Change Your Amex Airline Incidental Selection

Premium cards come with big annual fees, but they also come with huge welcome offers and lots of perks. One such perk, an Amex favorite, is the airline incidental credit. This credit comes on some of American Express’ premium cards like the Hilton Aspire card, the Amex Platinum and Business Platinum cards. The credit is intended to be used on incidental charges airlines have like bag fees, lounge access and the sort. They end up working on things outside the lines as well too. One thing that is kind of set in stone is you need to make your airline selection for the year in January. This is the airline that the credits will work on. Unfortunately, they aren’t an open travel credit to be used on any airline. Amex loves that breakage after all! What happens if you have a change of heart though? All may not be lost, I’ll share how to change your Amex airline incidental selection after the fact. This is your mileage may vary though.

What Caused My Change Of Heart

I pretty much always select Delta Airlines for all our cards. It works best for me since I have status with them, we are a Delta hub captive and the credits are pretty easy to burn with Delta. That was my plan until the latest Southwest Companion Pass offer came out and I started looking at my upcoming travel to see if anything would work. We have limited non-stop options on Southwest out of Detroit but I did have a flight to Baltimore that would likely work. I checked my dates and the flight times and prices were comparable to Delta. Because they were similar I decided to book Southwest to lock in the Companion Pass for next year too.

My wife had a newer Business Platinum that we had not used the $200 credit on yet. If I could change the selection to Southwest I could use the credit to earn my Companion Pass for just a few dollars out of pocket.

Changing My Amex Airline Incidental Selection After January

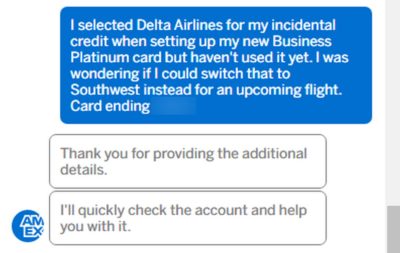

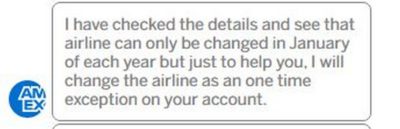

I knew that Amex agents have been willing to make a one time change for you in the past. This is assuming that you have not used any of the credit yet this year. We fired up Amex chat, used our trick to get an agent right away, and asked to change the selection. The agent said it is usually only allowed in January but they would give us a courtesy change (as expected).

I got the email confirming the change a few minutes later and it showed up in the card’s benefits section after that too. The agent said to give it a day or two before making a purchase to be safe. I couldn’t wait though because I was up against a deadline for the end of the promotion. Seeing the email and having it changed on the benefits page gave me the confidence it would work just fine. I made the booking and the credit posted 3 days later.

Amex Airline Incidental Selection: Final Thoughts

If you have a change of heart and need to change your Amex airline incidental selection you may still have options. It is still possible to change your Amex airline incidental credit selection even after the January cut off. Your credit for the year has to be unused and you will need to reach out to American Express via phone or chat. If you get turned down the first time then just try again. If you are polite and ask for a one time courtesy change I don’t foresee any issues doing it though.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.