Maximizing The New United Quest Card: What I’d Do With 100K Miles

If you’re wondering how good the United Quest Card‘s welcome offer is, it is phenomenal. For those looking at maximizing the new United Quest Card and its welcome offer, you’re in the right place. We’ll look at how to earn the miles from the card’s welcome offer, the key perks of the card itself, and then what I would do if those miles were in my account.

Some Of These Offers May Have Ended Or Changed

The New United Quest Card

We discussed rumors about this card before its launch. After the launch, we broke down the details on the card here. This is considered a new product, different from any previous United credit cards from Chase. That means everyone should be eligible for the welcome offer bonus on this card. You can see the application rules for Chase credit cards here.

Here are the important details of the welcome offer:

- Type of card: personal

- Card issuer: Chase

- Application rules to follow: 5/24 rule and no more than 2 cards in past 30 days

- Spending requirements: 2 tiers — $5,000 in 90 days and $10,000 in 6 months

- Welcome offer: 2 tiers — 80,000 United MileagePlus miles after the first spend is met, then another 20,000 miles after the 2nd

- Annual fee: $250 (not waived first year)

New United Quest Card Benefits

- Up to $125 in statement credits for United purchases charged to your card each cardmember year.

- Up to 10,000 miles back. Get 5,000 miles back for each award flight per year (up to two per cardmember year). This starts on the first anniversary of the card and only applies to United-operated flights. We don’t know if mixed-partner flight itineraries are included.

- Global Entry or TSA PreCheck fee credit, redeemable once every 4 years.

- 25% statement credit on purchases made using the card onboard United operated flights

Earning Structure

- 3 miles per $1 spent on United purchases

- 2 miles per $1 spent on all other travel purchases

- 2 miles per $1 spent on streaming services and at restaurants

- 1 mile per $1 spent on all other purchases

Other Card Perks

- First and second checked bags are free

- Priority boarding

- Premier upgrades on award tickets

- Access to more award space when redeeming miles through United

- No blackout dates

- No foreign transaction fees

- Rental Car Insurance

- Purchase Protection

- Lost Luggage Reimbursement

- Trip Cancellation/Trip Interruption Insurance

- Baggage Delay Insurance

Maximizing The New United Quest Card – Burning 100,000 Miles!

We understand the perks & features for maximizing the new United Quest Card. Now for the fun part: what would I do with 100,000 United miles? Technically, you’re going to have more than that. After spending $10,000 on the card, you’re going to have a minimum of 110,000 miles in your account, and I’m going to use this number for trip planning. Let’s take a look at options for economy, business, and first class. We’ll of course be using the Excursionist Perk where possible to maximize value. I gave an intro here, and Ian provided some mind-bending options for maximizing the perk here.

Economy Trip To Australia & New Zealand

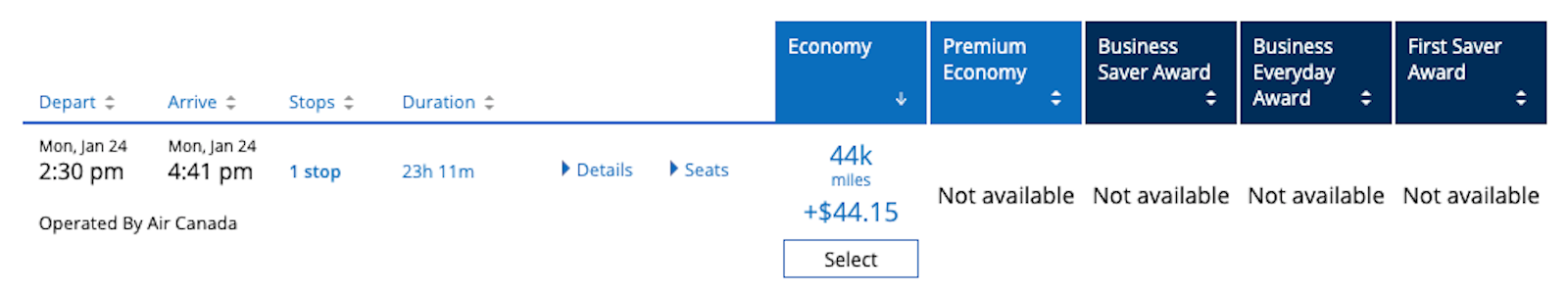

United operates on regions, and I can fly non-stop from a few cities in the continental U.S. to Sydney, Australia (SYD airport) in economy for 44,000 miles one-way. After some time in Australia, I can use my Excursionist Perk to go over to Auckland, New Zealand, since they’re both in the same region for United’s chart.

This flight costs me no points, just taxes. Unfortunately, fees and restrictions right now have increased that to $124.10 in taxes & fees, FYI.

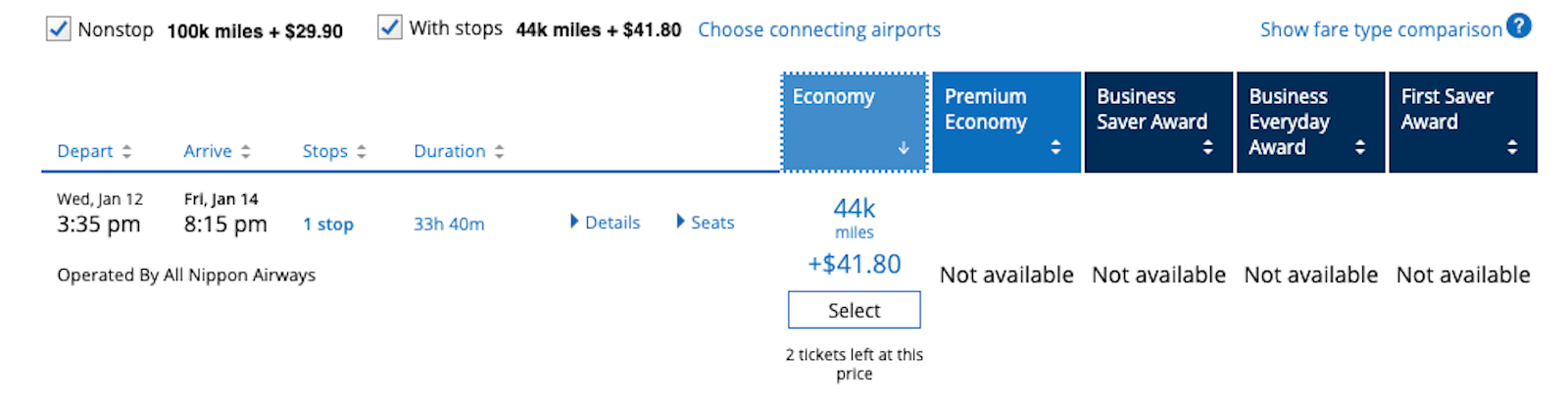

After a week in New Zealand, I’ll fly back to the U.S. for 44k miles. I’ll fly to LAX via Canada on Air Canada. Total cost of the trip is only 88,000 United miles. Obviously, I can do more!

Add Another City

Since I still have another 22,000 miles in my account, add on another city in Australia or New Zealand with a domestic flight. I recommend booking this domestic flight as a totally separate reservation. Here’s why: in the Excursionist Perk, the first flight that meets the rules will become the free flight. I’d rather have the most expensive flight be my free flight. A domestic flight will likely be cheaper. Check the cash price of your domestic flight vs the Australia-New Zealand flight. Whichever is cheaper, book it separately. Use the more expensive one as the middle flight in your USA-Australia-New Zealand-USA booking.

Here’s an option for 8,800 United miles and $6.80 in taxes/fees to fly from Auckland down to Christchurch on the south island of New Zealand.

In my itinerary, I’ll see 2 really far away, really awesome countries. I’d be super happy with this use of my welcome offer of 100k United miles + 10k miles from the spending requirements. I’ll pay $216.85 in taxes for this trip, plus 96,800 miles. Remember that United doesn’t charge carrier-imposed fees, which helps me out. Additionally, Australia, New Zealand & Japan set limits on those fees (some countries limit these fees), in case I were to book with a different program.

Business Class to South America, Central America & The Caribbean

Using my 100k United miles and the extra 10,000 miles from the spending requirements, I’m going to see South America, Central America, and the Caribbean.

To South America

From Chicago, my first stop is Peru. I’ll go see Machu Picchu by flying to Cusco CUZ airport. I’ll use 35,000 miles to fly there in business class. Taxes are $26.20.

After this, I’ll use my Excursionist Perk to visit the Galapagos Islands (read all the details about how to visit here), which are part of Ecuador. This is still in the “Northern South America” region with Peru and will be a free flight by staying in the same region. I’ll just pay $57.09 in taxes.

To Central America

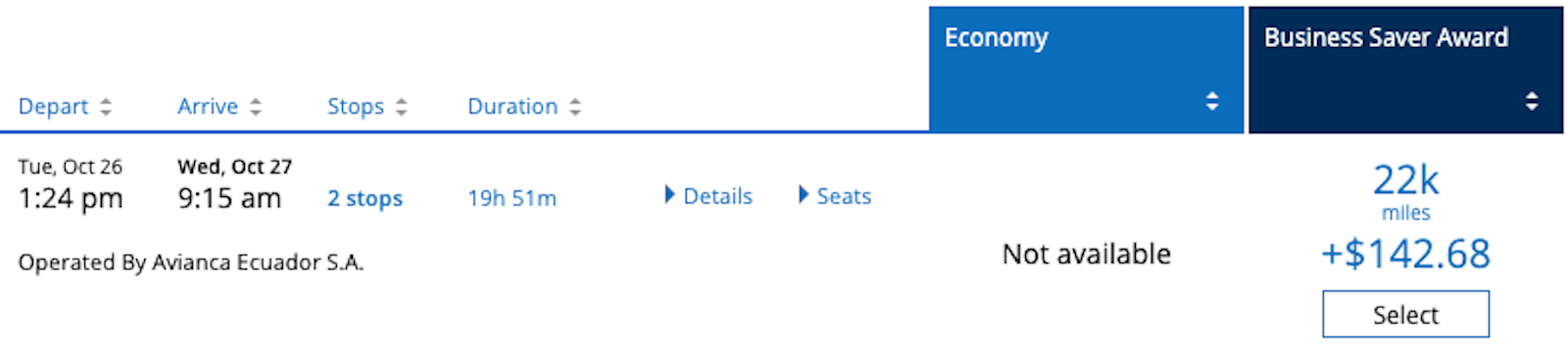

After the Galapagos Islands, I’m looking for zip-lining in the jungles of Costa Rica. Flying to San Jose, Costa Rica will cost me 22k miles in business class. I’ll pay $142.68 in cash, also.

To The Caribbean

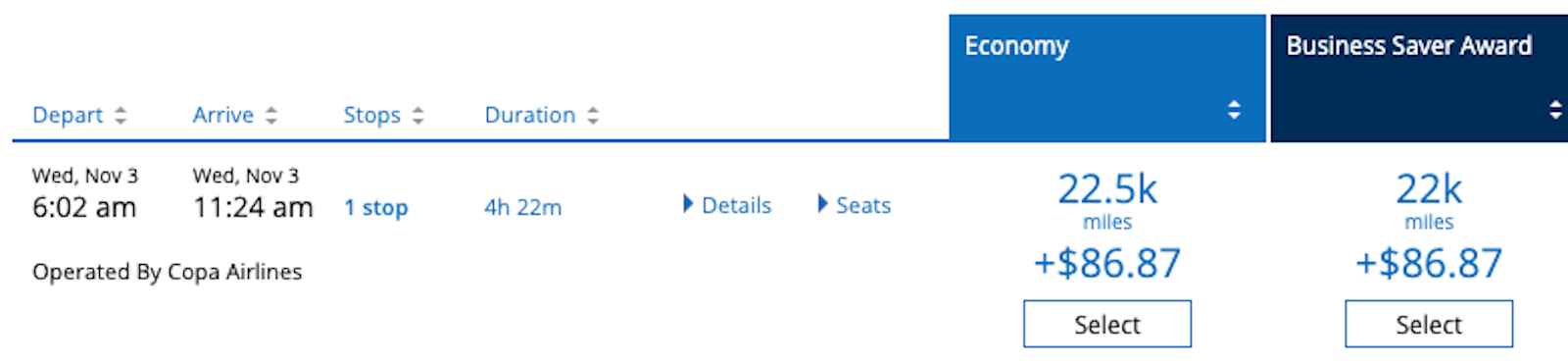

At this point, I’ll end my vacation by relaxing on the beaches of Jamaica. Flying to the Caribbean region will cost me 22k miles in business class. I’ll pay $86.87 in cash.

Back Home

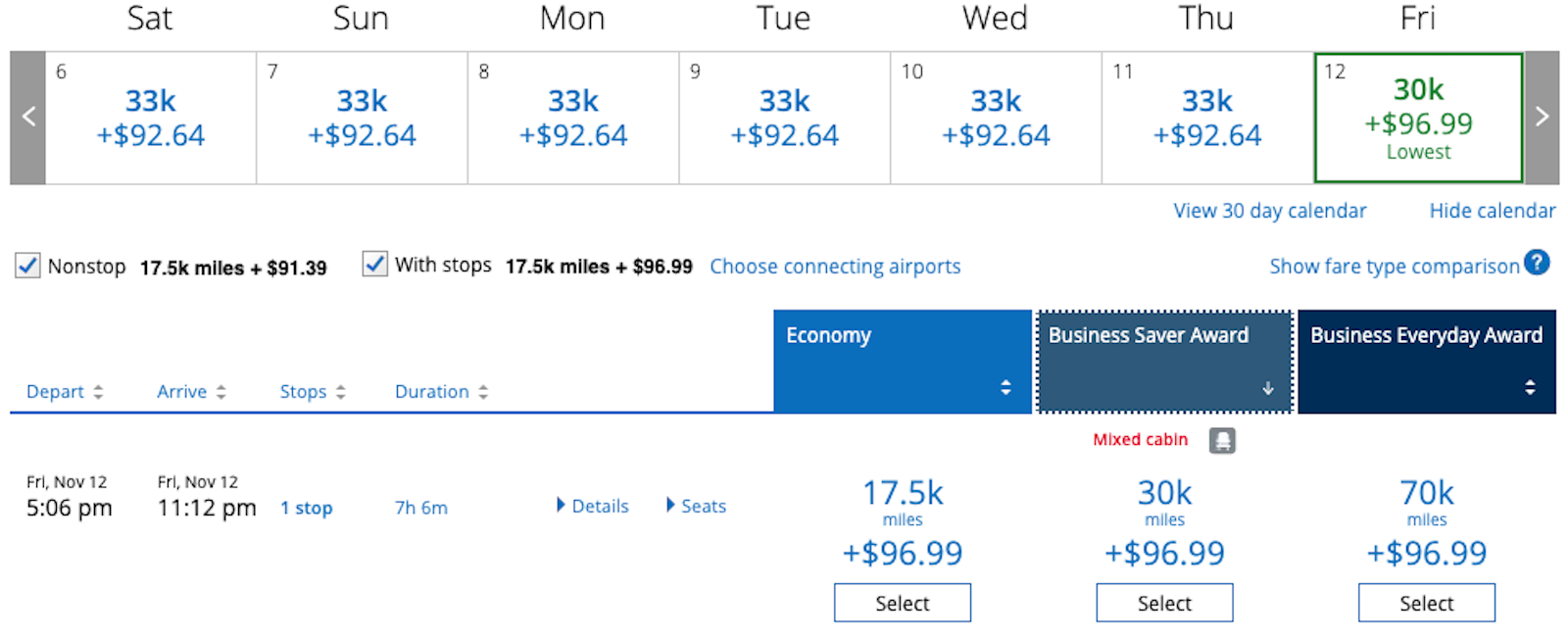

After a few days soaking up the sun, we’ll fly home in business class for 30k miles. I’ll pay $96.99 in cash. Notice in this last image there are options for some more miles but less cash on other days. And the option I chose is in ‘mixed cabin’. Mixed cabin means you will fly in different classes of service during your trip. The flights I picked would be from Jamaica to Washington, D.C. in business and then from there to Chicago in economy. I’d pay a little more in cash but save miles. I’d also save 5 hours of time. The option for 3,000 more miles but $4 less in cash goes via Panama on Copa. You’ll fly business the whole way but spend more time.

For my trip, I’ll spend a total of 109,000 United miles flying in business class. I’ve got $409.83 in taxes to pay for the flights. During the trip, I will see amazing nature, visit one of the 7 Wonders of the World, relax on the beach, and see rare animals.

First Class – 2 Different Options

I think we can all admit that you’re not going far in first class from the U.S. with 100k United miles. To maximize these and ride a great product, I’d go with either of 2 options.

Option 1 – Lufthansa First Class

Remember that Lufthansa doesn’t release first class award space to partners until 2 weeks before the flight. You’ll need to snag these shortly before your travel date, which can make planning a bit tough. It’s doable, though. If we want to burn as much of our 100k United miles as possible, Lufthansa runs 2 direct flights with first class options to South Africa: Munich MUC-Cape Town CPT and Frankfurt FRA-Johannesburg JNB. Either of these will cost you 100k United miles.

Because I’m into maximizing, remember that “Europe” is a region. Also, visiting the First Class Lounge before your long flight is all the rage (I wouldn’t know). So, we can add another flight from elsewhere in Europe to get that layover lounge experience. Unfortunately, these won’t have first class, so we’d have to slum it in business class for this connection. Add any city served by Lufthansa directly to your connection in FRA or MUC.

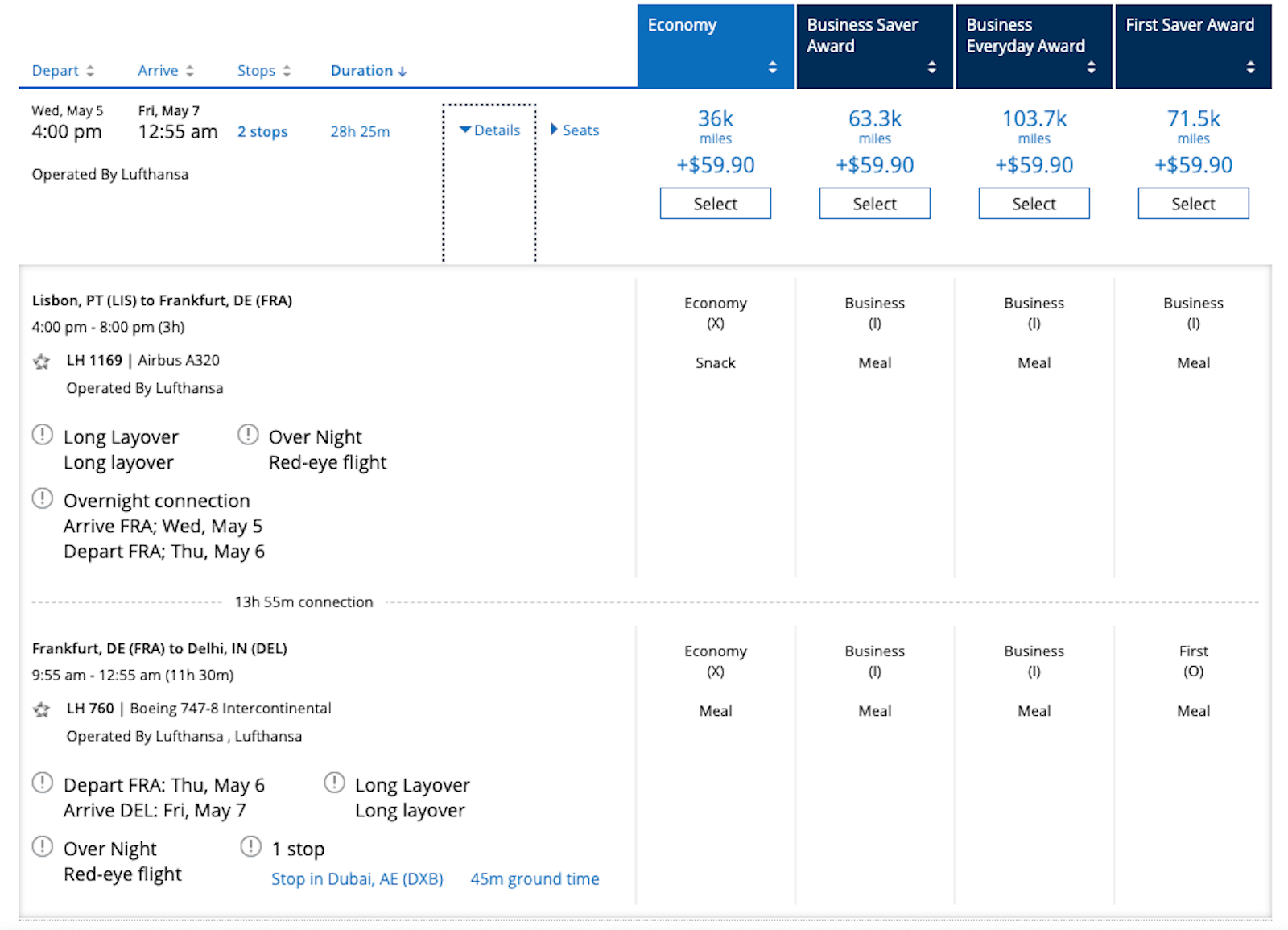

Unfortunately, I couldn’t find any availability for these flights in first class within the next 2 weeks. My next option is going to India to see the Taj Mahal. I need 71.5k United miles to get there in first class on Lufthansa from FRA. Since I want to max it out, I’ll start in Lisbon, Portugal (LIS). I’ll use 71,500 miles and only $59.90 in taxes.

Option 2 – Thai Airways First Class

Another Star Alliance first class with great reviews is Thai Airways. Going from Bangkok BKK to Japan costs 70-75k miles, depending on date and availability. This doesn’t use up all of my 100k United miles, and there’s no way to get a round-trip. Also, I won’t qualify for adding any flights with the Excursionist Perk. To add some value, I can start from somewhere else in the South Asia region. You can start in Singapore and get a business class seat on Singapore Airlines to connect to Bangkok. Leave enough time for your free massage at the BKK lounge when flying Thai Airways first class.

Unfortunately, Thai isn’t running any of its first class products right now, but you can still plan on this for the future.

Also: ANA, based in Japan, released a fantastic-looking new first class product. As more routes are added and Japan re-opens for visitors, you may find destinations on the new “The Suite” for less than 100,000 United miles.

Speaking of Taxes

All award tickets will have taxes. That’s a guarantee. While the United Quest Card earns 3 miles per $1 on United purchases, I would rather earn transferrable points. As I recently mentioned, using the best card for your purchase nets more miles. So does using shopping portals and cash back sites. This card wouldn’t be my first preference for paying the taxes/fees on the award booking.

I’d use an American Express Platinum Card as my first option. That would give me 5 Membership Rewards points per $1 when paying the taxes. The 2nd option would be Chase Sapphire Reserve or American Express Gold Card. Either of those will give me 3 points per $1 (Chase Ultimate Rewards or Amex Membership Rewards).

Final Thoughts On Maximizing The New United Quest Card

If you are about to have 100k United miles in your account from the welcome offer on the new United Quest Card, here are some great ideas for using them. We looked at the card perks and the welcome offer. Then, we dreamed big for using those miles on flights in economy, business, or first class.

This card is also a great long-term keeper for anyone who flies United regularly, due to the useful perks–especially the annual credits and extra award space for cardholders. United loyalists should have no troubles maximizing the new United Quest Card.

If you’re working on the minimum spend for this card and are already dreaming of how to use your miles, maybe you saw some new ideas. Planned your trip already? I’d love to hear how you’re using your 100k United miles.

[…] Update 8/28/21: There is an end date showing 9/22/21. Who knows if the offer will actually end then or not, if you’re interested in the offer I’d suggest signing up now. Hat tip to MtM […]

[…] end then or not, if you’re interested in the offer I’d suggest signing up now. Hat tip to MtM Update 7/24/21: Referrals now show the full 100,000 point offer. Do not share your referrals in the […]

[…] Update 8/28/21: There is an end date showing 9/22/21. Who knows if the offer will actually end then or not, if you’re interested in the offer I’d suggest signing up now. Hat tip to MtM […]

[…] Replace 8/28/21: There’s an finish date exhibiting 9/22/21. Who is aware of if the supply will truly finish then or not, in the event you’re within the supply I’d counsel signing up now. Hat tip to MtM […]

[…] Update 8/28/21: There is an end date showing 9/22/21. Who knows if the offer will actually end then or not, if you’re interested in the offer I’d suggest signing up now. Hat tip to MtM […]

[…] This offer was originally scheduled to end on 6/2/2021 but it was extended. Miles to Memories now reports that it will likely end on […]

$5,000 spend in 90 days for a PERSONAL card is a HUGE requirement. That breaks down to $1,667 EVERY MONTH for THREE MONTHS. Many people (including myself) DO NOT have that capability! Add in the $250 annual fee and I believe many people will take a HARD PASS on this “offer”.

$5,000 for a personal card is becoming more and more common these days. While it may be out of reach for some I think many people spend $1700 a month on everyday expenses. Gas, food, utilities, phone, cable, rent etc. etc. will add up to more than that for many people. It isn’t for everyone though for sure.