Serve Load Limits & Types

Two months ago I cancelled my Bluebird card and switched it over to a Serve card. In case you missed it, I detailed how to make the switch and how to get the special Serve with Softcard (formerly ISIS) instead of the normal Serve.

Higher Serve Load Limits with Softcard

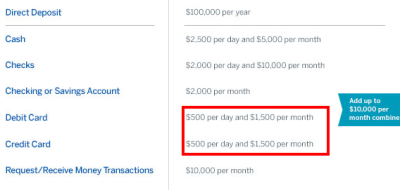

The main reason to get the Serve with Softcard is that it has higher load limits for credit & debit cards. The normal Serve load limits for credit & debit cards are $200 per day/$1000 per month while the limits for the Softcard version are $500 per day/$1500 per month.

Not only can you load an additional $500 per month from both a credit and debit card with the Softcard version, but you can load more in one day, making it possible to hit your monthly limit in a shorter amount of time. Unfortunately Serve’s site is setup for normal Serve cardholders, so it isn’t necessarily easy to see how to add $500 per day.

Don’t Believe the Site! Your Load Limit is Higher.

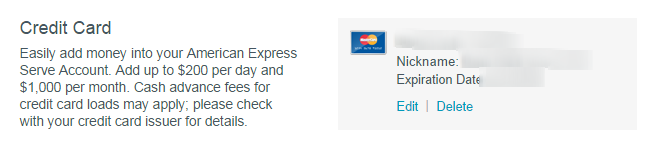

After setting up your Serve account, you will probably head straight to the settings to add a credit card. This way you can start online loads. On the add credit card screen, you may notice that it shows the normal Serve load limits. (Shown above.) That is what initially threw me off.

Loading $500 to Serve with Softcard

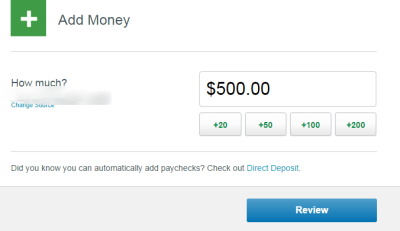

Fortunately Serve knows you have a superior card and will let you load more. After clicking on “Add Money”, it will show a number of buttons with dollar amounts ranging from $20-$200.

At this point all you have to do is type $500 into the “How Much” box and click “Review”. If you want to do a scheduled add, simply do the same thing when setting up the details. If normal Serve cardholders try to add $500, the load should fail, but it works for Serve with Softcard holders.

Perhaps this method (typing an amount into a box) seems like common sense, but for two months I did not know that I could do more than $200 in one day. Since the site mentioned the $200 daily limit, I never really tried to load more.

On the “Add Money” screen I usually just clicked the $200 button and didn’t think much of it. It wasn’t until a reader asked me about the $500 limit that I questioned my process.

Conclusion

For those new to Serve, I highly recommend getting the Softcard version if possible. It allows for higher monthly loads which amount to $6,000 per year of no-fee additional spending per person. Now that I know about the $500 per day ability, I can max out my credit card loads on the first three days of the month. In fact, I have sServe scheduled to do it automatically!

I am sorry Shawn to bother you again, but I was wondering if you can help to figure our how to sign up for Serve through Softcard application.

Thanks,

Val

Hello, I am wondering also, I have an iphone 4s which is not compabitle with Softcard. Do you know if i can setup and account and link it to Serve without ever using the softcard app?

There are iPhone compatible cases, however I am not sure if they will work with the 4s. You need to sign up through the app to get the Softcard version.

Im getting the 1500 cc load with serve and softcard. For the 5k cc load in store, do i just go to walmart with my serve card and load with a cc there? Then just dd the money back into my checking through serve online?

You can’t load Serve at Walmart with a credit card. You can only load with pin-enabled gift cards or a debit card.

Hello,

How do I sign up for serve card through Softcard application? I went through all option in app and could not find the option to sign up for serve.

Thanks,

Val

Is anyone else having trouble loading more than $200 with a credit card? I have Serve with Softcard, but the website is telling me that I’m over my limit if I try anything above $200. I’m on the line with a customer service agent, and they’re telling me the daily limit is $200 for credit card loading, regardless of Softcard. Just wondering if others are experiencing issues.

I did my credit card loads about two weeks ago, but $500 was working fine then. The transaction limits still haven’t changed on their site.

https://www.serve.com/help/#use-your-account-in-softcard-18

Is the load limit per month by calendar month or by bill month? I ask becuase Ive already successfully loaded $2050 in visa giftcards this calendar month with no issues.

The load limit is per calendar month. Keep in mind the $1,500 is online credit card loads. You can load up to $5,000 in store with debit or pin-enabled gift cards.

Shawn,

Now that Serve is doing away with loads from non-American Express cards, is there any point in me getting the softcard?

Also, what’s your expert advice for the best route to take in racking up those points on my cards once the the loads are stopped? I have a Barclay Arrival + and and American Express GC. I can meet the spending threshold with continuing to do the Serve loads, but am looking for additional ways to rack miles for a trip I’m going on in June.

Any advice is much appreciated! Thanks 🙂

Hi Shawn,

Thanks for all your helpful insight.

Do you know if Barclay Arrival + charges a cash advance fee for loading money to the Serve card at this time? I called Barclay to double check today (2/3/2015), and the representative told me that I would get charged a $10 & 25% APR for this because it is considered a cash advance transaction. I asked her to double check with a supervisor, after which they both told me the same thing.

From your comments, I gathered that you use the Arrival + and SoftServe, and that you don’t get charged anything. Correct?

I just want to know if I had the bad luck of getting stuck with 2 workers who don’t know their stuff, rather than find out the hard way by getting charged a lot of money.

Thanks!

You generally can’t rely on any phone rep to tell you what is going on. I can confirm that as of just a few days ago online Serve loads counted as a purchase and earned points with an Arrival Plus. Thanks Irina! Let me know if you have any other questions.

Okay, that’s great to hear! Thanks 🙂

One more question about the softcard- So I downloaded the app from the link that you have posted in the above blog. But I was limited to having only $200 loads, so after a few tries, I called customer service from my Serve card. They transferred me to SoftServe, which told me that that app is not associated with softcard. They even had me send them a screen shot of the app I had installed and told me that that’s not their app, but Serve’s app. They said that their app was pink..? Or does the blue and white “Serve Amex” app that is linked in this blog work for you?

After 4 hours spent on phone calls, I am more confused than when I first started.. help!

Also, in previous comments, I am reading that people are having no problem “adding a card” on their app. Is that what links the Serve card to the softserve to make it a softcard?

I do not remember doing this, and am only able to add cards from which to upload money on-if I go through settings (for which I added my Barclay card). There is not a button specifically for this.

Hi Shawn,

Okay, so nevermind about my last comment; I’m kind of getting it now. (My phone is unlocked, so that’s why the softcard app is not showing up).

Anyways, my question now is, how did you set up your auto deposit so that it deposits money each day, monthly? I was only able to get it to do daily, but not monthly. Is this how you did it, having to update that daily auto deposit, monthly?

Thanks

I do it manually and set up daily loads every month, but you could setup a monthly load for the 1st and another monthly load for the 2nd, etc.

I thought of doing that, but it allows me to set up an auto deposit only once. Are you able to do it the other way just because you have the softcard and they have a different system, or did you have that success on a serve account as well?

I’m not sure. I have three old ones setup. I guess you will just have to go in there each month and setup a new schedule for 5 daily loads of $200.

After my first 200 dollar load on my southwest personal card, it now says please call serve customer service and won’t process any more loads. Any ideas?

They do this often with a new card. Most likely they are just trying to verify your identity. I have had to do it twice.

Sorry for typo, and to comment in an old thread…

Has anybody put their SIM in a friend’s phone to register? I have ATT, but I’m using a Moto X pure edition, which doesn’t seen to support serve softcard (the ATT version does, but evidently not the pure edition). Thanks!

I wasn’t aware that you had to sign up for Serve through Softcard and got my Serve card directly from the Amex website and loaded it to Softcard so I can only get $200 loads and $1000 total. I saw above that you could cancel the Serve, wait 24 hours and renew it through Softcard to get the higher limits. My question for anyone that’s done this- do you get a new Serve card sent to you or do they just reactivate the closed one?

Also, do I have to deplete the loaded funds before closing the current Serve card?

This is awesome, thanks so much for sharing!

Yes you should deplete your balance before closing the Serve account and you will be given a new Serve card. Serve with Softcard is technically a completely different product, although the only real difference is the online load limit.

Great, thanks. One other question out of curiosity, did Amex ask you to send them photocopies of your drivers license, credit card and statement for verification after you started loading from a card?

Yeah it is pretty common. Has happened to me twice. They sometimes ask again if you change which credit card you are loading from. They have an online upload site to make things easier.

I would suggest not changing the card you add for online loads to prevent having to verify your information more than once.

I already have a Serve card not through Softcard. I noticed on the Softcard website it noted one way to use Softcard with Serve is:

Add your American Express Serve Card to Softcard

Open Softcard.

Click Add A Card on the Home screen.

To add your American Express Serve Card, select American Express Serve and follow the instructions on the screen.

Does this mean I do not have to cancel my current Serve card (without Softcard) to begin using the increased monthly spending threshold?

Thanks,

Sam

No you need to sign up through the app to get the increased limits. If you add your regular Serve card to Softcard it will not increase your limits unfortunately.

I am just wondering can I use my newly arrived Amex Gold PR card to load serve in order to meet the spending threshold of say $3000 in 3 months? I understand I wont get amex points but at least spending threshold will be met.

I do believe you won’t earn spending credit either if using an Amex Gold card. I haven’t done it, but those who I have spoken with have stated that is the case.

Thanks Shawn. Is it the same case with Redcard and bluebird too. That using Amex gold card to load those will also not get me meet the spending threshold? Thanks again for your response. Cheers

In store loads for Redbird should earn points. Bluebird doesn’t allow credit card loads, but you could use your Amex card to buy GCs and load them to Bluebird.

Can anyone tell me what the process is for changing over from one card to another

(bb to serve or bb to redbird)? Do I have to call Amex bb to cancel my card or will that happen automatically upon registering for Serve or Redbird?

You need to cancel your current card first. You may have an option to cancel online in your account settings. If not, call the number on the back of the card.

Once your current card is cancelled, you should be able to sign up for a new one. If you sign up for the new one while the current card is open, the application will be denied!

The online credit card load limit is different than the in-store load limit. If you load $1500 online, then you still have $5,000 which can be loaded in-store!

@Shawn: hmm weird…..I loaded $1000 from my credit card to Serve, then do in store load for $4000 ($1000 per day load in store for 4 days)…so total in my Serve account is $5000 now. I tried to load $500 again today in store but it was denied and says it the “transaction was not approved, call your credit card issuer” in the receipt. Tried different walmart and cashier and even walmart money center machine but still same result, I haven’t load anything today so I am sure that I am over the $1k daily load limit yet.

But when I got home just now and tried to load $500 from my credit card to Serve it worked!

Then why Serve won’t allow me to load more at WM while I am not over the $5k monthly in store limit? but it allow me to load more from credit card.

Thanks Shawn and marshdom.

By the way, since I am new to Serve and just got the card few days ago, there is something that I want to confirm. So the Serve with Softcard monthly load limit is the same as Bluebird, which is $5k/month? I remember Shawn has a primer that said if we get the Serve with Softcard, we can get more bigger load limit, for example we can do direct load from credit card to our Serve in amount of $500 a day for 3 times a month for total of $1500. So if I do the $1500 load from my credit card per month, how much do I have left for Visa gift card load at Walmart? $3500 or $5000?

Hi Shawn, thanks for great post. I am new to Serve and just got the card. What are the credit cards that don’t count as a cash advance when it been used to load the Serve?

It is tricky. I know people have had success with the Barclay’s Arrival lately. I have heard mixed things about Chase cards and people have reported BofA, US Bank & Citi all charge cash advance fees.

FWIW, I’ve had success with the Chase Ink Plus Visa recently. As others have reported, the transaction initially shows up as pending (as most charges do) and temporarily reduces the amount on my cash advance available line item (in my account detail). That’s kind of scary, but so far (knock on wood), when the transaction moves out of the pending status it goes through as a regular charge and my cash advance available goes back up to the full amount. And the first time I used the Ink I got a fraud flag and had to call Chase to clear it (and they indicated that it would be a cash advance – but it wasn’t once it cleared, as I described).

But I think other people (on FlyerTalk) have reported that other Chase cards don’t work. So I think Shawn has always properly advised to start with a small charge (to test it), in case it goes through as a cash advance. And be prepared for the worst.

@ Shawn and marshdom: Thanks, just experiencing with my CSP card and you are right marshdom, it drew from cash advance balance first and show as pending but change to regular spending.

Will try Arrival Plus later. I just hoping Amex SPG would work for this since starpoints is the hardest to get (no category bonus like UR or TYP).

Amex cards don’t earn points when loading Serve in my experience.

I have loaded to (Softcard) Serve with Chase Sapphire Preferred and it was posted as regular sale with rewards points.

That’s good to know, Vic. Thanks. Have you done it very recently? I know it’s always a YMMV situation, but (as I mentioned above) I have done my Ink Plus very recently … so feel pretty good about it … at least until I don’t! 🙂

since we’re only allowed one at a time (or is there a workaround to have both?) which is better in your opinion..? redbird or serve?

5k cc load in-store/mo vs 1.5k cc load online/mo, but 8k limit/mo?

I would say Redbird is better, but it just depends on how long the in-store credit card loads last. The in-store loads by credit card are not a feature, so it could be patched anytime.

what card do you load normally? do you use the arrival+ for its 2x, or do you do some other card?

If I’m not in need of minimum spend, then I use the Arrival. I would say I use it 95% of the time.

Thanks for the heads-up, Shawn. Unfortunately, I still appear to be limited to $200. When I try more, I get an error message that says: “You have the following errors. That transaction will cause you to exceed your monthly limit.” [My note: seems like more of a daily limit issue – since $500 wouldn’t get me up to even $1000 for the month.] I am hoping that it is because I have not yet received my physical Serve card in the mail (should be here in the next day or two), so I haven’t activated the Serve card on the website yet. And the website says (on my main Serve page – next to the “activate card” button): “When it arrives, activate it to unlock all the benefits of Serve.”

Just thought I’d post my experience in case anyone else runs into the same situation as me and wonders what’s going on. I’ll update my situation (hopefully success) after I activate my physical card. If anyone else has had this situation and it “fixed itself” after activating the card, please let me know!

Quick follow-up to my previous post. I got my physical Serve card in the mail today and just activated. Now I am able to load $500.

did you have to sign up for the actual serve softcard through the app? i have the serve card and i associated it with the soft card (ISIS) app but i am still stuck at the old limits. Do i need to cancel the old card and apply for a new card?

Yes you need to sign up through the app. Others have had success by canceling their Serve, waiting 24 hours and then signing up again through the app. That is the only way to get the increased limits unfortunately.

When you do that (cancel Serve and reopen via Softcard), are you going to get new Serve checking a/c # and new card #? all Serve subaccounts will be closed and need to re-opened? I’m debating if its worth the effort. I also have a payroll d.d. to Serve & need to cancel that as well.

Yesterday at local Walmart, I had trouble loading Serve with multiple Visa GCs. After the 1st load, the clerk asked me what type of card is it. Once they saw it was a Visa GC (GCMall), they refused to unload one more.

The automated kiosk was down – I’m not sure if the same one works for loading Serve too? The advertising on the machine says Bluebird.

The automated kiosk does work to load in the same exact way as loading Bluebird. As for account numbers, it is my understanding that your current account will be closed and you will get an entirely new account number, so it is a bit of a hassle.