Save Money with Points – 15 Rewards to Increase your Financial Freedom

I recently described 15 easy ways to save without significant lifestyle changes. I just scraped the surface of all possible options in that article, and it didn’t include any points- or miles-related possibilities! Today’s article is focused on how to save money with points, credit cards, and other loyalty programs. Some options involve taking tried and true methods and tweaking them for cash over travel. Others involve redirecting lifestyle creep possibilities to more practical, everyday savings solutions. I continue to save money with points, and so can you! Here are a few ways how.

15 Simple Options to Save Money with Points

Credit Card Welcome Offers

Let’s start with one of the more commonly-known methods for achieving lucrative rewards – credit card welcome offers. Banks big and small provide tens (and, increasingly, hundreds) of thousands of points for obtaining a new credit card and meeting minimum spend requirements in the first few months. Many use these points as an excuse to fund an extravagant, fleeting vacation they would not normally be able to afford. Or, you could simply cash out that welcome offer (sometimes worth over $1k) to lower your expenses and save more. The former gets all the attention, but the latter can be more fulfilling and still fun.

Ongoing Credit Card Promotional Offers

In recent years, various banks have provided cardholders more promotional offers. Amex Offers probably get the most attention, but Chase, Citi, Bank of America, and other entities have solid options. To truly maximize savings, use offers on goods and services you normally spend on. Savers end up losers here if the offers just create more spending that wouldn’t have naturally existed otherwise. An example? A recent Amex offer for $200 off a $1k office chair. That’s not a $200 savings – that’s an $800 office chair most of us don’t need.

Ignore Others’ Points Valuations and Cash Out

Overall, I don’t pay much attention to the points valuations of others (but MtM’s valuations are stellar, of course). I try to maximize points for my own situation and goals. If I’m addressing a high priority goal with any points currency, I’m getting excellent value. I can most freely accomplish my travel goals with cash. I cash out all bank points, including Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou points. Doing so with Chase and Citi is fairly straightforward for most cardholders. Amex is a bit more involved and has just devalued, but I still cash those out, too. You can then use the cash to meet your savings and travel goals with no strings attached.

Fuel Rewards Programs

We can save on car fill-ups by collecting and redeeming points in fuel rewards programs run by grocery stores or gas stations. Of course, don’t fall for higher fuel prices due to such a program. I’ve found most fuel rewards programs easy to use and maximize. I predominantly use Kroger and Speedway programs in my region, but many great options exist across the States.

Pay Yourself Back

I want to give a separate, special shout-out for Chase’s temporary elevated value program called Pay Yourself Back. Sapphire Preferred and Reserve cardholders can apply Ultimate Rewards to a variety of expenses at 1.25 cents per point (cpp) and 1.5 cpp valuations, respectively. I’ve primarily used mine to cover grocery expenses, but the program has also covered dining and home improvement store expenses. Chase hasn’t guaranteed this program beyond the end of this month, but another extension is possible.

Individual Card Benefits

Ultra-premium cards like the various flavors of Amex Platinum, Chase Sapphire Reserve, and Citi Prestige provide various credits in return for a substantial annual fee. Many of us subsidize those annual fees with more valuable welcome or retention offers. You can use the benefits to lower your expenses and save more. Again, use them to decrease your normal expenses without creating any new ones. For instance, the personal Amex Platinum offers digital entertainment, Uber/Uber Eats, and Saks credits. The Business Platinum provides a $100 Dell credit twice each year. Premium and mid-tier cards are increasingly similar benefits, as well. Just one card example is the Amex Gold’s Uber/Uber Eats and Grubhub credits. Use them wisely and save!

Spend and Retention Offers

I’ve periodically contacted Citi and asked for any available offers to encourage me to spend on their cards. They’ve delivered solid offers on multiple occasions! I redeem the points or direct cash bonuses to save more. Likewise, around credit card annual fee billing, contact banks to obtain retention offers. Often, these involve waived annual fees, but also bonus points or cash offers. It never hurts to ask, and you’ll be pleasantly surprised sometimes!

Use Points and Miles for Necessary Travel

Instead of saving up points and miles for “aspirational” trips you may not ever take or not truly want to take, anyway, use them on actual travel needs in the meantime. Many hoard points and instead spend cash on travel. By doing so, they are investing in a devaluing currency (points) and losing an increasingly valuable one (cash). Avoid the self-imposed mental games and redeem. Remember, points and values are worth absolutely nothing until you use them.

Invest Your Points

Take the cash you obtain from points redemption and wisely invest the cash for long-term growth. Or simply maximize interest where possible with optimal savings accounts. Interest rates aren’t anything special currently, but it beats the points sitting in your partner account earning zilch.

Reevaluate Your Points and Miles Goals

Think about your goals, travel and otherwise. Do the points and miles currencies you actively earn match up with those goals? If not, realign those currencies for maximum return on redemptions. If you have no concrete plan to use them, you are more than likely losing out on value and savings.

Turn Points and Miles into Cash Equivalents

Beyond bank points and their cash back rewards systems, consider redeeming hotel points and airline miles into cash equivalents. Not too long ago, Radisson Rewards temporarily elevated redemption rates for Visa gift cards. These redemptions are rarely at eye-popping rates, but many have sky high Radisson point balances. And some, including this writer, have no plans to use them all on travel any time soon.

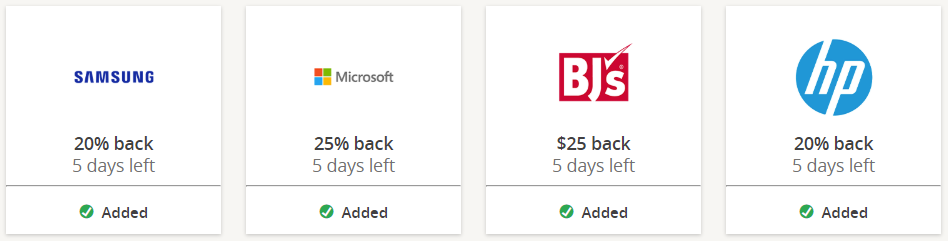

Online Rewards Portals and Card Linked Programs

Do your normal online shopping through portals to earn solid, steady cash back or points that can be turned into cash. My favorite is the Membership Rewards-earning version of Rakuten, but many other useful ones exist.

I enjoy using card linked programs, particularly Dosh, to earn cash back on spend primarily at brick and mortar stores. Signing up for many of these apps is easy, and often already included in your other points plays. For instance, Rakuten has a card linked program within their portal system – simply attach your card and activate the offers before shopping.

Always Pay with a Credit Card

This may seem obvious, but particularly pay attention to creative opportunities where credit cards aren’t traditionally used. Many individuals pay rent, mortgage, tax, and insurance bills via credit card without much effort. Fees sometimes exist, but you can often minimize or avoid them altogether with Visa or Mastercard gift cards (purchased with points-earning credit cards).

Gift Card Redemptions

If directly cashing out your points isn’t an option, consider redeeming for third party gift cards to decrease your living expenses and save more. Grocery, dining, department store, entertainment – the options are seemingly endless. Even better, banks elevate redemption values periodically, bringing you more savings.

Restaurant Loyalty Programs and Apps

Join restaurant loyalty programs, earn points, and check out their mobile apps to save while dining at your favorite establishments. I’ve summarized several solid options here, and I look forward to describing newer options and plays in the future.

Conclusion

As I’ve said before, I’m just scraping the surface of options to save money with points. Many other methods exist, and I look forward to identifying and maximizing more of them. I love the flexibility of saving money with points; I can use that extra cash for everyday needs but also future travel goals. Indeed, I’m into the Rewards hobby, not the Travel Rewards hobby. Saving for aspirational redemptions definitely works out great for many. But for others (myself included), routinely redeeming and realizing more immediate value wins out most of the time. What are your favorite methods for saving money with points?

[…] Points in the Bank – 15 Simple Options for Transforming Rewards into More Savings […]

This is a great article and one that I wish more miles and points blogs/sites would consider writing about! I know cash back is considered ‘boring’ and ‘not sexy’, but with loyalty programs seeming to devalue on an almost annual basis, the cash back and invest (until you’re ready to travel) strategy has been my preferred method for a few years now. Sure, I may never get a legendary awards redemption, like those talked about in the days of old, but I’d probably miss out on any that pop-up anyway, as it’s just not my style for travel planning.

Paul,

Thanks for reading and the kind words!