Maximizing the Chase Sapphire Preferred – Burning 100,000 Ultimate Rewards Points

With its best-ever offer right now, let’s look at maximizing the Chase Sapphire Preferred credit card. What are its key perks and benefits? What’s the best way to spend those 100,000 Ultimate Rewards points? In this article, we’ll take a deep dive on the Chase Sapphire Preferred to look at the ins and outs, what makes this card a favorite in this hobby, and also that great welcome offer. After we get to know the card, I’ll show you how I would go about maximizing the Chase Sapphire Preferred and the points earned from the welcome offer.

Some Of These Offers May Have Ended Or Changed

Update 10/6/21: This offer ends today!

Chase Sapphire Preferred Credit Card Benefits

The Chase Sapphire Preferred is a favorite in this hobby, and that’s with good reason. High up on the list of reasons for people loving this card is the welcome offer. Here are the important details of the all-time highest welcome offer:

- Type of card: personal

- Card issuer: Chase

- Application rules to follow: cannot open this card if you have opened more than 5 credit cards in the last 24 months, no more than 2 credit cards in 30 days from Chase, cannot have any other Sapphire card from Chase right now (see bank rules here)

- Spending requirements: $4,000 in 3 months

- Welcome offer: 100,000 Ultimate Rewards points

- Annual fee: $95

- Learn More

Remember that the best version of this welcome offer (with the fee waived the first year and the $50 grocery credit) is available in branch.

Chase Sapphire Preferred Credit Card Benefits

- 5X on Chase Travel

- 5X on Lyft rides

- 3X on dining, streaming & online grocery (excludes Target, Walmart & wholesale clubs)

- 2X Points on travel (flights, buses, hotels, etc.)

- 2X Points at restaurants

- 1X Points on everything else

- Get a 10% back in points anniversary bonus as well. This happens after you renew and pay an annual fee. It is based off of the money spent on the card. So if you spent $25,000 in a year, you would get 2,500 points.

Other Benefits

- $50 hotel credit every cardmember year

- 5X Points on Lyft rides

- $0 delivery fees by signing up for DashPass with DoorDash

- Additional cards at no additional cost

- Additional protections like trip insurance, extended warranty, purchase protection, and rental car insurance

- Redeem Chase Ultimate Rewards points in the Chase portal or via Pay Yourself Back at 1.25 cents a piece

- No foreign transaction fees

- Learn More

What I Would Do With 100K Ultimate Rewards Points

So…what would I do with 100,000 Chase Ultimate Rewards? Technically, you’re going to have more than that. After spending $4,000 on the Chase Sapphire Preferred credit card, you’re going to have a minimum of 104,000 miles in your account. I’m going to use 104,000 points for trip planning.

The best thing about Ultimate Rewards is their flexibility. Unlike earning miles with an airline or a hotel, your points aren’t locked into that program. If I earn Delta SkyMiles, I can’t send those points to a different airline program or transfer them to a hotel program of my choice. With Chase Ultimate Rewards, I can do a lot. That’s why they’re so great.

There are 10 different airline programs and 3 different hotel programs you can transfer to. See our guide to Ultimate Rewards here. Also, our transfer partners list is here. All of your Chase points will transfer 1:1 to these loyalty programs. With that in mind, what can we do if the goal is maximizing the Chase Sapphire Preferred card? Here we go.

Economy Flights To Hawaii PLUS Hotel For A Week

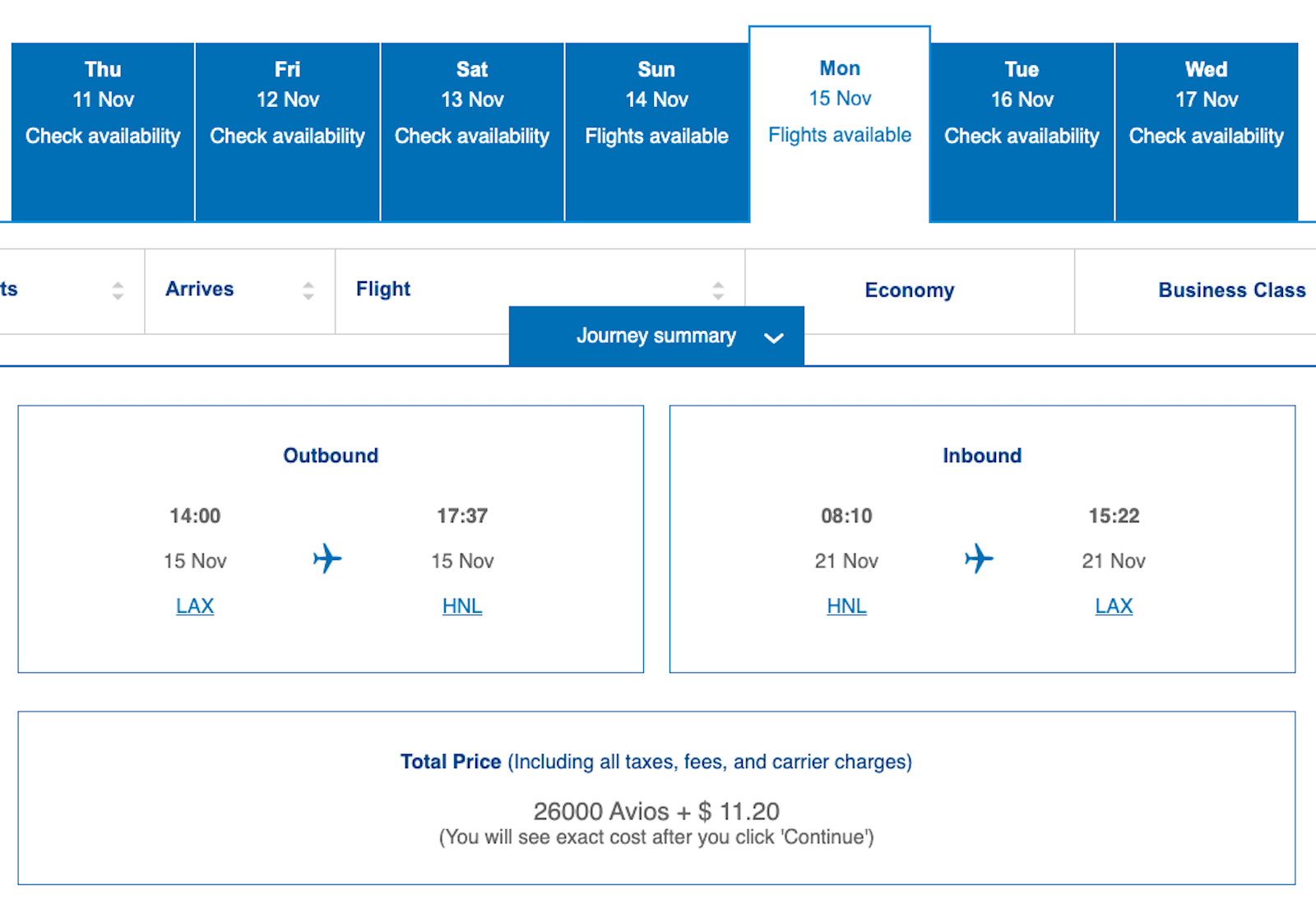

British Airways is a transfer partner of Chase Ultimate Rewards. Using their award chart for partners American Airlines and Alaska Airlines, we can get to Hawaii on non-stop flights from the West Coast. Round-trip tickets from cities with non-stop flights to Hawaii will cost 26,000 miles for a round-trip ticket. The distance needs to be under 3,000 miles for this value, FYI.

Now for the hotel…

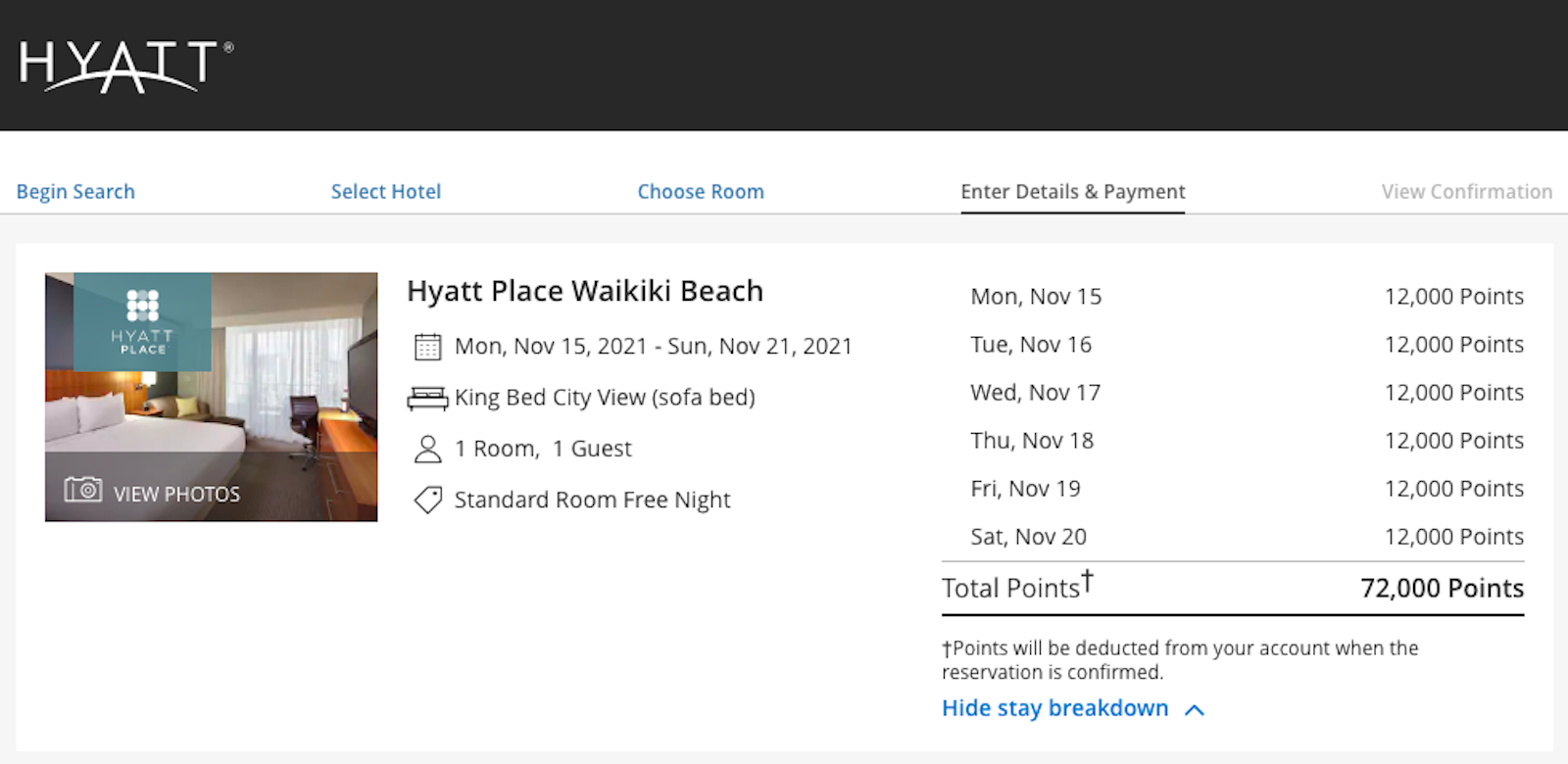

Since we started with 104,000 points in our account, we’ve got 78,000 left now. Time to get a hotel on the famous Waikiki Beach near Honolulu. Take advantage of the transfer partner Hyatt Hotels for 1:1 points transfers.

We’ve used 26,000 points for round-trip tickets to fly to Hawaii and 72,000 points for 6 nights at a hotel. That’s 98,000 of our 104,000 points. For this, we got a trip to Hawaii and paid only $11.20 in cash out of pocket. A deal!

Splurge Trip to New Year’s Eve In Times Square NYC

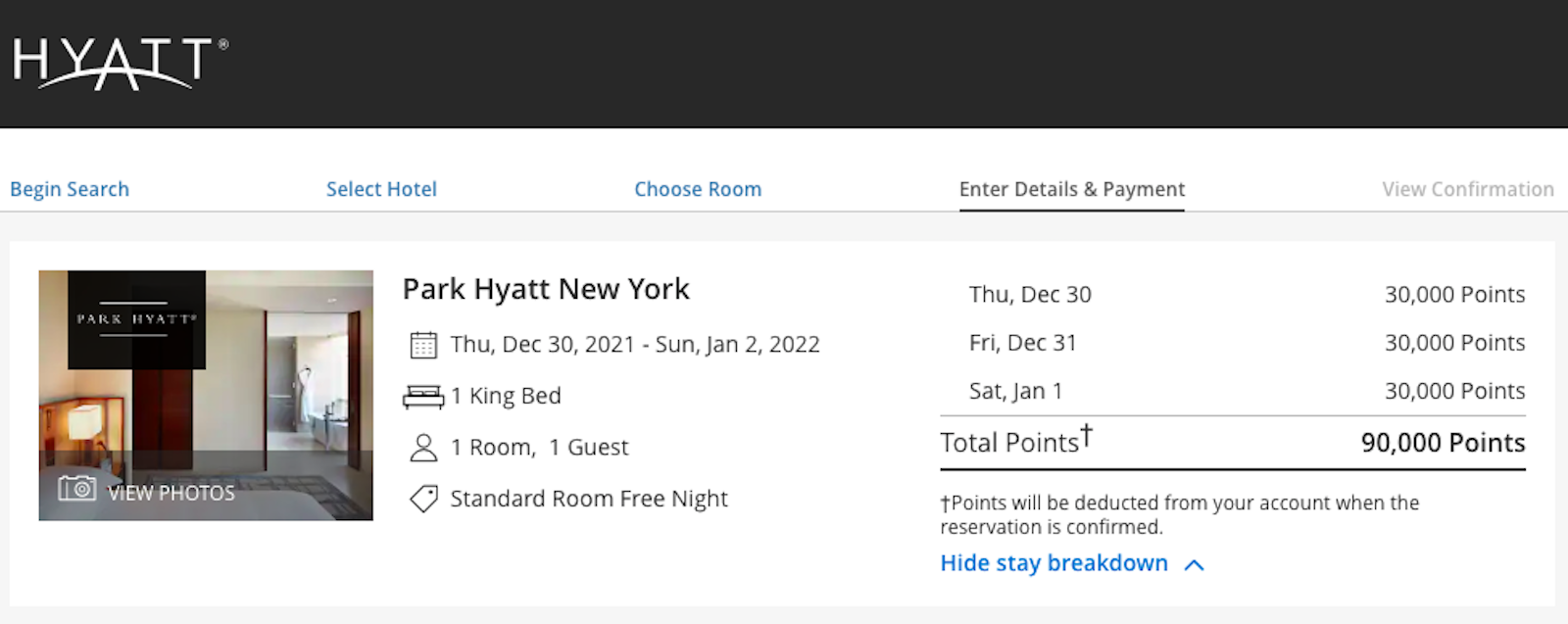

Ah…the sounds, Christmas lights, ice skating in Rockefeller Center, and winter in Central Park. The world-famous ball drop in Times Square. Let’s go take all of that in. We’ll use our 104,000 Ultimate Rewards points to make it happen. We’ll splurge on this trip to New York City.

For our luxury trip, we’re staying at the famous Park Hyatt Hotel. Located right near Central Park and Carnegie Hall, it’s less than a 15-minute walk from the Rockefeller Center. Rockefeller Plaza is where you can see the famous Christmas tree and even do some ice skating.

Cash prices for the Park Hyatt around New Year are $1,200 per night. Not for us. We’re maximizing the welcome offer and the 104,000 Ultimate Rewards points from the Chase Sapphire Preferred to pay for the 3 magical nights.

You’ll also have 14,000 points left that you could use for flights in the Chase travel portal, if you find a good deal.

Singapore Suites First Class

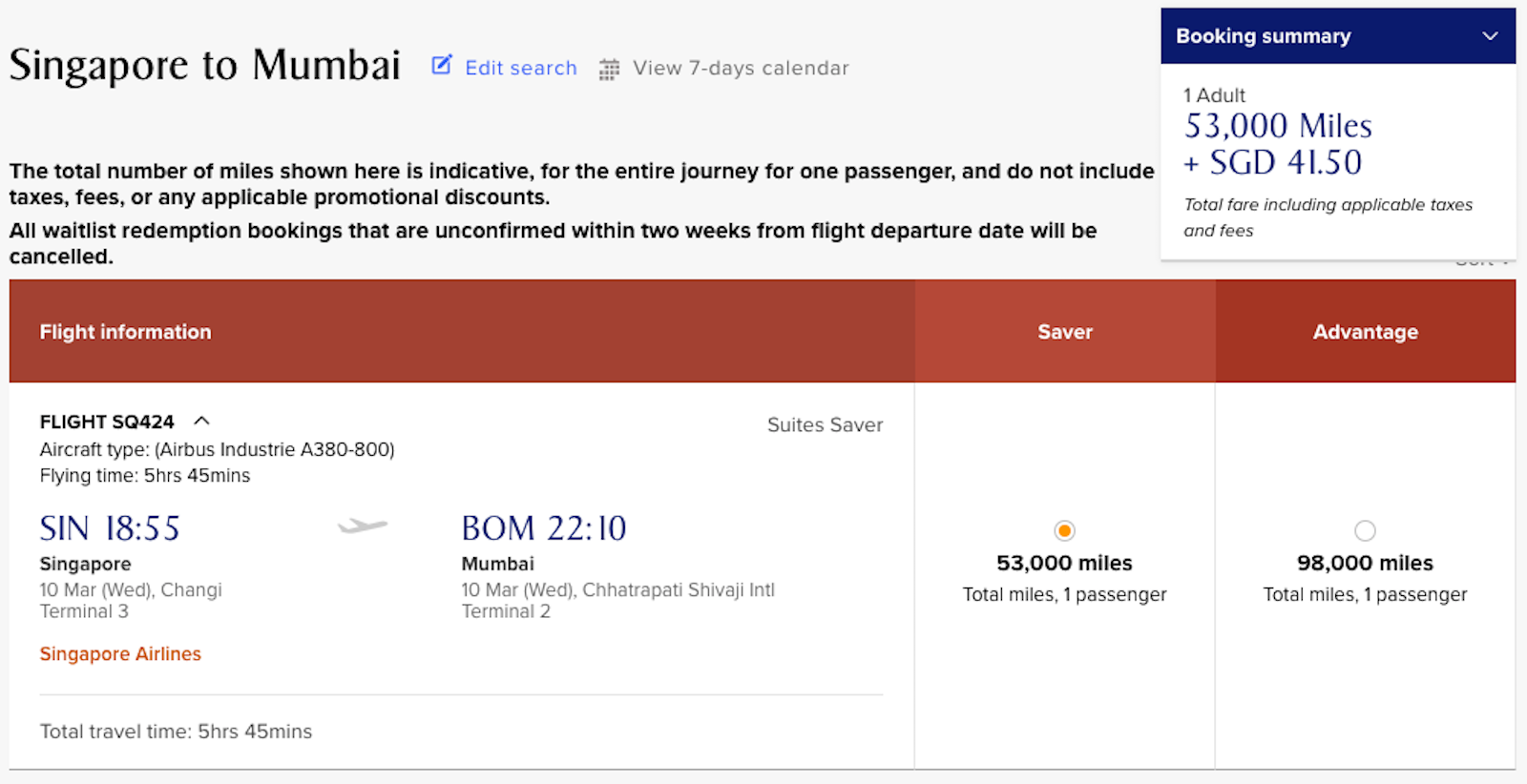

Singapore Suites is an aspirational booking for many. I previously talked about making great uses of the Singapore KrisFlyer program, but we’re going big on this one. We’re taking Singapore Suites first class from its home base in Singapore to Mumbai (Bombay), India.

At only $29.25 in taxes and fees, you’re getting massive value from your points and miles to fly Singapore Suites. This route also has the newer, 2017 version of Singapore Suites on the A380.

We’ve used 53,000 of our 104,000 points for this flight. We can also add hotels in Singapore and Mumbai.

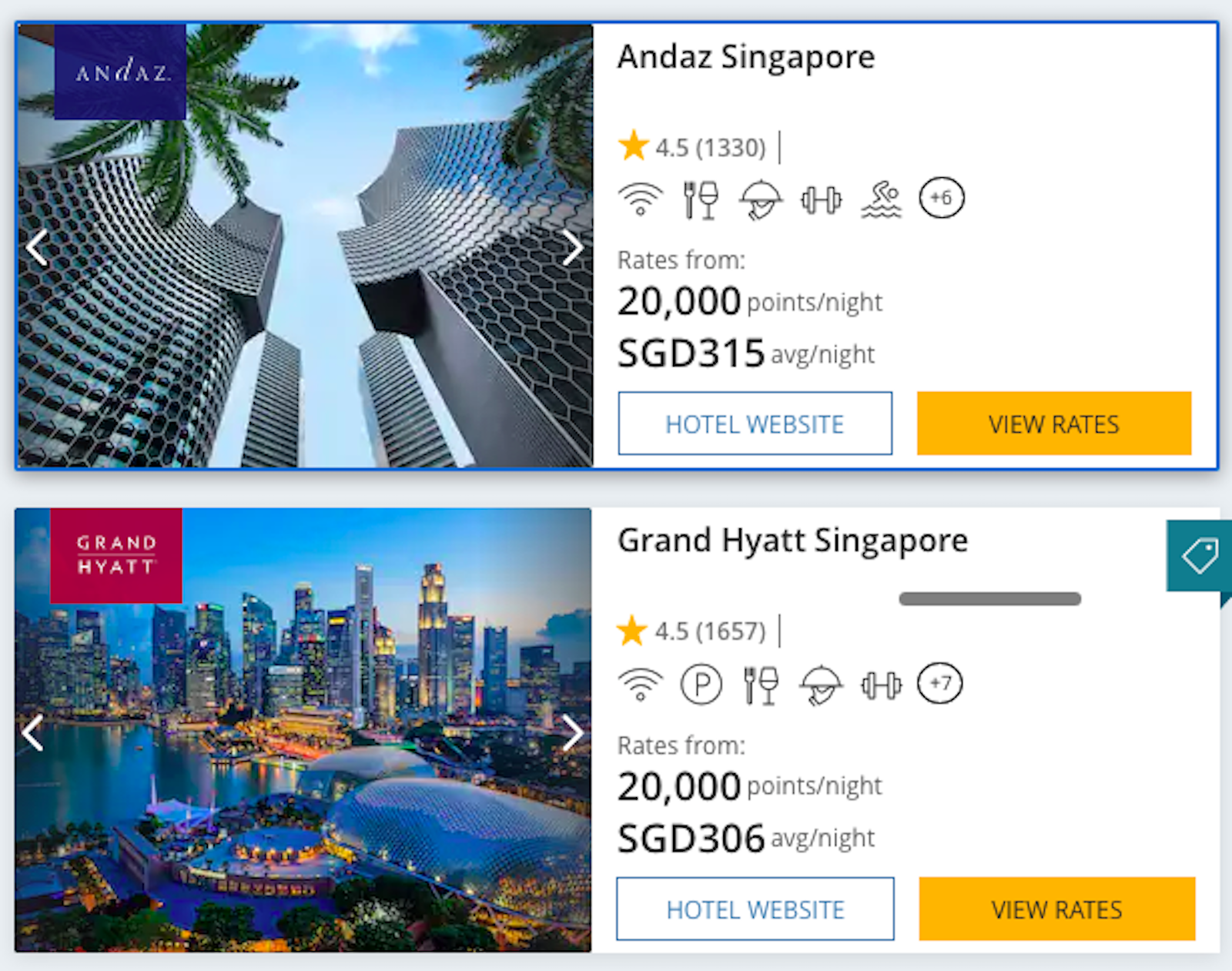

We’ll need 20,000 points for a night in Singapore at either Hyatt property. Transfer your Chase Ultimate Rewards 1:1 to Hyatt.

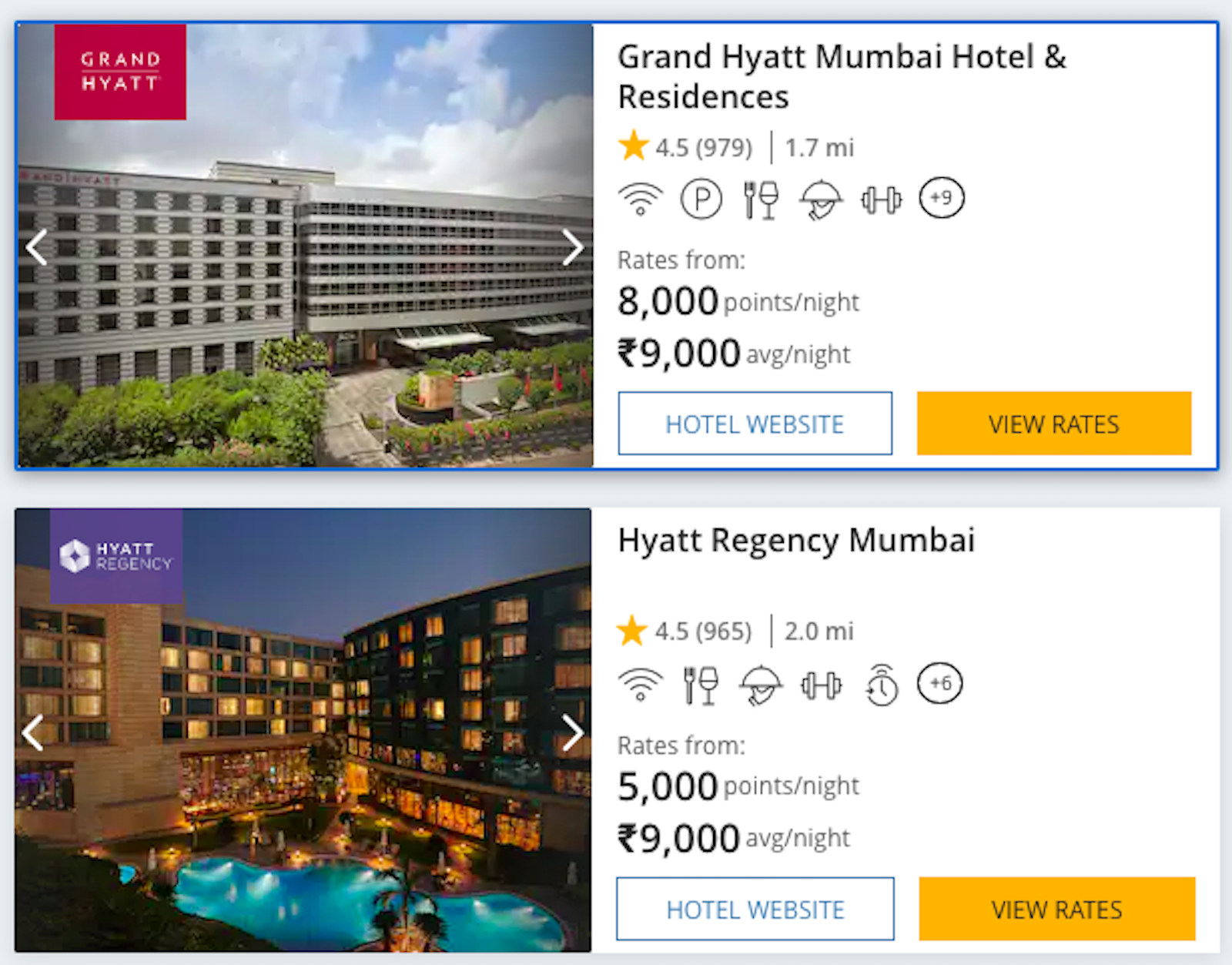

At 5,000 points per night, we can stay at the Hyatt Regency Mumbai cheaply. India is a great country, and this is a solid use of the 104,000 Ultimate Rewards points you’ll get from maximizing the Chase Sapphire Preferred card.

Flights within India are super cheap, as are trains. So get up to the Taj Mahal from here.

We’ve used 78,000 of our 104,000 points at this point. If you find a good deal on a cash price, you’ve got $325 worth of points left to use in the Chase travel portal for getting home.

Final Thoughts On Maximizing the Chase Sapphire Preferred Card

If you’re maximizing the Chase Sapphire Preferred and its welcome offer of 100K Ultimate Rewards, I hope you found some good ideas here. We looked at the perks of the card and the welcome offer. We also looked at ideas for maximizing those 100,000 points for some great trips.

Remember that other ideas are also in play. We previously looked at using Ultimate Rewards transfer partners in articles about United Airlines, Singapore Airlines & Iberia. There’s also this article about British Airways redemptions for under 10,000 miles. There’s also this guide to cheap Hyatt redemptions. Added flexibility comes from the fact that Chase lets you share points with others in your household, and many of their transfer programs let you make bookings for others.

Let me know how you use your new Ultimate Rewards points. I love hearing about people’s redemptions.

I… I mean a friend is thinking of closing or downgrading their CSP card and reapplying soon. Do you have any idea how quickly it would be reasonable to apply after the close or downgrade? Any insight appreciated.

Wanna hope for instant approval online? Probably wait 20-30 days. Technically, the only rule is that you can’t have a Sapphire card right now. I could close it now and apply tomorrow. Their computer would probably deny me for “you have a Sapphire card” and I’d have to do a recon call, but I’m fine with that. It all depends on your friend’s comfort zone. 15 days seems like a middle ground with decent chances.

except that others have said it expires on July 17th. I’ve read that it should work in 3 business days after downgrade.

Lynn – are you referring to this? https://www.doctorofcredit.com/chase-sapphire-preferred-branch-offer-100000-points-50-grocery-credit-waived-annual-fee/

That’s only for the extra perks on the “in branch” offer, as far as anyone knows. For the online/regular offer, we haven’t heard anything about an ending date.

Many rumors floating around. Some say reps have told them the 15th for online and 17th in branch. Wish we knew!!

[…] There have been just two credit card conversions in the month of April in my blog. That is the bad news. The good news is that they were both for the Chase Sapphire Preferred card with a current signup bonus of 60,000 Chase Ultimate Rewards points! It is still considered the workhorse in this hobby. There have been numerous posts about it because we bloggers LOVE when readers apply for the card with our links because we get paid well for each one. So read another post glorifying this travel rewards credit card and please come back to apply for it HERE, thanks! What I’d Do With 60,000 Ultimate Rewards Points – Maximizing the Chase Sapphire Preferred. […]

Great, thanks man!

I’d like to apply. But I’d also like the 6 months to meet msr. But you can’t find out about getting that extension until after you applied.

True, and I think those are winding down, since the chatter seems to have calmed down a lot.

Well that’s ok. I’ll just have to go back to my old way of planning for an mark spend of this amount.

**msr***

Before the bankruptcy rumors, where would Virgin Atlantic rank in terms of the airline transfer partners for chase?

I haven’t used them myself, but I’ve been eyeballing several possible redemptions for the future. Now with this, I definitely would wait. If you fly from the US to Europe a lot, I’d rank it highly.

Sell it boyyyyyyyyyy! 🙂

I love this! Can’t wait until we can all start traveling again!