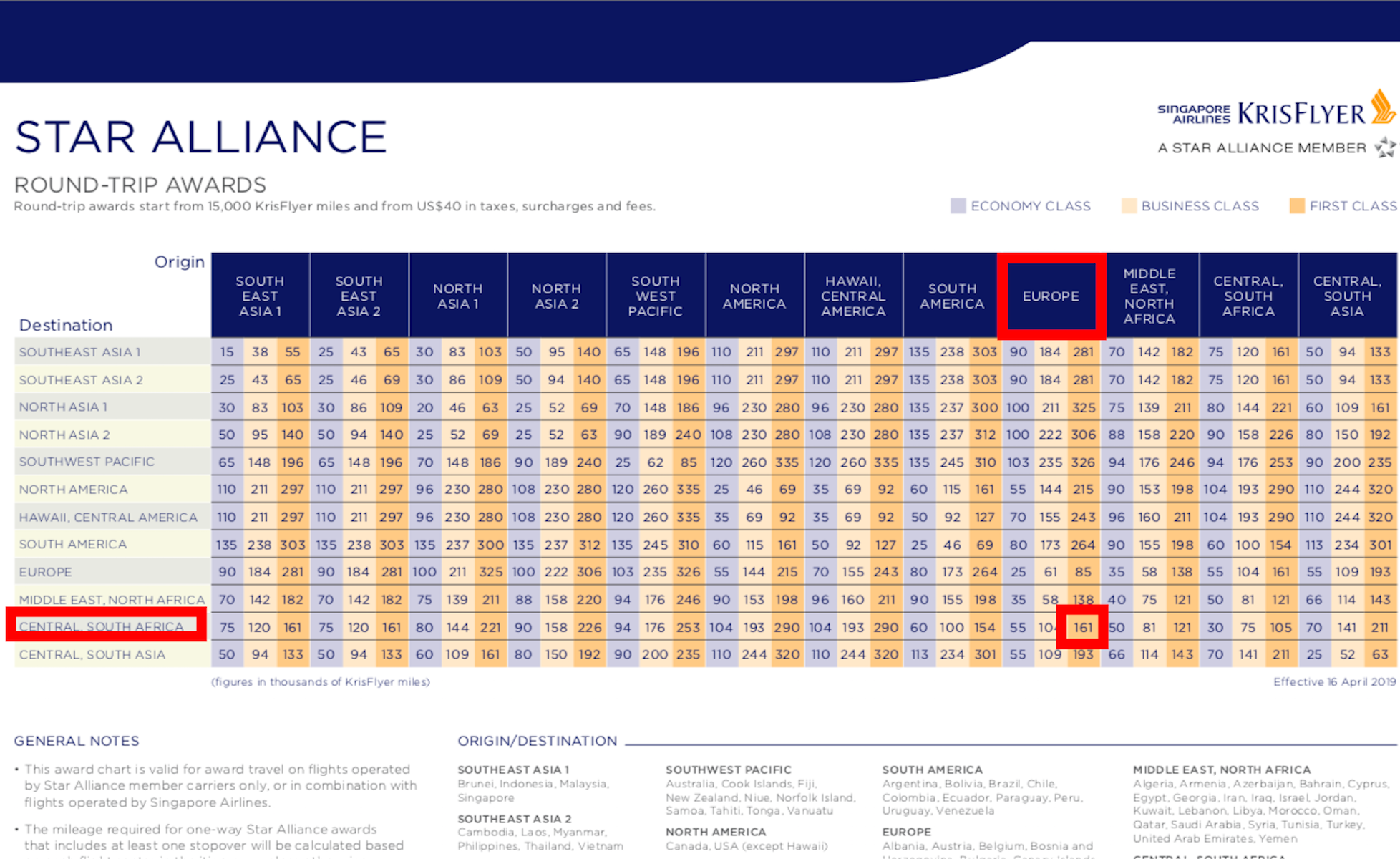

The problem with booking Lufthansa first class through a partner is that you can only book up to 2 weeks in advance. The best deal on this booking is using Singapore Airlines and their KrisFlyer program. Not only do they have very friendly change/cancelation fees, it’s also your cheapest option here.

Using the new search tools on the KrisFlyer website, you can book up to 2 weeks in advance for Lufthansa first class. This means you’ll need a combination of flexibility, last-minute planning, and luck. The award chart above shows prices for a round-trip ticket, so half of that is what we need. 80,500 miles for that 11 hours of pure bliss.

Final Thoughts On Maximizing the Chase Sapphire Preferred Card

If you’re maximizing the Chase Sapphire Preferred and its welcome offer of 80,000 Ultimate Rewards, I hope you found some good ideas here. We looked at the perks of the card and the welcome offer. We also looked at ideas for maximizing those 80,000 points for some great trips.

Remember that other ideas are also in play. We previously looked at using Ultimate Rewards transfer partners in articles about United Airlines, Singapore Airlines & Iberia. There’s also this article about British Airways redemptions for under 10,000 miles. We also have a guide to cheap Hyatt redemptions. Added flexibility comes from the fact that Chase lets you share points with others in your household, and many of their transfer programs let you make bookings on behalf of others.

What would you do with 80,000 Ultimate Rewards points?