Maximizing the Amex Platinum Card – Burning 100,000 Membership Rewards Points

What are my strategies for maximizing the Amex Platinum Card? What are its key perks and benefits? What’s the best way to spend those 100,000 Membership Rewards points? In this article, we’ll take a deep dive on the Platinum Card from American Express to look at its key features, why it’s a favorite in this hobby, and also the incredible welcome offer people drool over. After we get to know the card, I’ll show you how I would go about maximizing the Amex Platinum Card and the points earned from the welcome offer.

Amex Platinum Card Benefits

The Platinum Card from American Express is a favorite in this hobby, and that’s with good reason. High up on the list of reasons for people loving this card is the welcome offer. However, it’s not just ANY welcome offer. The unicorn, the dream, the fountain of youth that people (myself included) hold out for is the targeted offer of 100,000 points (and sometimes even 125k!). Note that this is not the standard public offer. Here are the important details of the elevated welcome offer:

- Type of card: personal

- Card issuer: American Express

- Application rules to follow: maximum of 4 cards and maximum of 10 charge cards, once-in-a-lifetime rule for welcome offers, 2 cards in a rolling 90 day period (see more here)

- Spending requirements: $5,000 in 3 months

- Welcome offer: 100,000 Membership Rewards points (standard offer is 60,000)

- Annual fee: $550

It may be possible to pull up a 70-75,000 offer right now as well if you are not targeted for the 100K offer. And that may be worth taking with the increased credits right now.

Amex Platinum Card Benefits

- 5X Points on flights booked directly with the airline

- 5X Points on travel booked through AmexTravel.com.

- 1X Points on everything else.

Other Benefits

- Fee credit for Global Entry or TSA Pre-Check application

- $200 airline fee credit each year with your preferred airline

- $15 per month Uber credits ($20 in December), which also work for Uber Eats

- $100 in shopping credits with Saks Fifth Avenue, given as $50 each half of the year

- Complimentary access to American Express lounges

- Annual Priority Pass membership

- Complimentary Gold status with Hilton and Marriott hotel brands

- Additional protections like trip insurance, extended warranty, purchase protection, and rental car insurance

- No foreign transaction fees

There are some limited time credits offered for May-December of 2020 only as well.

What I Would Do With 100,000 Membership Rewards Points

So…what would I do with 100,000 Amex Membership Rewards points? Technically, you’re going to have more than that. After spending $5,000 on the Platinum Card from American Express, you’re going to have a minimum of 105,000 miles in your account. I’m going to use 105,000 points for trip planning.

The best thing about Membership Rewards is their flexibility. Unlike earning miles from a credit card for Hilton or with American Airlines, I can transfer these points to numerous programs. If I earn American Airlines miles, I can’t send those points to a different airline program or transfer them to a hotel program of my choice. With Amex Membership Rewards points, I can do a lot. That’s why they’re so great.

There are 18 different airline programs and 3 different hotel programs you can transfer to. See our guide to Membership Rewards here. Remember that you can always use points in the AmexTravel portal or towards paying your bill, but you get only 1 cent per point value that way. Using your points with the airline and hotel programs has a much better value. With that in mind, what can we do if the goal is maximizing the Amex Platinum Card? Let’s look.

Family Trip To A Festival In The U.S.

What’s a festival you’ve always wanted to attend? Go to it, and take the whole family! Domestic flights in economy are cheap on points with Membership Rewards. For this, let’s use the New Orleans Jazz Festival (April – May 2021) as an example. You also could insert Mardi Gras, Macy’s Thanksgiving Parade in NYC, your favorite Comic-Con, a PGA golf tournament, etc.

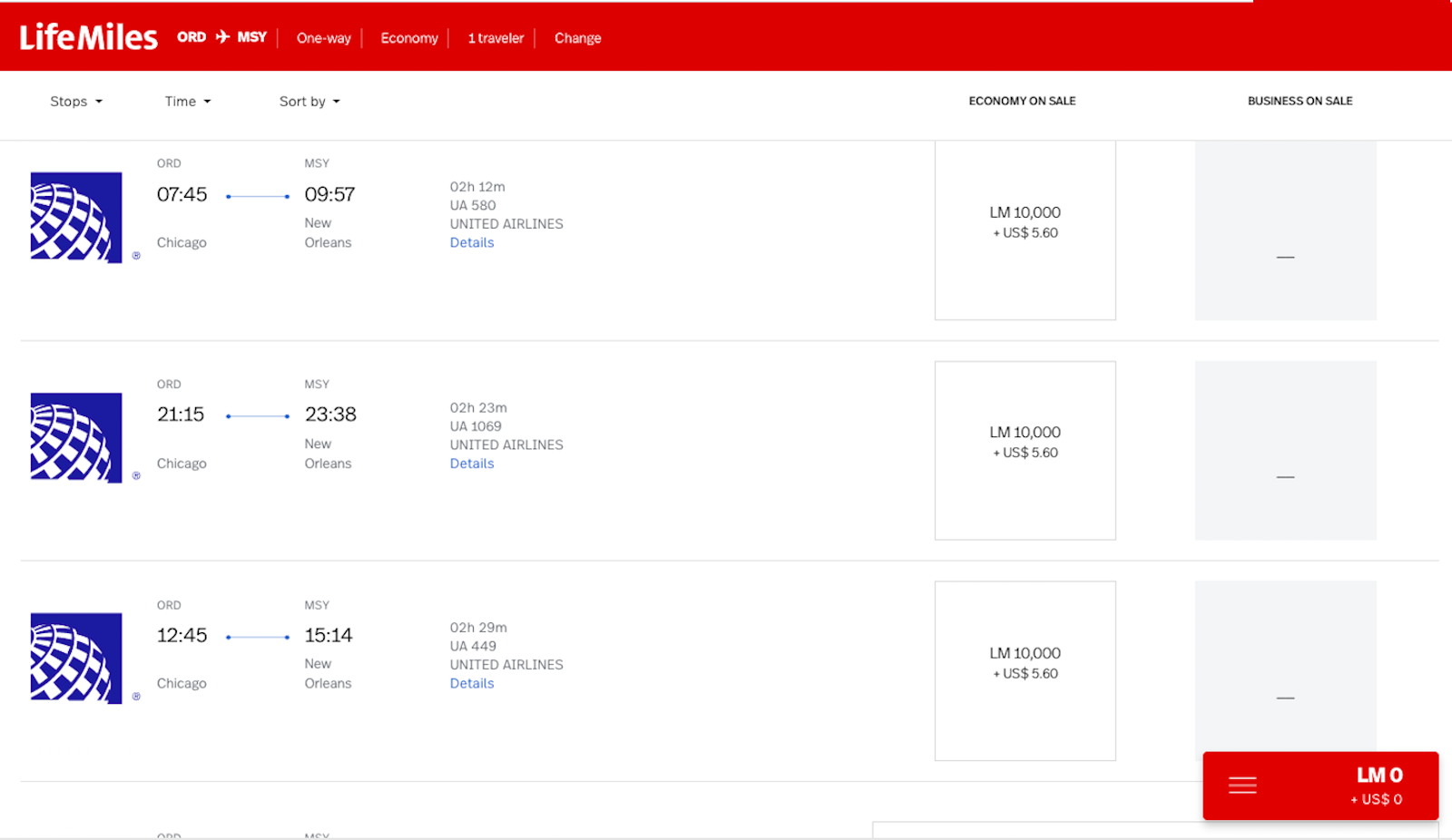

Using Avianca LifeMiles and their partners in Star Alliance, we can get most places in the U.S. for 10-12,500 points per person in economy. That’s one way, so double it for round-trip.

This is 10,000 points per person from Chicago to New Orleans. If you’re coming from farther away, Seattle is 12,500 points, for example. Kansas City, which is closer, is only 7,500 points. Assuming we’re spending 10,000 points each way for each person, a family of 4 would spend 80,000 points to get there and back. If one of the people in your family is a lap infant, you won’t use any points.

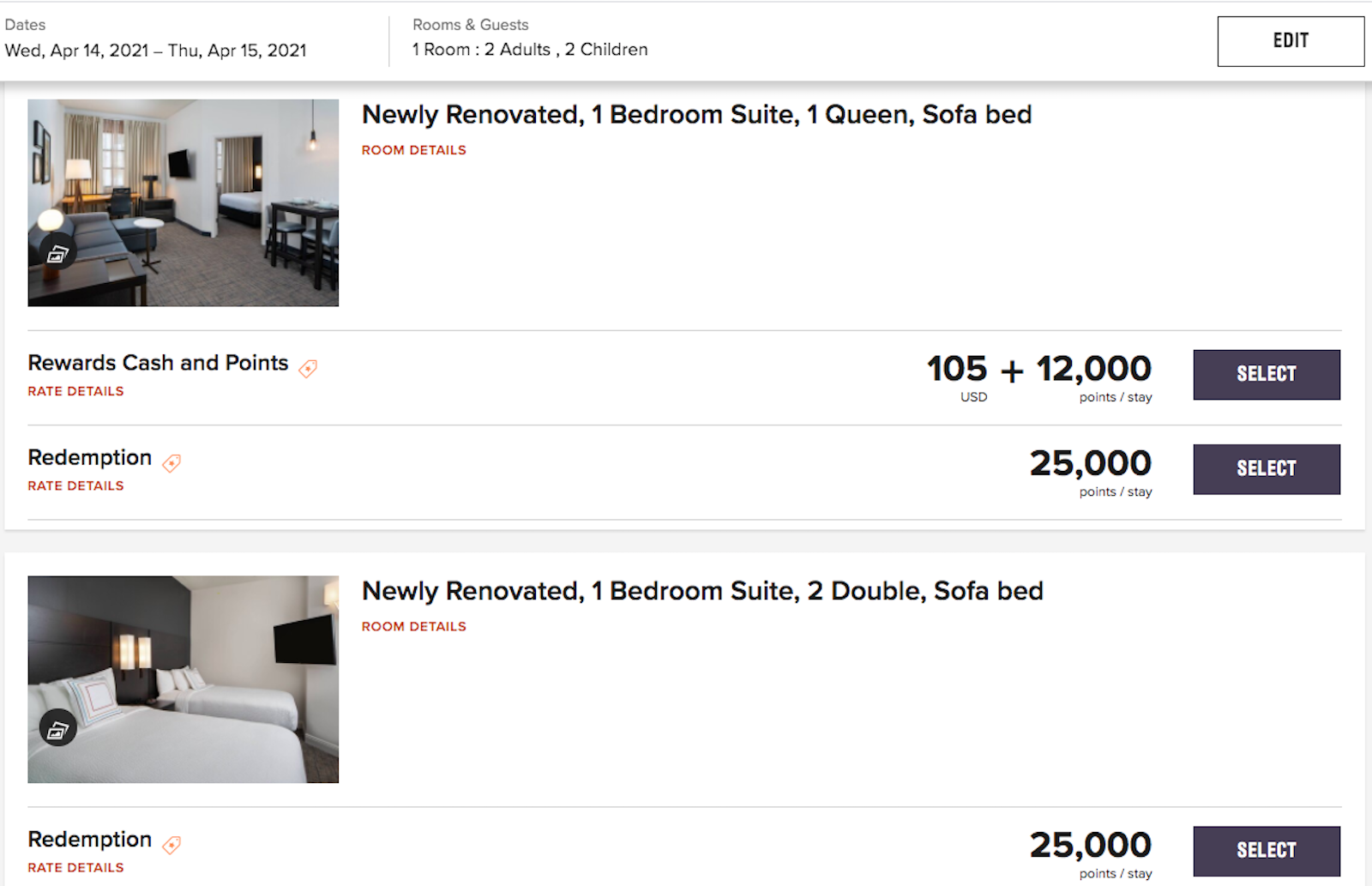

Now for the hotel…

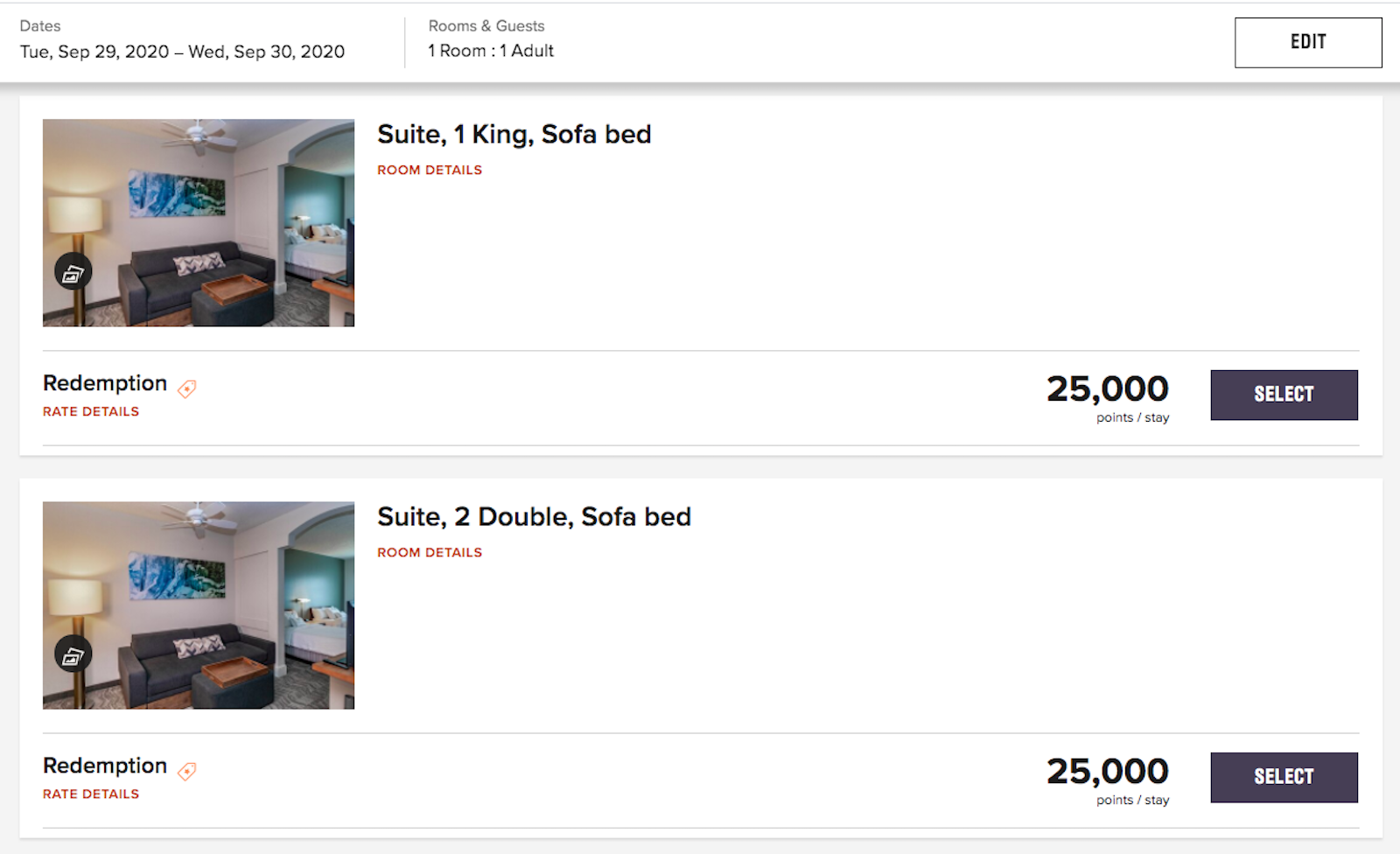

We started with 105,000 points and used 80,000 to fly our family of 4 round-trip from Chicago to New Orleans. Now, we need a place to stay. With a family of 4, finding rooms is more difficult. Do you cough up extra points for 2 rooms? Do you cram into one room? For 25,000 points, Marriott has several offerings with a separate bedroom plus living room with sofa bed. This should work for your family. Check the locations of Residence Inn (pictured), SpringHill Suites, and TownePlace Suites.

This only covers 1 night, obviously. Budget for that during your trip. For 105,000 Membership Rewards points, we got a family of 4 from Chicago to New Orleans and back and covered the first night of the hotel during Jazz Fest.

Business Class To See The Northern Lights

One of my most memorable experiences is seeing the Northern Lights. I’ve been lucky enough to see the Aurora Borealis more than once, and the best sighting I’ve had was in Alaska. Let’s fly there in style and get our breath taken away.

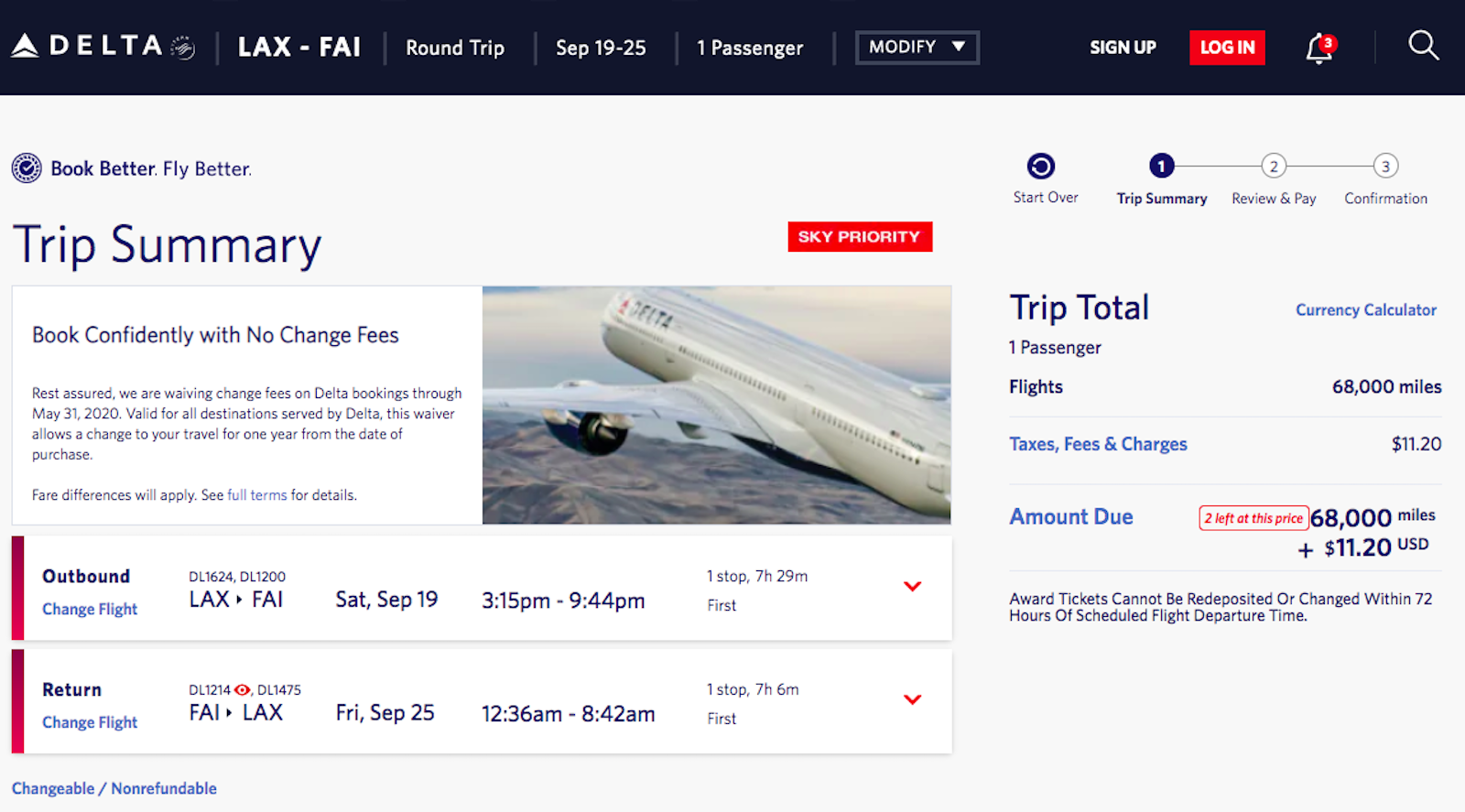

The cheapest flights and cheapest hotel nights in Alaska are at the start of Spring and end of Summer. These are the least busy, least popular times. Early October is also a great time to see the Aurora, which is when I saw it. Let’s imagine you live in Los Angeles and want to do this.

For 68,000 Delta SkyMiles (transfer Membership Rewards to Delta at 1:1 ratio), we’ll fly domestic first class (business class) round-trip from Los Angeles to Fairbanks and back. Change planes in Seattle each way. Make sure you get a window seat, because I saw the lights from the departure lounge at the airport and from the window on the plane the night I left Fairbanks!

Now for the hotel…

We need a place to stay in Fairbanks, Alaska. From our 105,000 Membership Rewards points, we’ve used 68,000 on the flights. We have 37,000 points for hotels. That’s enough to cover the first night of our hotel and half of the 2nd night with a points + cash booking.

It’s not enough for the Hampton Inn & Suites from Hilton, also located in Fairbanks. This requires 45,000 points per night.

A Note On Seeing The Lights

I rented a car and drove out to the Chena Hot Springs, about an hour outside Fairbanks (it also has the only restaurant around, so prepare to be price gouged!). I sat in the hot springs, surrounded by snow and staring up at the sky. Turns out I didn’t need to do this, because everyone in Fairbanks was just standing in the street and looking up when I got back into town.

However, you’re more likely to see the Aurora Borealis outside of a city, and you should have a clearer view, also. That being said, I also mentioned seeing it from the airport and even on the plane. Sometimes, you just get lucky. This was what we saw for a good 3+ hours.

Pro tip: Don’t forget to visit the amazing Denali National Park and the Christmas-themed North Pole, Alaska (a real city) while in Fairbanks.

First Class – Take A Shower In The Sky

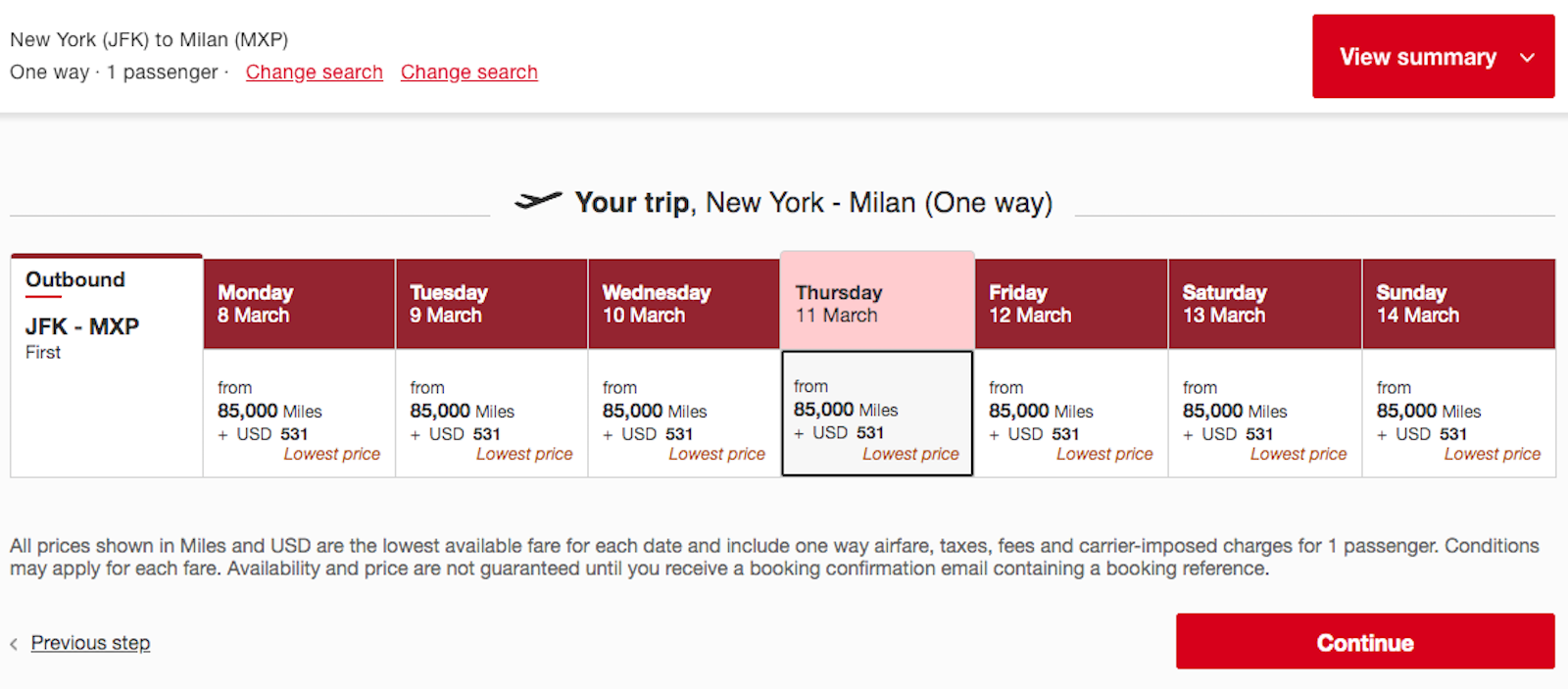

Emirates first class is an aspirational booking for many. For some, it’s considered the best first class product, or at least “up there” on the list. Transfer your points to Emirates Skywards for their fifth freedom flight from New York JFK to MXP in Milan, Italy.

We’ve used 85,000 of our 120,000 Membership Rewards points for the flight. Notice that we’re going to pay $531 in taxes & fees, since Emirates adds surcharges.

The Remaining Points

We still have 40,000 points. What should we do? Obviously, we need to get home at some point. Here’s how we can finish off those remaining points.

12,000 points to fly home in economy. Transfer points to Virgin Atlantic Flying Club and use their various partners to fly home. It should require just 1 stop from Milan back to New York.

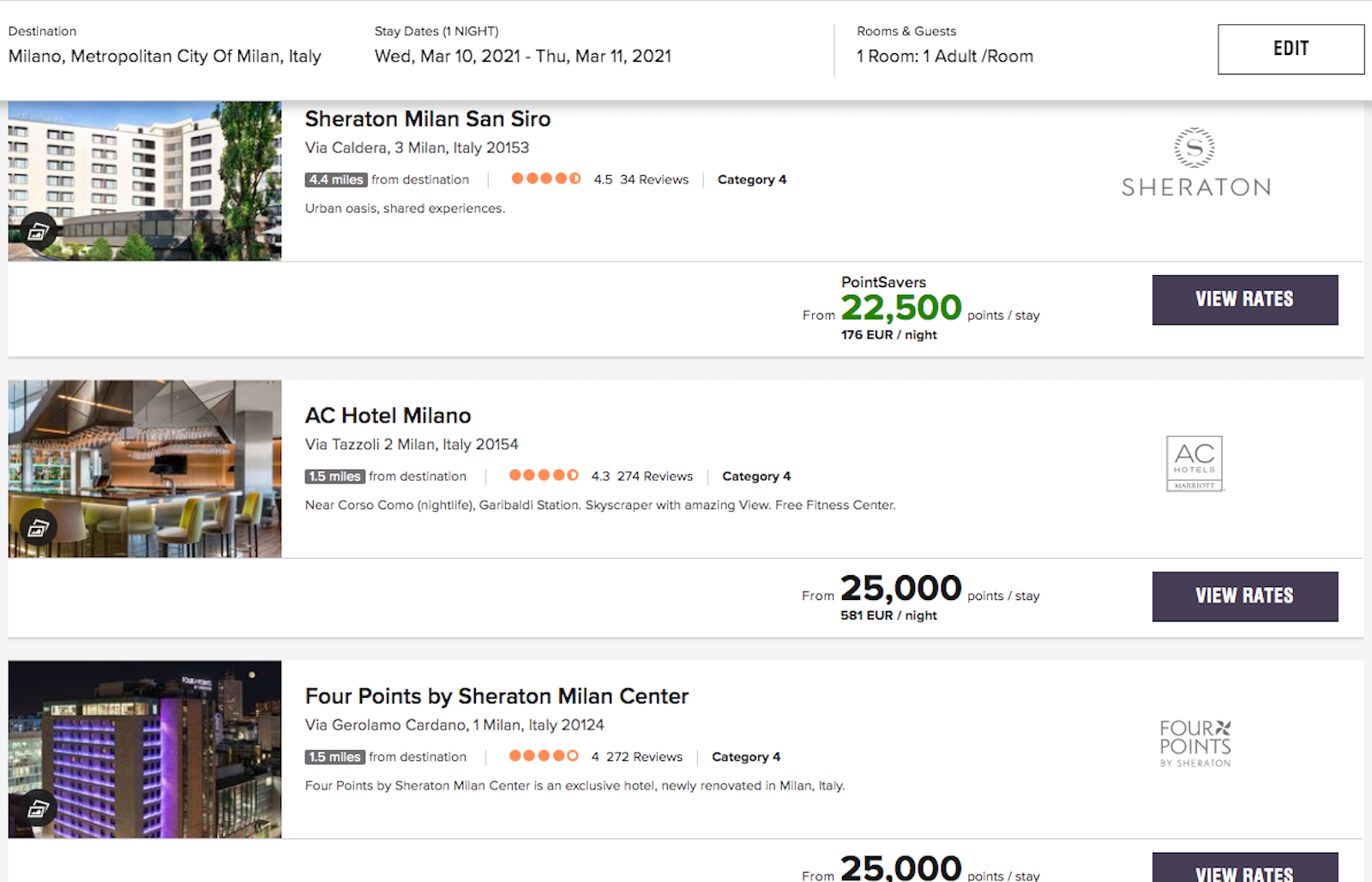

Stay at a hotel for a night. Use the remaining points to stay at a hotel in Milan. You can stay at 2 Hilton properties: Hilton Garden Inn Milan Malpensa or DoubleTree by Hilton Brescia. You also have a choice of 7 different Marriott properties for less than 28,000 points.

Final Thoughts On Maximizing the Amex Platinum Card

If you’re maximizing the Amex Platinum Card and its elevated welcome offer of 100,000 Membership Rewards, I hope you found some good ideas here. We looked at the perks of the card and the welcome offer. We also looked at ideas for maximizing those 100,000 points for some memorable trips. It’s also worth noting that there is more than one type of Amex Platinum Card, and I got a different one while holding out for the increased welcome offer on the standard version. There’s also the Business Platinum Card, which has some of the same perks and can also have this increased welcome offer.

There are tons of other things you can do, as well. We previously looked at using Membership Rewards transfer partners in articles about Singapore Airlines, Avianca LifeMiles & Iberia. You can find British Airways redemptions for under 10,000 miles. Added flexibility comes from the fact that Amex lets you transfer points to others’ accounts if they are an authorized user on your card, and many of their transfer programs let you make bookings for others.

Let me know how you use your new Membership Rewards points. I love hearing about people’s redemptions.

Actually, you can stay at the Hilton or the SpringHill if you pay cash instead. Assuming you cash out your MR points for a statement credit, you can get the SpringHill for the date in your screenshot (9/29-9/30) for $166/night or $152/night with the AAA rate. The Hilton/Hampton is even cheaper @ $144 regular rate and $129/AAA rate. Again, I’m not debating the merit of doing that, just suggesting it can be a better value than a conversion to points in this case – and you would earn points on the stay!

That’s assuming you have AAA, which a majority of people don’t. Good find, though.

And that’s fine, but 16,000 MR/night (plus taxes, etc) is still cheaper than 25,000/night as a points redemption.

Ah, I originally saw your comment on my phone, so I only noticed the AAA part and didn’t notice the part about non-AAA rate, apologies.

That’s a good tip comparing cash out as for me I can get a military rate which is normally way cheaper then the standard rate. In addition if you transfer and pay with points you will not earn points and/or bonuses for the stay unlike paying with cash. On the other hand if staying at a “resort” when I pay with points im normally not charged any annoying resort fees & taxes. So I guess it depends on the situation but good idea to check the options.

Are you really recommending a transfer from Amex to Marriott at 1:1? I’d argue that you’d be cutting the value of those MR in half with that transfer. Don’t use Amex points to pay for hotels. That’s what Chase points are for.

For the purpose of a specific trip, yes, I am suggesting that. The post isn’t “what I’d do with Amex points and also some Chase points” 🙂 The Amex points are what we’re working with, and we can use those to cover our hotel expenses for the trips after the airfare is covered.

Then you’d be wasting your Amex points. Maybe some of your readers are interested in doing the same.

Ryan, I think you’ve missed the point of the article and the exercise at hand.

I’ve done an entire series of these posts that utilize only the points from that specific welcome offer. Are there better options if I can use something else? Sure. Having Citi TYP could be a better option for some of the flights domestically using Turkish, but that isn’t what we’re working with. We’re looking at option for using these specific points ONLY and what we can do with only those available, nothing else.

Maybe look through the other posts in this series and understand the idea of “what can I do with just these points?”

https://milestomemories.com/maximizing-chase-british-airways-visa-100k-avios/

https://milestomemories.com/maximizing-the-chase-sapphire-preferred/

https://milestomemories.com/maximizing-the-citibusiness-aadvantage-platinum-card-70k-aa-miles/

Funny that your solution is to waste more time on this series of articles. If you’re suggesting people transfer Amex to Marriott in any way, shape, or form, you’re doing them a disservice. As one of your handful of readers pointed out, you could simply cash out the points and pay for the room and still save. This is a spectacularly bad post, so I’ll pass on your offer to read more of your work.

Not sure why you’re so angry, but thanks for stopping by 🙂

Ignore Ryan Z. I’m not sure why but he just doesn’t get it.