REDbird Postmortem – Ideas & Strategies Going Forward

Update: I have now seen a memo that was distributed to Target stores explaining their new “cash only” policy for REDcard, Amex for Target & other prepaid cards. REDbird is 100% dead for debit/gift card loads. I hope the information below helps some of you find your next step.

So the news doesn’t look good for REDbird. I shared my thoughts this morning on why I think it is essentially dead, but that doesn’t really help you much. As I mentioned in this morning’s post I thought I would put together a list of resources and ideas for those who have never lived in an MS world sans REDbird.

Before I begin, a few things. I am not trying to say REDbird is or isn’t dead and I highly recommend reading other people’s data points and making your own decision on what you think is going on. My opinion is that it would be prudent to wait a bit more time before making any sudden changes. With that said, I feel this post will be helpful to many of you. Even if REDbird somehow lives, diversifying your strategy may not be a bad long term move.

Now let’s look at some things I know many of you are wondering about.

Liquidating Gift Cards

Some of you no doubt have gift cards that you now need to get rid of. Fortunately I maintain a permanent resource on this website discussing how to liquidate Visa & Mastercard gift cards. Among the ideas I discuss are:

- Merchant gift cards

- Bill Pay Services

- Bluebird/Serve

- Money Orders

- Reselling

- Emergency methods with a ~3% fee

There are even more ideas than that, so I recommend giving it a read. Hopefully you will quickly see that there are other options beyond Target for liquidating gift cards. My only advice would be to stay within your comfort zone and don’t go too big too quickly. When dealing with large amounts of money, it is often possible to make a huge mistake.

Also, I need to add I am not advocating any method discussed here or on that page. I am simply presenting available options and letting you do more research to determine what works for you.

Switch to Serve/Bluebird

I suspect many of you will want to switch from REDbird to one of the other American Express prepaid products. (Assuming they continue to work.) Thankfully the process of switching is fairly painless. You simply need to close your current account and then apply for a new one. Just make sure you empty out the account balance and verify all payments have been cleared before closing. You might also want to download any statements if that is important to you.

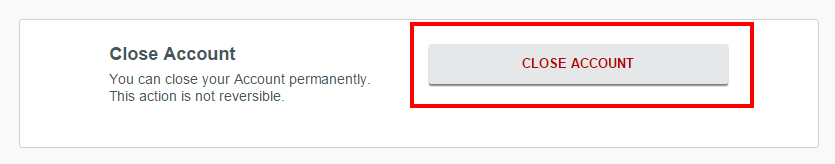

Closing REDbird

To close your REDbird, login to your account and go to your “Profile”. Once on that page scroll down and look for the “Close Account” button. Click it, follow the prompts and your accounts is closed.

Here are a few tips to make this go smoother:

- You don’t need to wait to open your new account. Once your REDbird is closed, you should be able to open a Serve or Bluebird right away.

- In the past using the same email has been problematic, however Frequent Miler has recently reported that using the same email is actually the preferred method. Update: I can confirm that using the same email works perfectly fine now!

- Some people have issues opening a new account, because their old one isn’t closed out completely for some reason. If that happens simply give Amex a call. They will be able to fix the error.

Now that I have given you the basics, I highly recommend reading the following resources on Frequent Miler which go further in depth on the subject.

Bluebird or Serve – Which One?

Now that you know how to close REDbird, you must make a decision about whether you want to switch to Bluebird or Serve. Thankfully this is an easy question to answer. Unless you physically need to write checks, Bluebird is inferior to the good versions of Serve in just about every way.

Serve allows online credit card loads from Amex cards and also gives you the ability to load at Family Dollar in addition to Walmart. Unfortunately Amex just launched a bunch of different versions of Serve, some of which stink.

Which Version of Serve?

If you have decided that Serve is the right choice, then you must decide which version of the product to open. Unfortunately all versions of Serve are not created equal and there are a couple of bad (in my opinion) flavors out there. Thankfully I created an entire resource on Frequent Miler comparing and contrasting each version. Luckily there is a clear winner.

In my opinion the best version of Serve is the One VIP Serve. It has a waivable monthly fee and free loads at both Walmart and Family Dollar. In other words, it has pretty much all of the features of the old Serve card without any of the fees, etc. that the other new versions carry.

Walmart 101 – Prepare for Fun!

So you never had to subject yourself to Walmart? Well get ready for the beautiful hues of red to be replaced by a dark, sort of sad blue. Ok, I will admit I am a little burned out on Walmart after having done this for several years, however it is a necessary evil for me and one I hope sticks around. The good news about Walmart is that you have more options for loading Bluebird/Serve than you did for loading REDbird at Target. Let’s take a look.

Cashiers

Like at Target, you can go to any Walmart cashier and ask them to load your card if they are willing. Unfortunately in some areas management has restricted loads to the customer service desk or MoneyCenter, however every register has the ability. Hopefully you can find a friendly cashier who knows how to do it.

MoneyCenter or Customer Service

You can also load your card at the MoneyCenter or Customer Service desk. I often find the employees in these areas are rushed and try harder to shut you down, especially if you are using a gift card. With that said, if you can find a friendly cashier, then you will be golden. Most likely you will get to know the MoneyCenter staff pretty well.

The Kiosk (KATE or MoneyCenter Express)

The final option for loading is perhaps the most unique and what I think sets Walmart apart. In most stores Walmart has a kiosk known as the MoneyCenter Express. This kiosk which has been nicknamed KATE by the MS community, allows for something beautiful. Yes, you guessed it, the absence of human interaction.

KATE can be really buggy and is often broken, however some stores have more reliable versions than others. Unfortunately this machine is being replaced by a dumb ATM in many areas of the country, so it remains to be seen how much longer this method will last.

If you are interested in how KATE works or the process of loading, see: How to load Bluebird/Serve at the Walmart MoneyCenter Express kiosk.

GoBank

Did you know there is another product that can be loaded for free at Walmart? It is called GoBank and people don’t talk about it too much because they shut down a lot of MSers a couple of years ago. Recently they have revamped their product and put limits in place for loads. They also instituted an $8.95 monthly fee, however that is waived with a $500 or more direct deposit monthly.

I am not advocating that people get GoBank, but merely want to point it out as an option for anyone who will be spending time in Walmart anyway. If you do get this card, then take it slow, because like I said they are shutdown happy. You can purchase a starter kit at Walmart or sign-up online.

Walmart Loading Tips & Best Practices

I have been loading Bluebird/Serve at Walmart for several years. During that time I have found that cashiers often make up rules and each store has its own policies. Walmart is cracking down on gift cards in some stores, so be prepared for the occasional rejection. In other words, it isn’t going to be all smooth sailing.

There are also occasional glitches where certain cards won’t work temporarily. If this happens don’t freak out right away. Just simply try a different store or the same store later. Also, Vanilla Visas don’t work at Walmart for loads of $50 or more. If those were your main go-to, I might suggest purchasing cards issued by Metabank or U.S. Bank since they work much better.

For more information on which cards work at Walmart, Family Dollar and elsewhere, see: Beginner’s guide to buying & liquidating Visa & Mastercard gift cards on Frequent Miler.

Recap

So I think I have presented enough information that you can find a way forward if REDbird is indeed shutdown. Now let’s take a look at a quick recap:

Is REDbird shutdown?

- We don’t know. I recommend waiting to see, but it doesn’t hurt to find out your options.

Liquidation

- If you are stuck with a lot of gift cards, then there are plenty of ways to liquidate.

Switching to another Amex product

- For most Serve will be the best and among the Serve versions the One VIP seems to have the best overall features. Switching is fairly easy.

The Walmart Reality

Walmart has its drawbacks, but you also have the possibility of loading at the kiosk which is an added benefit.

Conclusion

Most of the resources I have linked to have either been written or in some way updated by me either on Miles to Memories or Frequent Miler. I am here to answer any questions, however I request that you ask them in the comment section instead of emailing me. That way others can help provide answers and people who may be wondering the same thing can get the knowledge they seek as well.

If REDbird is indeed dead then it is a sad day, however the sky isn’t falling. You might have to work a little harder, but this stuff generally pays off in the form of amazing travel adventures. For that reason alone I think it all is worth it in the end.

[…] how I miss my beloved REDbird. She was so generous with her credit card loads and easy to use bill pay system. She even gave us a […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

Hey Shawn,

Love the work you do and the resources you have created. You wrote above that “Serve allows online credit card loads from Amex cards.” Is my recollection correct that you don’t earn points for these Amex loads, but you do earn spend credit towards spending thresholds (e.g., I’d like to spend $20k to get to Hilton Gold on my no-fee Hilton card).

Thanks

I went to WM and asked about loading One VIP Serve with VGC and the CS directed me to a sign

that WM was no longer accepting prepaid cards for loads.

They also informed me that they no longer accepted prepaid gift cards with pins (3rd party VGC)

for payments of MO.

These are WM in the East Bay area (San Leandro and Union City).

We had similar problems at other east bay WMs over 6 months ago and were told it was a store by store decision. We continue to have no problems at our local site but there may be regional or national momentum. I hope not

And you have just demonstrated why these deals fail. NEVER ask. Just try it yourself. If it doesn’t work you have your answer. By asking you’re bringing it to their attention.

Closed my Redbird and signed up for One VIP a few minutes later with the same info and success!

@ Shawn: I read about online credit load, 1) Is it in addition to the debit online load? 2) Is it any visa/mc card?

3) Will the credit card earn points? 4) Will AMex SPG earn points for online cr load? Thanks for the post.

Yes, only amex cards(unless you have a old old serve), no unless 3rd party amex, no

I went to a WM Money Center yesterday and asked about loading a One VIP with VGC (northern CA).

I was directed to a sign stating WM was no longer accepting prepaid cards.

[…] REDBird Postmortem: An MS Path Forward – Forging a path forward after the death of REDbird. Information on: Alternate gift card liquidation methods, how to close REDbird, choosing Bluebird or Serve, how to load at Walmart, GoBank as an alternative and more. […]

switched one of my RedBirds over to Serve today. I couldn’t find on the website what the daily/monthly load limit was with debit cards? Does anyone have the link to find this?

In-store loads of cash/debit are $2,500 per day and $5,000 per month. Online debit loads (which don’t work for gcs) are $200 per day or $1,000 per month.

I wasn’t able to liquidate 3K worth of Simon Mall gift cards. They’re all pin based VISAs and what would be the easiest way to go about this?

You could load them to Bluebird/Serve at Walmart or Serve at Family Dollar.

You can also buy MOs with them $1K at a time for 2 swipes using 2 $500 SMGCs. At WM, fee is .70 up to $1000, at other grocery stores, fee varies from .59 to $1 and some of them has max of $500 per MO. Check your stores to find out.

Closed 2 REDbird’s today. Used all the same exact info, e-mail, pw, pin, etc. with no issues when opening 2 One VIP Serve accounts. On one REDbird, a transaction had not cleared yet, but was still able to open new Serve account. Seems that if your account shows zero balance, you’re good to go for a new Serve. Kept one REDbird open until the dust settles.

Word of caution w/ FD: Always ask the cashier if anyone has loaded a Serve that day. Over a year ago, I loaded $500 on Serve and found out someone had already loaded Serve that day in that store. The FD system crashed and it took me 6 weeks to get my $500 back.

Good advice. I have avoided FD because of all of the small quirks, but with Walmart cracking down in some areas it could be a good way to go.

From what I am reading, gift cards(pin enabled) are not accepted for Serve? What’s the limit per day for loading ?

I’m not sure where you read that. Both Walmart and Family Dollar allow pin-enabled gift cards and debit cards to be loaded in store, although Vanilla branded cards don’t work at Walmart in denominations of $50 or more.

What you probably read is VGCs are not accepted to load Serve ONLINE. As of this afternoon, I was able to load several VGCs to my Serve accounts at WM.

Thanks Shawn/Mimi for clarification. So I can still buy VGC from Walgreens/CVS and load it in Serve. Does it need to be in denomination of 50 only or I can buy $500 GC as well ? I was comfortable with Redbird but trying to learn the ropes here. thanks again.

since drugstore VGCs are mostly vanilla Visas and MCs, if your plan is to load them at WM, better think more than twice because ALL vanilla GCs can only be loaded UP to $49.99 per transaction (you can do less but not more) so if you have a $500 vanilla, that’ll take at least 10 transactions to drain. If you have FamilyDollar around, you can load those vanillas up to $500 in one transaction although most FDs can only do one transaction per day. You can go to several FDs if you want to but that is time and gas consuming. You can check your FD if it’s capable of doing multiple loads to Serve per day since there are some stores that can do it w/o transactions getting aborted. There is risk to this experiment because there are FDs whose managers do not know how to void transactions of failed loads so you have to call FD corporate to get your money back.

There are always risks involved, choose the one you think you can manage.

Thanks Mimi. So just picking your brain here. What kind of GC or VGC should I use to upload in Serve? For Redbird, it was easy to upload upto$2500 in one go. For server, I am hoping to atleast put $3000 a month and maybe 2-3 trips as WM is closeby.

I would honestly stick with cards that will work normally at Walmart, unless as Mimi says you have a reliable Family Dollar. Here is a resource I helped to create on Frequent Miler that describes where you can get various kinds of cards. http://frequentmiler.boardingarea.com/2014/07/30/best-options-for-buying-visa-and-mastercard-gift-cards/

You mentioned 7/11 as a place to load Serve in a previous post. Is that still an option?

Yes, but 7-11 and CVS are both cash only for loads. The only places to load Serve with debit or gift cards are Family Dollar and Walmart.

I have a GoBank from 2 years ago. I barely used it so it’s still open. Do we have an idea what the threshhold is before shutdown?

I still have mine as well. The limit is $3K every 30 days. I usually do $2,500 per month and leave the money there for a while before bill paying. It has worked well for me.

I also load max of $3K per month aside from the $500 DD to waive my fees. Then I w/d some via ATM and B/P the rest.

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which Serv… by Miles to Memories. I wouldn’t be counting it dead just yet, but it most likely is so here are some options. […]

Family Dollar has recently been bought out by the Dollar Tree corp. Going to be lots of sales at Family Dollar and Dollar Tree’s Deals stores. Wonder if the Serve loads at FD will continue past January.

[…] the one resembling a communist bird, you know, the Redbird at Target, appears to be dead. First, Miles to Memories came out with a good post on what to do and leaving some hope. Then Frequent Miler called it dead, […]

Does anyone know which version of Serve is sold as a starter/temp card at Family Dollar? The load to the temp card does not count against the $5,000 monthly load limit so buying a temp card can get you an extra $500 of load this month compared to just opening a new Serve account online. But I want the One VIP flavor, and would like to save the trip to FD if they don’t have that flavor.

If you’re going to buy a temp kit from FD, make sure you can pay it with CC since most of them don’t accept CCs, just cash/DC. If you’re lucky to pay it with CC, that extra $500 load to be added to your permanent card would be good. However, I’ve read reports that the temp kits sold are for the NEW BLUE Serve with fees when you load them in-store and I don’t know if there are still kits sold for the OLD BLUE Serve before all other flavors came in. IMO, 1VIP would probably be the best choice to avoid any issues.

I bought the blue one at CVS with a $100 left on a Visa gift card at CVS last month for Hubby because I started his switch from Redbird to Serve.

I believe the One VIP version is only available online.

Just wanted to point out one thing…. Frequent Miler said “Based on a number of reader accounts it seems that you must use the same email address to register Serve as was used with REDbird.” And, you said “Make sure to use a different email address for the new Bluebird/Serve account.” Hmm????

Fair enough. I haven’t done the switch from REDbird back to Serve myself, however when I switched in the other direction I had read accounts from many people that their data was messed up when using the same email. Since FM’s data is newer I’ll make sure to update the post.

I am not switching now but when I did it from RB to Serve, I registered with a different email addy initially. Soon as my account was opened, I went to Profile to edit and switch to the email addy I used with RB and make it as my primary email. It worked.

Good advice. Thanks!

[…] it out to see if REDbird comes back to life? Switch to Serve? Switch to Bluebird? Switch to something else? Give it up altogether? Please comment […]

This is really in the weeds, but if you use Amex credit cards to load Serve, will you be charged a cash advance fee?

I know most amex CCs don’t charge CA for Serve loads but since I cannot guarantee that, you can try with small test loads so that in case they charge CA, it won’t be too much. If it’s the first time you’re charged CA, you can always call to request it to be waived, which they often do.

Back in the day before Redbird, I had Serve. Amex did not charge CA fees to load Serve on-line.

1. NO place in Dallas, Texas area will sell money orders using loaded debit/PIN cards.

2. Without details, I can’t use Redbird, Bluebird, etc.

3. Fees for Plastiq, etc. are more than the extra miles are worth.

4. So, my only way to liquidate the cards is prepayment of utilities, cable, cell phone, etc.

I get it back at no cost from not having to pay the bills for a number of months.

Fort Worth is working just fine for GC >MO.

[…] Read the full story at milestomemories.boardingarea.com […]

Is there a way to cancel Redbird and open a Serve without using a different email address?

Yes. I answered that in this post. https://milestomemories.boardingarea.com/redbird-to-serve/

It used to not work, however that seems to be fixed.

Yes, lets lead all the sheeple back to WMT to kill it next. Yeah!!! You guys are a bunch of locust. Going from crop to crop stripping it bare then moving on to the next thing to destroy.

Let me guess, you go to WM and want it to yourself. Don’t forget you learn from other locusts, what does that make you?

Why would u assume that I even remotely chase the same small slice as everyone else. Please tell me you are smarter than that? And that you have a brain so you can use to realize following the bloggers into the same scenario over and over again leads to the same issues. Think about it.

like his comment or not but this large influx will not be good for serve and BB futures.

Sorry to break the bad news, but at least knowing for sure is better than the stress of uncertainty: As of October 13, 2015 Redbird is officially dead: http://goo.gl/A6Q8NE

Thanks for sharing.

Does the One VIP include online bill pay?

Yes

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]

[…] REDBird Postmortem – Alternate Liquidation Methods, Closing REDbird, Serve or Bluebird, Which … […]