Breaking Down The Best Card For Plastiq Online Bill Payments

Wondering what the best card for Plastiq bill payments is? What card should you use for the best return on your payment, in order to negate Plastiq’s fees? And does the answer change depending on what type of bill you’re paying? Today, we’ll break down the best card for Plastiq online bill payments depending on what you’re paying and what cards you have in your wallet.

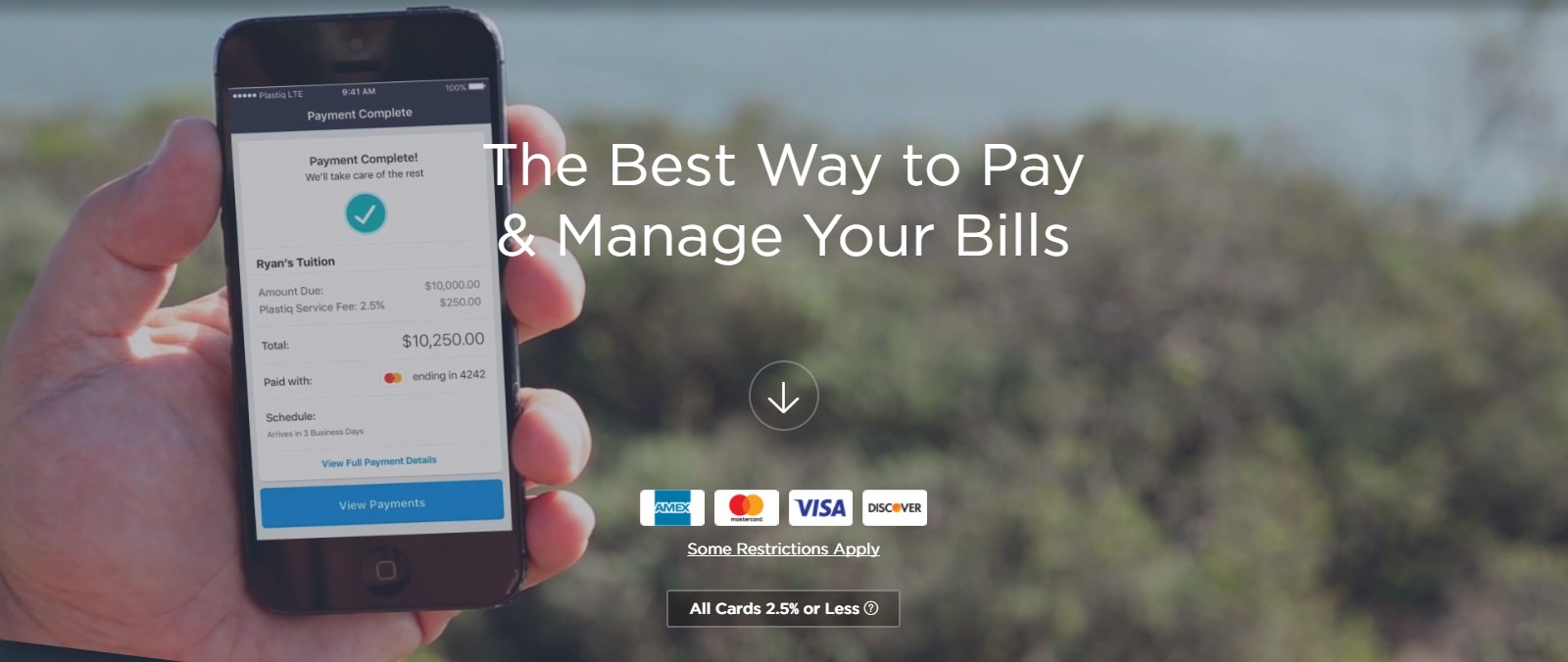

What Is Plastiq?

Plastiq is an online bill payment service that lets you pay pretty much anything with a credit card. That even includes bills for companies located outside the U.S. The awesome thing about this is that it lets you pay bills with a credit card even when the company/person you’re paying doesn’t take credit cards. You pay Plastiq, and Plastiq will send that person a check or online wire transfer. The down side is that there’s a fee, of course. And that fee recently increased to 2.85% (July 1, 2020). Despite this, the lack of real competitors for paying your mortgage with a credit card leaves many of us still using Plastiq for lack of better options. Additionally, you can’t use Visa or American Express cards to pay a mortgage via Plastiq, which is a bummer but not their decision.

Additionally, you can offset fees by looking for referral offers or periodic bonuses. These will give you fee-free bill payments via Plastiq’s website.

The Best Card For Plastiq Payments

So, what’s the best card to use? Ideally, we want to overcome or offset that 2.85% fee as much as possible to make paying bills via Plastiq “worth it”. Depending on what you’re paying (since different types of bills have different rules) and what cards/earning boosts you have access to, here’s a breakdown of the best card for your Plastiq payments.

1 – Any Card For Minimum Spend Requirements

I’ll say it again and again: the best card for ANY payment is the one you just opened. If you’re working on minimum spending requirements to earn a welcome offer, use that card for everything possible. This card absolutely offers you the best return on your spending. Why? While we’re talking about 3-5% types of numbers for “normal” spending, you should be earning FAR better than that from a lump of airline miles or bank points through welcome offers.

2 – Any Card With Bonuses At Play

Similar to the above, any card with a bonus at play is your next best card for Plastiq payments. If you received a retention offer and can earn extra points/miles through spend in a short period of time, use that card on Plastiq. If you need to finish off the $15,000 spend requirements for a free night certificate or need to qualify for a companion certificate on an airline, use that card. Use any card available that’s offering you a “spend A bet B” bonus at the moment. Here are some cards with bonuses you can earn every year:

- Chase World of Hyatt Card

- Hilton Surpass Card

- Delta SkyMiles Platinum Card – personal or business

- Delta SkyMiles Reserve Card – personal or business

3 – The Best Card For Ongoing Bill Payments

If we don’t have any bonuses or welcome offers available, it’s time to consider what’s already in the wallet. What cards do we have access to, and what will offer the best return? Here are the best options:

Bank of America Business Advantage Cash Rewards Card – Up to 5.25% return

The best card in terms of return rate is the Business Advantage Cash Rewards Card from Bank of America. It can give you a 5.25% return, which more than offsets Plastiq’s 2.85% fee. However, not everyone is going to earn that rate. You need to have Platinum Honors Preferred Rewards for Business with Bank of America to qualify. You earn 3% back on your chosen category, then Platinum members earn 75% extra on top of that. That adds up to a 5.25% return. To qualify, you’ll need to have $100,000 in business investments with Bank of America.

Bank of America Premium Rewards Card – Up to 2.62% return

If you don’t have business investments with Bank of America, the best personal card is the Premium Rewards Card. Again, the real advantage is from having Platinum Honors Preferred Rewards. Everyday spending earns 1.5% back for standard users. Those with Platinum Honors will earn 2.62% return on standard purchases. Not always, but some Plastiq payments will code as travel with Bank of America, which means you could possibly earn 3.5% here. It’s worth trying and seeing if you get lucky.

Discover It Miles Card – Up to 3% return

If it’s the first year you’ve had the Discover It Miles Card, all the cash back you earn is doubled at the end of the year (uncapped). The standard 1.5% return becomes 3% at the end of the year, which makes this card worth using. That is better than Plastiq’s 2.85% fee, so you’re getting paid to use this card on Plastiq. After the first year, when your earnings aren’t doubled, this card drops significantly in the rankings of which is the best card to use on Plastiq bill payments.

American Express Blue Business Plus – Up to 2.5% return

The Blue Business Plus from American Express is on our list of the best no-fee credit cards for a reason. You earn 2X Membership Rewards on the first $50,000 of spend per year. (1 point per dollar thereafter.) You can cash those out at 1.25 cents each if you have the American Express Platinum Card for Schwab. That makes this a 2.5% return for those taking advantage of this cash out feature. Otherwise, you’ll earn the standard 2X. The down side is that you can’t use Amex cards for mortgage payments.

Citi Double Cash Mastercard – 2% return

The Citi Double Cash Mastercard also sits on our list of the best credit cards with no annual fee. It earns a straightforward 2% cash back on all purchases. You also have the option of converting that cash back into Citi ThankYou Points. The flexibility of how you use your earnings and the fact this is a Mastercard (so you can use it for mortgage payments) puts it on our list of the best card to use for Plastiq payments.

Final Thoughts

Making payments through Plastiq isn’t perfect. However, it allows us to multiply the amount of credit card rewards we can earn. Be smart about it, though. Make sure that what you’re earning is worth the fee you’re paying for it. The best return will always be from bonuses via welcome offers and spending bonuses on credit cards. Other than that, for ongoing / daily spend, the best cards to use on Plastiq are those that can offset Plastiq’s fees. If you have the right set up, you can even get paid to use the Plastiq service.

If you’re ready to start using Plastiq, here’s a guide on what you can pay and which card types you can use for that bill.

All information about American Express cards in this post has been collected independently by Miles to Memories. Some offers mentioned in this post have expired.

I wish Plastiq and CapOne would work out their differences because my Venture was my workhorse on Plastiq as CapOne was the least likely of my lenders to be bothered by such.

Have you tried to use the World Of Hyatt card with Plastiq? I tried a couple of months ago and it wouldn’t go through because Plastiq was coding as a cash advance and my cash advance limit was lower than the attempted charge. Any help or thoughts appreciated.

Christian – I haven’t tried using the WOH card myself, because you can’t use Visa cards for mortgage payments. What bill were you trying to pay? I think it’s more that bill than the card–just a hunch. Have you tried asking Plastiq why it’s coding as cash advance or tried another card on that same bill to see how it codes?

I was trying to pay my business rent. I didn’t ask Plastiq, although that’s not a bad idea.

I’d mess with the variables. Here’s what’s at play:

1-the bill (how it’s coding)

2-the card being used

If Plastiq swears it’s not a cash advance, try a different Chase card. Still no? Try a different visa from a different bank. Still no? Try a non-Visa from a different bank. See how ‘different’ you have to get before it works.

Obviously, watch your cash advance limits on anything you try, to avoid issues. It’s a science experiment 🙂

Does Plastiq charges earn 3% bonus on the Bank of America Business Card?

Sam – which card are you referring to? The Business Advantage Cash Rewards? We mentioned that one in the article, since you can choose a 3% category (choose ‘business services’ or ‘travel’ depending on how your Plastiq payments are coding).

I upgraded to the AAdvantage Aviator Silver MC in January. I generally don’t have the spend to hit the EQM and EQD bonuses based on my normal spend, but put mortgage and a couple others through Plastiq and I can. Already hit $20,000 and $40,000 spending marks on Aviator Silver for 5K EQM each, will be hitting $50,000 YTD spend shortly to get the 3K EQD. (I know this card used to have higher EQD bonus, but it is new to me.) Having not had airline status previously, and with reduced AAdvantage requirements, I should hit PlatPro or maybe ExPlat once I ramp up flying again.

ramcm7 – another good point. If you can hit bonuses that you otherwise can’t hit, that makes it ‘worth it’ for the perks you’ll get that offer value above the fees.

I do my house and car payments on the Double Cash on Plastiq. My choice is earn nothing on those spends, or earn something on those spends. These points require no travel or effort to earn them. That counts for something and the risk is low. I do tell myself those points can only be used for high value Bus. or 1st class seats.

I also look a my points like money and diversify the spend on several cards that earn more points than Plastiq, and I like to earn MR, UR, and TY each month.

Byron – good point that you can earn nothing or earn something for a fee. I’m happy to pay a fee to earn something vs earning nothing, as long as what I use the points for provides value — just like you said.

How do you get a positive return given that the Plastic fee > 2%?

Jablinski – depends on the card you use, what points you earn, and then what you use those for. There are a ton of factors here, but that’s the gist of the article. The article answers that question.

Right. I was asking specifically was about Byron’s use case — how does he get > 2% value from Double Cash points.

I should have said > 2.85% (Plastic fee).

He likely transfers them to ThankYou points and then redeems them at over 1.5 cents per point. That would be my guess at least.