Switching From American Express Bluebird To Serve

Last month my wife and I successfully switched from American Express Bluebird to Serve via the Softcard Mobile Wallet app. It was a very easy process, but did involve a few steps. In this post I will go over the benefits of Serve ($18k free spending per year) and explain the steps involved in converting a Bluebird card to a Serve card.

Bluebird Vs. Serve

American Express Bluebird & Serve are essentially different skins for the same product. While there are a few minor differences, the backend system is the same and thus American Express only allows people to have one card or the other.

While I could spew out a bunch of data points comparing the two cards, the two advantages that Serve has over Bluebird are Amex Offers (formerly Amex Sync) and online credit card loads. The regular Serve card allows you to load up to $1,000 per month from a credit card, while if you sign up for Serve through the Softcard Mobile Wallet app you can load $1,500 per month.

The only two advantages of Bluebird are paper checks and no foreign transaction fee. I have no intentions of ever using my Serve card outside of the country and I have a stack of unused checks that I got for free on my old Bluebird account. I say that I have a stack, however I have no idea where the checks are. For a deeper comparison of the two cards, Frequent Miler has a great post.

Switching Over From Bluebird To Serve

As I mentioned before, the main reason to switch from Bluebird to Serve is the online credit card loads. I say you should always jump on any and every opportunity to manufacture spend with no fee, especially when it isn’t time consuming.

Before switching over from Bluebird to Serve, you should max out your $5,000 monthly load limit before closing your Bluebird card. This essentially allows you to double dip in the month that you switch over. You will get $5,000 in loads on the Bluebird and $5,000 in loads on the Serve if you time it correctly. In my case I maxed out my Bluebird in the first couple of days of the month to ensure my Serve card would arrive before the end of the month so I could max it out. (The $5,000 load limit resets at the beginning of the calendar month.)

Once you have loaded up your monthly limit on the Bluebird card, make sure to pay off bills and/or transfer money to bring your balance down to $0. Once that is done, simply call 1-877-486-5990 which is the same number listed on the back of your card.

After you navigate the prompts and get to a human, tell them to cancel your card. They will then inform you that the card will be closed, however you can reopen it any time in the next 30 days. Hooray you are on your way towards getting completing the switch from Bluebird to Serve.

Signing Up For Serve

To get a new Serve account you can go one of two ways. There is the easy way and the hard way. To go the easy route, simply wait 24 hours after cancelling your Bluebird and go to Serve.com to sign up. The only thing to note is that you must use a different email address than the one linked to your old Bluebird account or you will get an error.

The second way is more difficult, but also comes with more reward. If you have an Softcard compatible phone, simply download the Softcard app and sign up for Serve through the app. Once you open the app it will walk you through the process. If you don’t have an Softcard compatible phone there is some hope.

Buy Your Way To Serve With Softcard

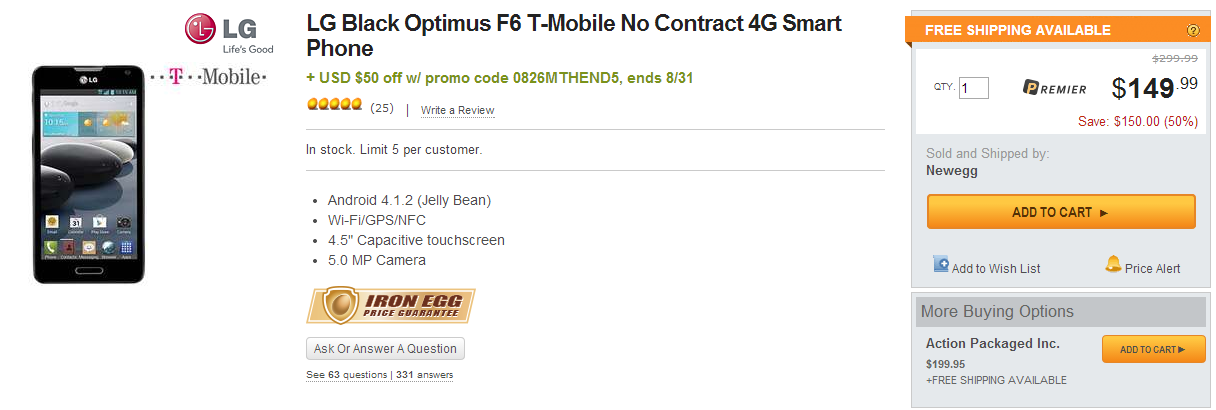

Currently T-Mobile is offering a $50 credit for new Serve accounts when signed up through the Softcard app on a T-Mobile compatible phone. (Set to expire on 8/31 but they have extended it several times. Check this Slickdeals thread for the latest info.) You can use this to your advantage!

Right now Newegg is selling the Optimus F6 for $99.99 or if you don’t like Newegg or they charge tax in your state then some sellers on Amazon have it for $110. (I personally bought it through Newegg.)

The Optimus F6 is by far the cheapest Softcard compatible phone around and is less than half the price of the next cheapest option that I have seen. Additionally it is a well reviewed phone and a good deal. Once you receive the phone, you must activate it with T-Mobile prepaid to get Softcard to work.

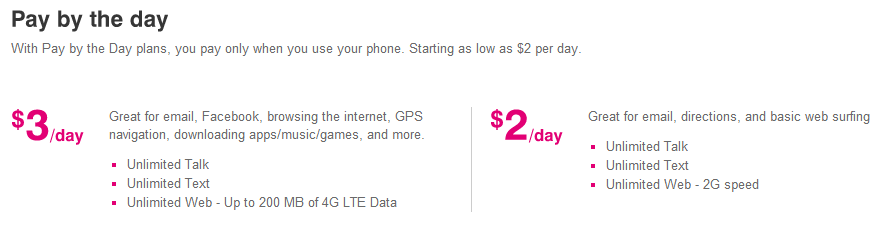

Luckily T-Mobile offers a $3 per day prepaid service which will do the trick. Unfortunately there is no way to only load only $3 on to the account, so you must load a minimum of $10. One other thing to note is the phone does come with a sim card, but it may not be Softcard compatible. If your sim doesn’t say Softcard compatible on it, then call T-Mobile and they will send you out an Softcard sim for free or you can also go into one of their stores and they will swap it out for free as well.

Now that you have signed up for the prepaid service and activated the phone, download the Softcard app from the Google Play store. The app will first ask you to setup an Softcard account before taking you to the Serve card registration. Don’t forget to use a different email address from the one linked to your Bluebird. If all goes well you will have a new Serve account within a minute or two.

Once the Serve registration is done through the Softcard app, you never have to use it again if you don’t want to. Softcard offers a lot of great deals, so you may want to consider keeping it, especially if your current phone is Softcard compatible. If not, you can now log in to your Serve account on Serve.com. When you login for the first time you will notice the $50 credit is already sitting there.

A Trick To Get A Second Softcard Account With The Same Phone

Since my wife and I both wanted to switch our accounts, I thought simply getting a second sim card would work. Unfortunately a phone’s Softcard account is linked to the sim & phone number which means if you try to sign up for a second account it will give you an error message.

Thankfully there is a small workaround. After you complete the registration for the first Serve account, go to T-Mobile and get a new Softcard sim card. As mentioned before, they will give it to you for free and update your account to the new sim card.

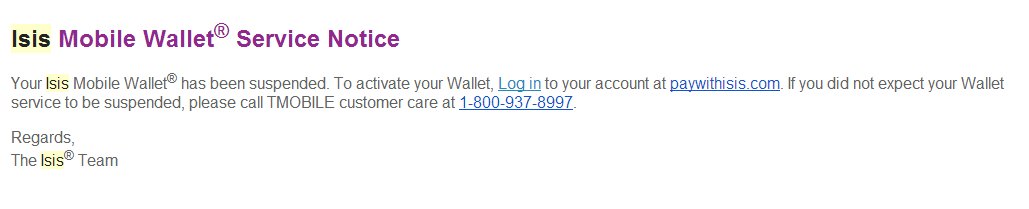

Once you have that done, uninstall the Softcard app and call Softcard support at 1-800-937-8997 and explain that you accidentally signed up for Softcard in your name to test it out, but this is your wife’s phone and she needs it in her name. (Or something along those lines.) They should out of courtesy de-link the Softcard account from the phone. When this is done you can then register re-download the app and sign up for another account.

The trick above worked for me, but I don’t see it working for more than a second account. If you wanted to do more accounts, then you would probably need to cancel the T-Mobile phone number and wait to sign up for a new prepaid account a few days later.

While this process seems a bit lengthy, in the end you will have spent $110 and will have $100 in your two Serve accounts along with the phone. (Verify the $50 promotion is still running when you sign up.) In my case I needed a new phone for my son so I gave it to him. If you didn’t want the phone, you could sell it for about $75 which would yield you an overall profit of around $65.

The real reason to go down this path is that Serve with Softcard allows $1,500 in online credit card loads per month while the normal Serve card only allows $1,000. Assuming the limits don’t change, that is an extra $6,000 per year per card. To me that makes the process worth it.

How Much Time Is Involved

I personally spent less than an hour total doing this. There is a T-Mobile store right next to my house, so it wasn’t time consuming to switch out the sim card. After ordering the phone, I was able to activate and sign up for the prepaid service online.

Downloading and installing the app took a few minutes as did signing up for the first Serve card. It took about 15 minutes for Softcard customer service to de-link the first account and another five minutes to setup the second one. I never cancelled the T-Mobile account since my money ran out and it wasn’t on auto renew.

Conclusion

Whether you decide to go the route of Softcard or not, getting online credit card loads by switching from Bluebird to Serve is worth it. In our case, we now have $36,000 per year in no fee spending that we didn’t have with our Bluebird cards. A regular Serve card yields $24,000 in no fee spending for two people.

I know this post is lengthy, but hopefully it will help you realize that you are leaving money on the table by keeping Bluebird. If you have any questions about what I covered here, feel free to ask below!

Can I use my gold American Express card to load $1,500 and will this count toward my Amex card sign up bonus?

You don’t earn points when using an Amex card for online Serve loads. I have heard varying reports as to whether it counts towards a sign-up bonus or not, but I have never tried it myself.

[…] is interesting since Softcard has been trying to attract users with very generous bonuses. I still enjoy my “SoftServe” to this […]

For my previous > Oops, sorry…” put in required advanced sim card” then

Is this scenario possible? I have a HTC ONE (regular), so i dont believe its a TMobile compatible phone. BUT…. what if i ask TMobile to put in required then open a Serve without ever intending to use Softcard thru the phone (only use Serve online)??

It actually has to be an approved Softcard phone or the app won’t even install. Even with the correct sim, you won’t be able to get the app installed and thus won’t be able to sign up through it unfortunately.

Hi Shawn,

Thanks for sharing this. I’m having a problem and wonder if you have any idea: I had a serve card which was not linked to softcard. I was dumb to try to test out softcard by linking that serve card first, then I was told only serve account opened through softcard can have this increased limit (500/1500). So I had to cancel the serve account and uninstalled the softcard app. Then I saw you mentioned that using a different sim card and phone number I should be able to get another serve account, so I gave it a try last night and ran into an error “Something went wrong” right after I was directed from softcard app to serve.com on Chrome browser. I spent 3 hours with Verizon, AE Serve, AE softcard and got nothing resolved, everyone claimed it’s not their problem, I was kicked like a basketball between these departments. Now I tend to think it may be because the phone was used before with another softcard account. Did you ever try to use different sim on the same card to register another serve account?

The Serve account is tied to both the sim card and the phone number, not the phone itself. If you are using a different sim card, but a number that has had Serve attached then it won’t work.

Hey Shawn,

After having gotten a new SIM and delinking your phone number, can you use all the same exact info (from your first Serve account) to open your second Serve account? Same email, address, social, phone number, etc.?

You can only have one card per person/social.

[…] even explained a couple of months ago how Softcard paid my wife and I each $50 when we switched our Bluebird cards and signed up for Softcard Serve. (SoftServe!) In other words, they are paying to incentivize […]

[…] Softcard, is offering a $20 Amazon gift card when you link and use a credit card on your account. Apparently there is no limit as to the number of cards which can be used. You can see the offer here and see strategies for maximizing the deal on Slickdeals. Offer ends 10/31/14. […]

@ Shawn:

Need your help please:

1. I currently have a BB, so the first step is to call and cancel my BB after draining out all the balance, then after that can I download Softcard app on my phone and register for Serve right away? or do I have to wait 24 hours after I called to cancel my BB?

2. After signed up with Serve via Softcard app, can I immediately do the $1500 credit card online load or do I have to wait until my physical Serve card arrived?

Thanks in advance!

I waited 24 hours to sign up, but others have told me they were able to do it immediately.

As for the load limits, a few people have said the limit was the normal $200 per day and $1,000 per month until they received and activated their physical card.

Be careful with the credit card loads. Some banks are now classifying them as cash advances. I recommend doing a small test load.

Hope this helps!

@ Shawn: thanks, it helps. I already maximize my BB load $5000 and spent it all to pay bills, if I cancel the BB today, wait 24 hours to apply Serve thru Softcard tomorrow, it will take around a week for my physical card to arrive right? then it will be almost end of month….do you think it is better to maximize the BB $5k again and cancel it then apply for Serve at beginning week of next month so I can maximize both?

Regarding the cash advance, what do you think among these banks’ credit cards, which will count as cash advance:

1. Chase

2. Citi

3. Barclay

4. US Bank

so when u unlinked due to you saying the number was your wifes, did they ask you for your number to update in system or did they just unlink the number to you and didnt ask questions? just want to know what to expect if i try this lol

i hv a question about the trick to get a 2nd softcard account on same phone.

if you were to uninstall soft card from your phone then use a new sim card with different number attached to it this wouldnt cause a problem correct?

was the reason you had to call and delink softcard was bc u were trying to use the same sim card?

In other word, The softcard app attaches to the sim card/ phone number not the actual phone correct?

im a little confused

You are correct. The Softcard account attaches to both the sim card and the phone number. In my case I was using a new sim card, however it was attached to the same number that had already been registered.

You can use different sims and numbers with the same phone without issue. You have it right.

[…] Express doesn’t want to see happen over and over. I have already recently switched from Bluebird to Serve and don’t want to rock the boat too much by switching again so soon, especially if they fix […]

I has several questions: if I use gift card which is paid by credit card to fund my serve account, do I have to go to Walmart in person everything time? What is the maximum amount per day with a ISIS Serve account? What is the best gift card to buy? I have heard people saying they can’t load Vanilla to their bluebird. Is that true for Serve account? Thanks!

1. Gift cards which have pins can be loaded to Bluebird or Serve at Walmart. Also, you can load Serve with gift cards at Family Dollar stores.

2. Serve ISIS Load Limits are $500 per day/$1500 per month for online credit card loads and $2500 per day/$5,000 per month for Cash/Debit in store loads.

3. Visa cards from U.S. Bank and Metabank work well. Vanilla cards work at some Walmart kiosks and at Family Dollar to load Serve according to some reports.

Hope that helps!

On a totally different note, can and if so how can one load Mastercard debit cards with pins (the ones you get at Staples) to PayPal? Thanks!

Shawn, I just installed Softcard and also opened a Serve account via the app….but, when I log into my Serve account, the max limit I can load with CC is $1000 and not $1,500. Do I need to do anything different?; also, on the Softcard, I can’t load BofA cards, only Chase and Amex. When I try to load BofA, it wants to take me to Serve Website. Also, should I wait for the actual Serve card to arrive before loading money?

Thanks.

I’m really not sure about the BofA issue with Softcard. That is the first time I have heard of such an issue. As for the limit, according to another reader, the increased limit doesn’t take effect until you activate your physical card. Once it comes, you should have the $1,500 limit. I am not sure if you should wait to load, however I probably would. It should only take a few days and that will make sure your full limit is intact.

[…] which currently is only available in select Target stores across the country is very much like the Serve & Bluebird […]

[…] cancelled my Bluebird card and switched it over to a Serve card. In case you missed it, I detailed how to make the switch and how to get the special Serve with Softcard (formerly ISIS) instead of the normal […]

Has anyone does any calculation on what would be the cost of manufactured spending using Serve and assuming you max out your CC ($1,5000) and debt card ($5,000) limits every month and use ATM to withdraw funds?

The cost would vary based on the methods you use for the $5,000 limit. There really is no need to use an ATM though. You can pay your bills directly from Serve or just transfer the money to your bank account.

[…] personally have switched over my Bluebird to a Serve card and detailed how you can to. Unfortunately for me, Walmart’s Savings Catcher makes […]

Just wanted to thank you for posting details of how you signed your wife up. With only 1 compatible phone I was wondering exactly the same thing, so you saved me a lot of trial and error. I had also wondered what would happen if I went into a Verizon store and used a display phone to sign up, then logged out of the app. This might even get me the Verizon signup bonus…

Not a bad idea. I’m glad this post helped!

Does anyone have any idea where on the serve site it says that you can load $1,500/month with a CC and Debit if you signed up with ISIS/softcard? All I see is the $1000/month. And is there any way to confirm that you are actually signed up as an “ISIS serve” account? Thanks guys.

This link takes you to a page on the Serve site showing the limits of the Serve with ISIS (Softcard). https://www.serve.com/help/#tap-and-pay-with-isis-17 Your Serve card will come in the mail with an ISIS logo on the front which is the main way to know. If you sign up through the app then you have an ISIS (Softcard) Serve card. If you sign up another way then you don’t.

I signed up for Serve via ISIS. Unfortunately this link (https://serve.com/help/#/#fees-and-limits-1) for checking my limits doesn’t seem to be working. And I seem to be limited to $200 per day in loads. Maybe it’s because I haven’t received and activated my physical Serve card yet. Hope so.

FYI – I really appreciate Shawn’s post, but I personally found the “trick” for using the same phone twice to be problematic. I’ll spare everyone the details (would take too long), but in retrospect I (me and my wife) would have just bought two $100 phones on Amazon (since we have iPhones) … and then sold them both when we were done.

Also, FYI – I found that, at least in my area, a lot of TMobile stores were out-of-stock on ISIS SIM cards. So definitely call a store and make sure the VERIFY they have them in-stock before you make a drive.

Click my link above and scroll down a little bit. You will see an image with the full load limits.

Thanks, Shawn. I did see that image. And I now realize that I should have a $500 per day limit (not $200). So the fact that I only have $200 limit right now worries me that I didn’t get credited with being an ISIS sign-up for Serve. But I’m hoping that it’s only a temporary thing, until I receive my physical Serve card and activate it. The website link you provided has a line that says: “If you have signed up for a Serve Account through the Isis Wallet, verified your email and activated the American Express Serve with Isis® Card you received in the mail, the following limits apply to your Serve with Isis Account”. That’s where I’m getting my hope that the $200 limit currently on my account will change to $500 after I activate my card. Hoping …

I’m actually thinking it is a typo on that image. (I missed it the first time I looked.)

I have only heard of the $200 daily limit from others and my limit is $200 as well, but I can do the full $1500 per month.

Well that’s a relief! I guess the only way for me to “test” the $1500 limit is to work my way above $1000, $200 at a time.

FYI & FWIW … when I went to the TMobile store, they charged me $10 for the plan (as per your post), but also said they HAD to charge me another $10 for the ISIS SIM card. When I pushed, they said they said that I either had to pay $10 for a new account activation or the ISIS SIM card fee – and they could waive one $10 charge or the other, but not both. So I’m in for $20. Still worth it.

Now a follow-up question. I’m going to try to follow your advice for signing up my wife using the same phone. When I go into the TMobile store, I just ask them for another ISIS SIM card? We’ll see if they give it to me for free or charge me another $10, but regardless they shouldn’t give me any hassle for wanting another SIM a day or two after I got my first one (is there a logical reason why I would need a second ISIS SIM)?? And you seem to imply in your post that I can use my same TMobile account … just changing the SIM, which I assume changes the phone number?

I had already activated my T-Mobile account online so perhaps that is why they didn’t charge me for the sim. They didn’t have to waive the activation fee.

As for the second sim, I just asked them for another sim for ISIS/Softcard and they gave it to me. They didn’t question the sim I already had, although I could have told them that ISIS/Softcard support told me I needed a new sim which they actually did.

Thanks for sharing this.

I do have one question: can OneVanilla or Vanilla visa card be successfully load to Serve at Walmart? Both of them can NOT be loaded to BB at Walmart now.

Thanks

Some people have had success loading OV cards to Serve/Bluebird at the Walmart kiosk. It worked for me about a month ago, but I have been traveling and haven’t tried it more recently.

wouldntyou need to go to tmobile to get the isis sim card bc dont they have to manually link it to your phone number? or is this something you can do yourself ?

also, please give me a break down of daily and monthly limits on isis serve.

is monthly as follows:

5,000 in combo of cash and/ or debit ( in store) + 1500.00 in credit cards ( online only) + 1500 in debit (online) so a total of 8,000 a month?

The T-Mobile store will link it right away which is the easiest way. If you get an ISIS sim in the mail, then you have to call and link it over the phone. As for the limits, you have them absolutely right!

Shawn, the Slickdeals thread you linked to suggests that if T-Mobile service is cancelled, Serve reverts to non-ISIS Serve. Presumably this would have happened to you (and would happen in the friend deleting ISIS situation as well). Is this untrue? Presumably your limits reset 9/1 so it has either worked or not? Any insight?

I have been traveling and haven’t done my loads for this month. I will be back on the 13th and will start the loads on that day. If anything changes I will update everyone. Thanks for the heads up.

Any update on whether you lose the ISIS/Softcard Serve features (the $1500/month load) if/when you cancel your T-Mobile plan?

My cards are still working for $1500 per month. Sorry for the delay. I was traveling most of the month and just did my loads this past week!

Glad to hear that! Thanks for the reply.

Too bad the $50 deal appears to have expired. Or at least nobody at Slickdeals has confirmed if it has been extended. Probably worth the time/expense without the $50 credit anyway. But if anyone knows about the $50 deal being extended (or not), please let us know!

A couple questions. If using a friends ISIS comparable phone to sign up, do they have to keep the app installed on their phone or can they delete it once I’m all signed up? You mentioned that when canceling BB to wait 24 hours and then use a different email address, does that apply when going through the ISIS app as well? Is there a way to use the same email address (ie wait a little longer)? Thanks. Excited to pair this with amazon payments for $2500 in free manufactured spend per month.

1. They do not need to keep the app. As soon as you sign up, a physical card will be sent. The Serve account will exist whether or not they have the app installed.

2. Yes the waiting period applies. It is based on anecdotal evidence that it takes a bit for their system to release your social security number so that you can get a new account.

3. As far as I know there is no way to use the same email address no matter how long you wait. The back-end system is the same for both cards, so the old email is linked to your closed Bluebird account.

I just called and canceled My Bluebird account. I did mention that I was canceling because I was switching to a serve account. The representative told me that I could sign up for a serve card after a couple minutes. I used the Isis app from my sister-in-law’s phone and was able to register for the serve card using my same email. The whole process took about 5 to 10 minutes.

Shawn – what do you think of Mike’s comment here? I haven’t cancelled my Bluebird yet (it is empty). And I just got my LG Optimus in the mail. I’m thinking about cancelling my BlueBird and then heading down to my TMobile store to get an ISIS/Softcard SIM card. But should I wait 24 ours to sign up for Serve via the Optimus app? And should I use a different email address? (would be nice to use the same one)

The latest info I have seen is that you can switch to the Serve almost immediately. I waited 24 hours and it worked well for me. I think going to the store for the sim is a good idea. Check the sim that came with your phone since it may already be an ISIS sim. It should say ISIS (or Softcard) on it if it will work. I switched my sim out in the T-Mobile store and it was quick and easy.

You do need to use a different email address for Serve then you used for Bluebird. It won’t allow you to sign up with the same address since it will say you already have an account with that email. Bluebird and Serve use the same account databases.

Thanks for the feedback!

[…] other day I wrote about how I converted my American Express Bluebird card to a Serve card using ISIS Wallet. The ISIS […]

Shawn,

Do you get a serve card in the mail if you set up the account via ISIS? How many days did it take?

Yes you do get a physical Serve card in the mail. It took about a week for mine to arrive!

Unfortunately looks like the $50 offer is over and hasn’t been renewed. At least as far as I can tell from the Slickdeals thread you linked. Probably still a good deal to get the extra $500/month credit card load.

I zero’d out my Bluebird in anticipation of jumping on this, but bummed I missed the $50 offer. I assume that I should wait to cancel my BB until I see that any final bills I paid have been processed on the other side (on the websites of the vendors I paid).

[…] Switching from Bluebird to Serve […]

Did you install the ISIS compatible SIM card before signing up the prepaid service plan?

I did, but in theory it doesn’t matter. If you have activated a non-ISIS sim then the T-Mobile store will switch it over for you in their system.

Being that I have an Iphone 5S, I would have to buy an ISIS compatible case to get ISIS. Would this cause any issues (especially since there is an ISIS app involved)? I’ve never heard of ISIS til today. Thanks

Nope as far as I have read there wouldn’t be any issues. You could install the app and use the case and then remove it later if you didn’t want to use ISIS anymore.

Hi Shawn,

I’ve just finished my first months $1000 spend to Serve with my spiffy new Chase Sapphire Card. I have a Chase United MileagePlus Explorer card with an authorized user (this card gives the authorized user the same account number as mine and his purchases rack up points to my United Frequent Flyer account). I’m thinking he should get a Serve card and load $1000 from the United Plus card. I’ve heard of Amex shutting down accounts that seem “hinky”. Do you think this will be red flag for our accounts either to Amex or Chase?

Tip: I use the Serve card to send a paper check to my landlord so I get points just for paying my rent. Yay!

Technically I think the rules for the Serve card say that the main cardholder of the account has to be the Serve cardholder. With that said, I don’t think Serve would have a problem if he has the AU card in his name and his loading his own Serve card. With that said, I haven’t done that so it is YMMV.

Other than that, based on my own experience I wouldn’t think you would have any problems, however there are always reports of some people getting their accounts closed. My advice would be to check out the Flyertalk thread for the latest info. http://www.flyertalk.com/forum/manufactured-spending/1199432-serve-another-paypal-amazon-payments-77.html

Great info, thank you. Couple of questions: (1) Any data points on whether B of A credit cards earn points when loading online? (2) I don’t have an ISIS [what an unfortunate name, BTW] compatible phone and the acquisition process you describe sounds cumbersome. If I borrow a friend’s phone for the one-time setup, is there any downside (for either the friend or myself) aside from not having ongoing access to offers via app? My friends are totally not into MS so I don’t think I’ll be using up anyone’s SIM “quota.”

BTW, the Bluebird paper checks are a PITA for reasons beyond what you describe. I use them to pay rent and the landlord (a large, public company) cannot “deposit” them electronically like normal checks. Occasionally there is a new employee at the management company who doesn’t know that and tries to electronically deposit it. The transaction rejects several days later (not immediately). By then, they’ve shredded the physical check and have to ask me for a replacement check. I then have to call BB to stop payment the original check and then write a new once, which means repeating the same pre-auth process. Rather annoying.

People have reported that loads made with BofA cards reports as purchases. http://www.flyertalk.com/forum/manufactured-spending/1199432-serve-another-paypal-amazon-payments-77.html

There shouldn’t be any issue using a friend’s phone for signing up for ISIS. In fact, that is a great avenue to go down if it is available to you. The ISIS account can be in anyone’s name and doesn’t have to match the name on the cell phone bill.

As far as Bluebird checks, I have heard other horror stories similar to yours. I just use the online bill pay and thus haven’t ever had to write one of those checks. I think it is better to either bill pay online or transfer the money to a regular checking account and write the check from there.

Thanks Claire!

Do you know if an Amex gift card can be used to load serve through the online method?

I have never tried that, but most prepaid cards do not work. The credit card used has to be a primary card and in the same name as the Serve card. For example I have to load my Serve card with my own credit cards and my wife the same. Like I said, I haven’t heard specifically of Amex prepaid cards being blocked, but my guess is that they won’t work given the fact that almost all other prepaid cards are blocked.

IF we currently have regular Serve accounts, can we still sign up via T-Mobile ISIS and get the credit?

Yes. According to that thread on Slickdeals, people have had success closing down their regular Serve account and signing back up through ISIS. The process is the same as with Bluebird. Call to cancel, wait 24 hours and then sign up through the app. Check the thread for the latest details on that.

So Serve has a $5000 monthly load limit of which $1500 can be directly from a credit card?

Serve has a $5,000 per month cash load limit. (These are the type of loads you do at Walmart for example.) The $1,500 online credit card limit is seperate from that and is done online. You can even setup automated loads. Here is a link to Serve’s site with a list of all of the limits. https://www.serve.com/help/

Effectively with Serve (ISIS version) you get $6,500 per month of which $5,000 is in-store loads and $1,500 is online credit card loads. Additionally you can load another $1,500 online with a debit card. (This only makes sense if your debit card earns rewards.)

But without ISIS(bad name these days), we can load $5000(at Wally World) of VGC’s say from Kroger, and $1000 from a CC(hopefully not coding as cash advance) in $200 increments over the month.

That is correct.

Thanks for the great post (as always), Shawn.

I haven’t read the Frequent Miler’s post that you linked to yet, but a few quick questions:

1) Does Serve mostly work the same way as Bluebird (other than the lack of checks and foreign fees)? Most importantly, I’m assuming the loading with gift/debit cards at Walmart (whether self-serve or via cashier) is the same?

2) Sounds like you don’t miss having Bluebird checks. But is there any way to cut a check via Serve? I’m thinking of situations where strangely paying with cash or check is still the only (or only convenient) option.

3) Are there any credit cards (banks) you need to worry about using for loading Serve? For example, does Citi code it as a cash advance?

4) Finally, I’m assuming there wouldn’t be any category bonuses for loading Serve. So I suspect your first choice for loading Serve (online via credit card) would be meeting minimum spend on new cards. But, beyond that, what card(s) do you prefer to use? Beyond minimum spending on new cards (and without any category bonuses), is there anything better to use than just he 2%’ish back cards (Barclays Arrival, Capital One Venture, etc.)? I guess arguably a 1 pt/$ Ultimate Rewards card is worth arguably/roughly the same as 2%. But am I missing a better option??

Thanks again!

Thanks and I am happy to answer the questions.

1. It works the same at Walmart and can be loaded the same as Bluebird.

2. If you pay someone through their online Billpay then a check will be sent. This works the same with Bluebird. The only thing you don’t have are physical checks in your possession that you can write yourself. This was never really a useful feature anyway because you had to get a pre-authorization and it was a big pain. It is much easier just to use the billpay to automatically cut a check.

3. As far as I know every bank is safe, however if you use an Amex card then you won’t earn points. I have personally used a Citi card and it codes as a purchase.

4. Serve won’t earn you a category bonus so it is best used to meet minimum spends. Outside of that my current favorite card is the Arrival Plus, but any of the 2% cards would be your best option I think.

Thanks for the quick replies. Glad I am thinking about it the right way. Seems like a great move to make, to accomplish $1500 of the $5000 per month of loading much more easily.

@marshdom, the $1500 is in addition to the $5k. Actually, you can do $1500 by CC, $1500 by debit card (useful for those with the SunTrust Skymiles debit card), and $5k by vanilla reload of WM swipe reload per month, for a total of $8k/month.

Thanks for the reply, Autolycus. Not to pick nits, but isn’t it $1000/month for Debit? And do you (or anyone) know of any reward debit cards still available (that are worth the time/effort)? And are Vanilla Reloads still available? If so, where is the best place(s) to buy them (I don’t have CVS in my area – but thought that deal went away anyway) and in what denomination? I’ve been relying on Metabank and USBank Visa gift cards. Thanks again (and in-advance to you or anyone else who replies).

The Flyertalk Wiki on Serve says the limit is $1500 for debit loads.

I do not think there are any useful reward debit cards, per se, available for new customers, but it could be a way to unload from some of reloadable debit cards. I don’t know about that though, so read up on Flyertalk and/or slickdeals to see if anything like PayPal, GreenDot, etc. can be used.

Vanilla Reloads are still available some places with a CC. Not many, but some. Mostly gas stations.

Best current way to get money into BlueBird and Serve in large quantities is what you’re already doing: visa gift cards loaded at WM.

So with the Serve w/ ISIS, you should be able to do at least $6500 in CC spend each month. Possibly more. I’d be able to do $8k, but I still have reasons to stick with BlueBird for now, so I’m limited to just $6k ($5k swipe plus $1k debit).