RentTrack: A Service to Report Rent Payments, Build Credit History

Building credit history is one of the key factors in your credit score, and a service called RentTrack can report your rent history to help you on this path. But what is RentTrack? And how exactly can paying your monthly rent help with your credit score? Since I just heard about this service, I wanted to dig into it and share my findings for anyone who might be interested.

Overview of Credit Scores

Your credit score is made up from the following:

- 35% – payment history

- 30% – amounts owed (sometimes called “credit utilization ratio”)

- 15% – length of credit history

- 10% – new credit

- 10% – credit mix (types of credit you have)

The number one biggest factor in your credit score is the history of making payments on time. Second is how much you owe as a percentage of how much credit is available to you (ex: you have a credit card with a limit of $5,000, your billing statement this month was a balance of $1,000, so your utilization is 20%–that’s high). These first 2 factors make up essentially 2/3 of your credit score.

Smaller sections take the different types of credit you have (car payment, mortgage, student loans, etc.) and your applications for new credit (such as credit inquiries) into account. We also see the length of your credit history popping up in this section.

See more about your credit score and what impacts it here.

RentTrack Service Will Report Rent History

I moved last week. Before moving, I glanced over some information about our new apartment and vaguely remember seeing information about reporting rent history. Today, I got an email from the apartment management company specifically addressing RentTrack’s service to report rent history to build credit. Since I’m always interested in boosting my credit, I decided to check it out.

Firstly, RentTrack seems like it’s only available if your landlord has partnered with the RentTrack service. The home page tells me that they will report my rent payments each month to all 3 of the major credit bureaus in the U.S.

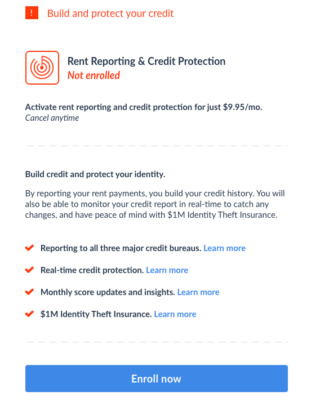

Beyond just reporting my rent history, RentTrack can provide credit monitoring services–included at no extra cost.

By reporting your rent payment history, RentTrack can help with your length of credit history (15% of your credit score) and also on-time payment history (35% of your credit score).

Does It Work?

But does this service really help? Does it actually boost your credit score?

RentTrack conducted a case study with one of the property management companies they partner with. After 2 months, the average bump in credit score was 29 points. At the end of the 21-month study, the average increase in credit score was 59 points.

However, I take this with a grain of salt.

Low credit scores to start with

The average credit score for study participants was 584 before they started. Given that the average credit score was quite low, I would expect significant results. We don’t see numbers for those with average or good credit scores.

Just one case study

Additionally, this is just one case study. Were there others? Were there others where results were bad, so RentTrack hid the results? Or others where results were “meh” so they just focused on this one? Just one case study does not guarantee results, especially the more “unlike you” the factors in the study may be.

Not all residents in the study group participated

Additionally, the control group for the test didn’t include everyone. How many of the eligible participants chose to join in? What was the number of people involved, and what proportion are they? Not sharing this data makes me skeptical.

A different study had lower results

A 2017 study from TransUnion had 12,000 participants who reported rent payments for a year. After 6 months, the average boost in credit score was 16 points.

How Much Does it Cost?

And now the burning question. RentTrack costs $9.95 per month.

I was very interested in signing up, until I saw this number. If it was $2/month or maybe $39 for a year, I would likely sign up. $119.40 for a year seems expensive to me. However, maybe that’s because I’m likely not in the target demographic.

Who is This For?

RentTrack is great for people with no credit history. Those of us with credit cards do not fall into that group. However, reporting your rent history with RentTrack or another service can help you establish credit history if you have none–as well as payment history that might help you get approved for another apartment in the future.

Additionally, those without credit history often have difficulties establishing it going forward. To get a loan or a credit card–which will establish credit history–requires a credit score evaluation, and if you have no history you can’t get the products that will help you establish credit history. Banks are looking to find financially responsible people who lack credit history by sharing your checking account behaviors, which could be a way to help people start establishing credit history.

I say all of this because there are obviously better ways to build your credit score, such as paying your credit card bills and mortgage on time. Or you can be added as an authorized user on someone’s credit card. However, these require access to some type of credit (or a trusted person who has it), so you may need something to help get you there if you have NO history at all. That’s where rent history services like RentTrack and its competitors come in.

Other Services That Are Similar

Once I decided that RentTrack was too expensive for the minimal gains I might achieve, I looked for similar services. And there are plenty!

Services you can use independently

- CreditMyRent: $14.95 per month with no setup fee. Charges fees for past rent history reporting, depending on length. Reports to TransUnion and Equifax.

- LevelCredit: $6.95 monthly fee to report monthly rent and utility payments. Reports to Equifax and TransUnion. 24 months of past reporting is possible for $49.95, but this only applies on your current lease.

- PaymentReport: Enrollment costs $49 and includes 2 years of rental history reports to Equifax and TransUnion. Ongoing reporting is free, and you can add a roommate or spouse for free. (There’s also a version offered to landlords which requires electronic payments to participate)

- Piñata: free to renters. It reports to at least one credit bureau, and — if your landlord signs up — your payments can be reported to all three major bureaus.

- Rental Kharma: Enrollment is $50, including 6 months of past history reporting. Monthly fee is $8.95. It reports to TransUnion only.

- Rent Reporters: $94.95 enrollment fee includes up to two years of past rent reporting. Going forward, there is a monthly plan ($9.95 per month) or an annual plan ($7.95 per month). It reports to TransUnion and Equifax.

- Rock the Score: $48 enrollment fee, plus a monthly fee of $6.95. You can report 2 years of past history for $65. Reports to TransUnion and, if the landlord is a property manager, Equifax.

Services where your landlord must participate

- Bilt: if you live in a Bilt-affiliated property, Bilt reports your rent payments each month to help you build credit history. It’s free, you just need to opt in.

- ClearNow: payments are reported to Experian via RentBureau if you and your landlord both enroll and if your payments are done electronically from checking or savings.

- Esusu Rent: reports rent payments to all three major credit bureaus. $50 enrollment fee via the app.

- PayYourRent: Fees are usually paid by the landlord. It reports to all three major credit bureaus.

Renttrack Rent History – Final Thoughts

If you lack credit history or have bad credit that needs a bump, then rent payment reporting services like RentTrack, Esusu, Rent Reporters, etc. can help you. Before signing up, be realistic about what to expect. The gains will be bigger the worse your credit is (if you have any). These services can help establish credit credit history if you have none, but that doesn’t mean it’s going to give you a high credit score.

Also, if you’re interested, look for services with low costs, preferably reporting to all three major bureaus, and see if you can have past rent payments reported to help get you started.

[…] This was published by Miles to Memories, to read the complete post please visit https://milestomemories.com/renttrack-a-service-to-report-rent-payments-build-credit-history/. […]

Also worth knowing that Bilt reports rent payments if you live in a Bilt building and doesn’t charge for this.

Thanks for reminding me.