Pondering My Amex Future – What’s Next with My Favorite Card Issuer?

Note: All information about the American Express cards mentioned in this post has been collected independently by Miles to Memories.

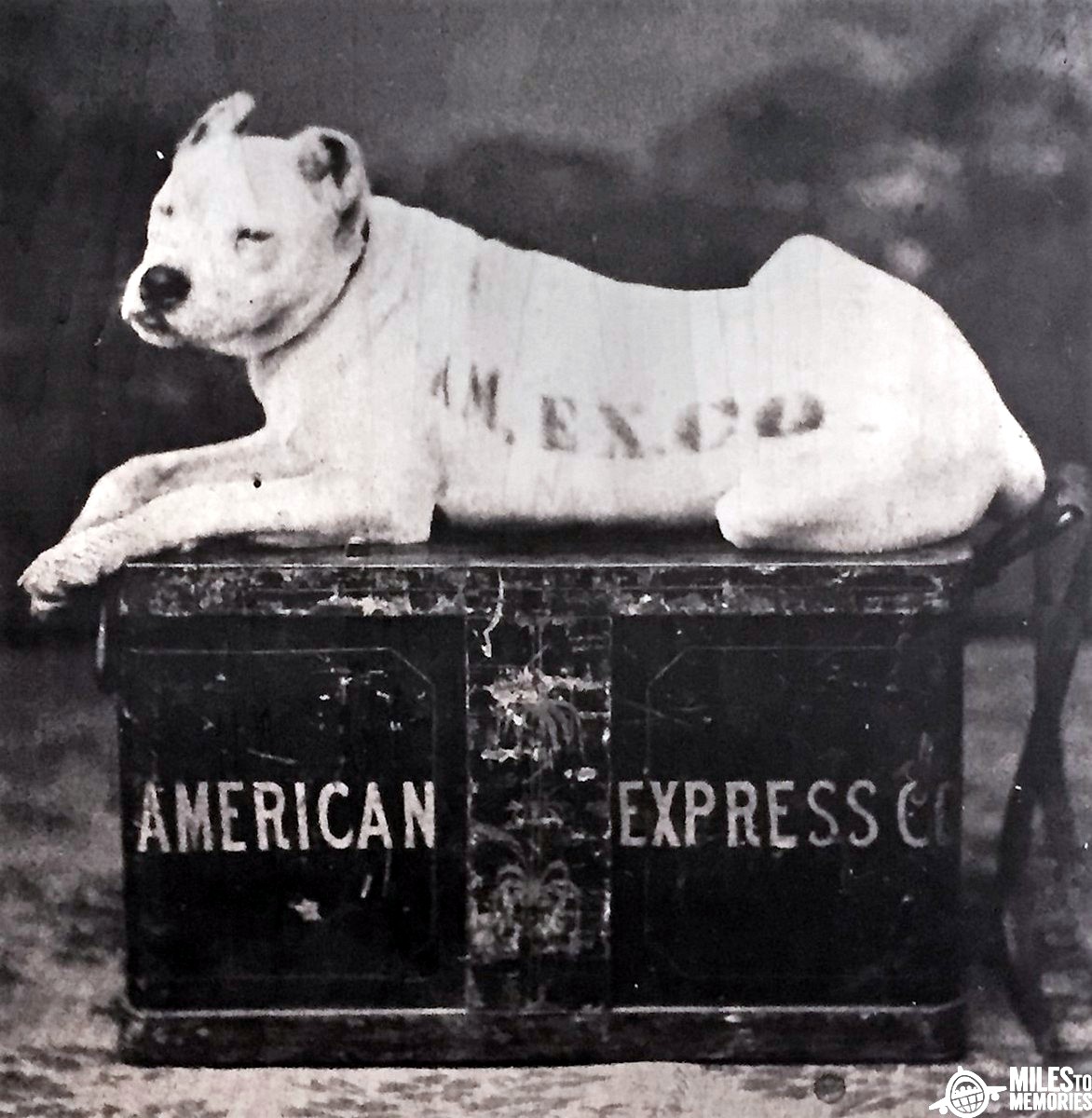

I’ve previously described why I think Amex is entertaining, unpredictable, and never boring. Amex has single-handedly made the hobby fun for me seemingly at every step. I enjoy the challenges and rewards I obtain with Amex along the way. Simultaneously, Amex has creeped many of us out with their clawbacks, shutdowns, and alleged unfairness to some hobbyists. How do I plan to enjoy the outsized rewards with Amex while mitigating against any and all of the bad stuff? I’m pondering my Amex future endlessly – here’s my latest version!

2021 – Balancing Aggression and Discipline

Despite Amex’s periodic surprises, I feel that they are predictable in certain aspects. While closely participating in the hobby and viewing others’ activities from afar, some trends appear. Offers that advertise unlimited bonus earning in a limited timeframe are seemingly riskier than traditional earning. We’ve seen these clawbacks from inflated earning bonuses on their Hilton, Delta, and Marriott cards several months ago. While details are a bit murkier on this month’s wave of shutdowns, similar behavior with more recent offers point to this trend. The first time around with increased Hilton earning, I was lucky. I ended up being occupied with huge bonus earning on my Banana Republic Visa rather than Hilton cards at the time.

With the perspective of those clawbacks over the summer, I purposefully stayed away from the more recent unlimited bonus point earning options. In my opinion, Amex has sent a clear message to hobbyists willing to listen regarding what’s acceptable behavior. Consequently, I plan a disciplined but aggressive approach, focusing on traditional earning rates in bonus categories at scale. In my opinion, those unlimited earning, short timeframe offers are generally too good to be true.

In the spirit of this approach, I’ll be even more aggressive in promptly closing and opening new card accounts next year. Two words: high turnover. Amex’s four credit card limit brings even more importance to the process. I’ll first start with our current Amex credit card portfolio, initial 2021 steps, and our planned account closures, openings, and product change.

Our Current Amex Credit Card Portfolio

My wife and I collectively hold the following Amex credit cards:

- Blue Business Plus (2x)

- Hilton Aspire

- Everyday Preferred (2x)

- Blue Cash Preferred

- Blue Business Cash

- Delta Gold

We consider three of the above eight accounts as permanent counts against our shared Amex credit card limit. Those are the two Blue Business Plus and Hilton Aspire accounts. Why are they untouchable? First, we enjoy the $100k of spend capacity at 2x Membership Rewards / 2.5% cash back the Blue Business Plus cards provide. Terms apply. Second, Hilton Honors is our favorite all-around hotel loyalty program, I’ve held all of their personal cards, card upgrade bonus possibilities, and I like the continued earning potential of Hilton cards (I’ll address that more in a bit).

Pondering My Amex Future – A Quick Start to 2021

We plan to charge into 2021 with Amex across three different cards. I’ll be maxing out the grocery categories ($6k each) on our two Amex Everyday Preferred and Blue Cash Preferred accounts. Once I receive the rewards for this spend, we plan to close each account. We’ve already held each account multiple years, and we aren’t interested in retention offers. Given the Amex credit cards we haven’t yet held, we aren’t looking to lock ourselves into holding the cards another year even with an otherwise-impressive retention offer.

Closing Time

Therefore, we will close our two Amex Everyday Preferred and Blue Cash preferred accounts in 2021 after hitting obtaining the maximum rewards in the bonus category. I also plan to close my Delta Gold card soon after the second year annual fee posts in early 2021. Again, no retention bonus can convince me to keep this card for the reasons I specified earlier. These cards do not offer us enough perks to make the annual fees worth it. We plan to close our Blue Business Cash later in 2021, also.

A Product Change

Once my Hilton Aspire annual fee posts in early February, I’ll immediately product change to the Hilton no annual fee card. Why not the American Express Hilton Surpass? I’m still currently drowning in Hilton free night certificates, so the Surpass free certificate benefit at $15k spend isn’t useful to us right now. We’re also set on status for the foreseeable future, so the Gold status the Surpass provides is unnecessary. While not the 6x points earning of the Surpass, I love the 5x points at grocery with the no fee card. I’m also hoping for two more upgrade opportunities to the Surpass and Aspire cards, as I was able to previously achieve.

Cards We Will Pursue

We should have five new Amex credit card opportunities collectively after closing the cards above. Here are six cards on our list, in no particular order:

- Hilton Aspire, Amex Hilton Business (x2): Hilton Honors is our favorite, and we can never have enough of their points. We love the variety of bonus spend categories across these cards. We will go after an Aspire for my wife when our travel starts picking up more.

- Delta Gold, Delta Business Gold: We are each in the process of rebuilding our Delta SkyMiles balances. These two cards are the next steps for my wife and I, respectively.

- Blue Business Cash: We love cash money, and this one delivers. The last available card slot will come down to this card and the Delta Business Gold – we’ll go after the better deal at that time.

Why am I not prioritizing these applications yet? Quite simply, I have to wait and see what offers are available when we are ready to apply. The Aspire would normally be set as the priority, but given the still unexpected travel patterns, there’s no need for us to pursue it yet. Currently no cards stand out from the others; I’ll defer that decision until application time.

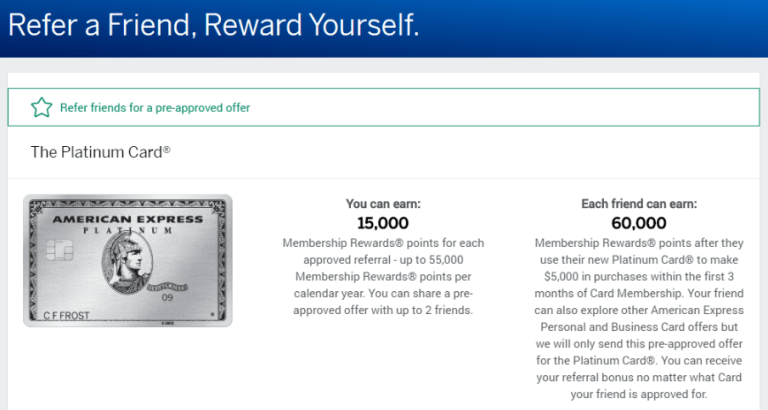

Referral Bonuses – Another Reason For My Love Of Amex

Amex has provided particularly high referral bonuses in 2020 – up to 35k Membership Rewards points per referral. I feel that referral bonuses will come back to Earth a bit in 2021, but they will still be substantial – think more 15k-20k Membership Rewards. The continuing stability of Amex referral bonuses leads me to factor them into every new application opportunity. I’ve come to consider these referral bonuses as a part of new Amex card welcome offers since my wife and I are in two-player mode.

Pondering My Amex Future – Conclusion

Amex has again succeeded in occupying the biggest amount of my headspace compared to the other major card issuers. I win big with Amex, but so do they in that regard. We’ve seen Amex blow up the hobby (for better or worse) plenty before. I’m cautiously optimistic to see how they adapt in 2021. But I’m in, regardless. Considering recent developments, what’s your current plan with Amex?

Note: All information about the American Express cards mentioned in this post has been collected independently by Miles to Memories.

Same here. Not a huge amount of spend, but I have not closed any accounts. I just downgraded two cards to no annual fee cards in a year and now the pop up.

It seems quite extreme to me given I have not yet even closed any cards, but that is how they operate.

If you cancel a card you have held a year to avoid paying 2nd year fee Amex has been known to claw back the initial bonus and also black list you from future cards.

I love Amex (member since 86) but am very happy w my Platinum card, Gold card, Hilton surpass and Delta Platinum. No plans to close any or add any cards although I think I could since 2 of mine are charge cards. Have 9 total and under 5/24 so no more cards for me until next November at the earliest.

You do not have to pay the 2nd year annual fee, you need to wait for it to post before closing the card if you are considering closing it. That is the way the terms are written and enforced.

AA Flyer,

I’ve updated the post for clarity. In my years with Amex, I’ve had no welcome offer clawbacks or future card issues. We’ve actually held some of these cards for multiple years and paid annual fees more than once, so we can cancel those any time. To Mark’s point, we are planning to close the others after the second year annual fee posts. We also plan to mitigate the velocity of these account closures by alternating them between my and P2’s accounts.

Proceed with caution. I closed 3 Amex cards between late 2019 and early 2020, I’d held all 3 for at least 2 years, and I’ve been getting the pop-up ever since. I put a lot of spend on my Gold and BBP, so I suspect that closing that many cards in a short time frame is what did it.

Ron,

Sorry to hear you are stuck in pop-up purgatory, but thanks for your datapoint! I’ll definitely pay attention to this as I move forward.