Should You Cancel Or Downgrade Your Credit Card? Factors To Consider.

Should I cancel or downgrade my credit card? It’s a common decision in this hobby. There are many factors to consider in this decision, so let’s look at them. How you weigh them can change, depending on your situation. Each situation is unique, but here are guiding principles and important items to think about when deciding whether to cancel or downgrade a credit card.

Why Does This Matter?

Most credit cards have an annual fee. When the fee rolls around, we have a decision to make: do I keep the card and pay the fee? In order to save costs, do the math on whether paying the fee is worth it for the benefits you get out of the card. The other option is a retention call, where you ask the bank to make you an offer to keep the card rather than closing it. Here are the current offers we’ve seen lately.

If you feel the annual fee isn’t justified by the benefits you’ll get out of the card in the next year, the “retention offer” from the bank might change your mind. If not, it’s time to decide what to do. Will you cancel or downgrade that credit card to avoid paying the fee?

Downgrade Card Options

The first thing to consider is what card you could downgrade to. Not every card has a downgrade option. If you have the Chase Sapphire Reserve, you could downgrade to several different cards: Chase Sapphire Preferred, Chase Freedom, or Chase Freedom Unlimited. All of these cards are in the same “family”, so you can change between them.

Other times, there exist downgrade options that are not publicly visible on the bank’s website. My wife and I both downgraded the United Explorer Card ($95 annual fee) to the version with no annual fee. We earn miles at a lower rate, but we aren’t paying the annual fee and still get some of the perks.

On the flip side, maybe the card has no options to which you can downgrade. I can’t downgrade my Barclays AAdvantage Aviator Business Mastercard when the fee posts next week. There’s no lower option. Keep the card or cancel it; those are the choices.

A Note About Citi

Citi does something differently that deserves a special look. Other banks and credit card issuers require you to change cards within a product “family”. At Chase, I can’t change a card that earns United miles into a card that earns points with Marriott hotels. However, Citi does let you change what type of card you have.

There’s a good write-up here on the rules, timelines, and how it works in practice. It’s worth drawing attention to Citi allowing you to “product change”, which gives you many more options when it’s time to considering canceling or downgrading your card. Last week, I changed my Citi AAdvantage Platinum Select card into the Costco Anywhere Visa Card by Citi. However, Citi doesn’t allow you to change card types for business cards, just personal. As far as timing, Citi will not allow you to change cards that are less than 1 year old, and the first annual fee must post before you can change. If the card is more than 1 year old, you can change any time.

A Note About Personal vs Business Cards

It’s also worth noting that you can’t change between these. You cannot change a business card to a personal card or vice versa. When making your plan and weighing options for canceling vs downgrading a credit card, make sure you know this isn’t possible. This applies to all lenders.

A Note About American Express

Remember that American Express has “once in a lifetime” rules on their welcome offers. If you’ve had the Delta SkyMiles Gold Card in the past, you can’t get a welcome offer on that card. Think twice before downgrading your Delta SkyMiles Platinum Card to the Gold option. If you want to get the welcome offer on the Delta SkyMiles Gold Card in the future, don’t downgrade / product change to this card. You didn’t get any sign-up offer, but you “had” the card, so no welcome offer for you.

Losing Your Points / Miles

This is an important one. Will you lose your points or miles if you cancel the card? If so, you need to have a plan for this. For this discussion, we’ll look at 1) points that sit in your account at the bank and 2) points/miles that are somewhere else.

Number 2 is easy. Those are yours and they remain yours. Points that were sent to your Marriott or United accounts, for example, are yours to keep. Even though phone agents will read you some legal terms and mention your points when closing your credit card, points in your outside account at yours–even if you close the credit card used to earn them.

Number 1 is more complicated. Some programs allow you to share your points with others, which is a great way to not lose them. Also, if you have another card earning this same type of points, you won’t lose them, because the account is still active. An example of this is having the American Express Platinum Card even after you close the Business Platinum Card. Your points are safe, because you still have an account earning Membership Rewards.

However, if I no longer have an account earning the type of points associated with the card I just closed, I may lose my points. The bank will tell you the timeline, but it’s going to be 30 or 60 days in most situations. Make & follow a solid plan (share, transfer to a hotel/airline program, open another card) to make sure you don’t lose your hard-earned points.

Affecting Credit Age

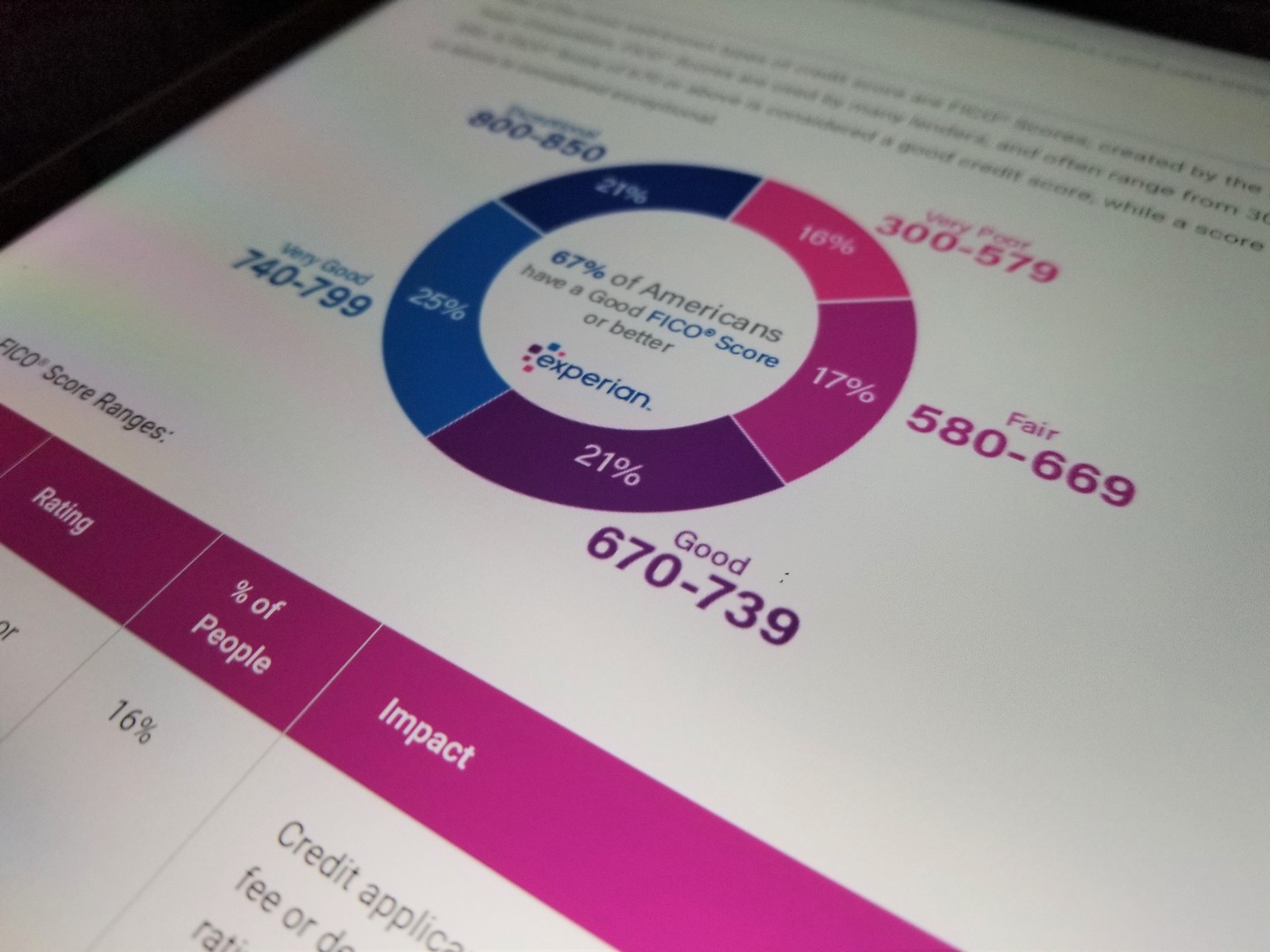

Credit age could be affected by this decision. In this, we are talking about average credit age of your accounts. If you have 2 credit cards that are 2 years old and a credit card that is 5 years old, your average age of credit is 3 years (2+2+5 / 3). After examining how credit scores are built in this article, we know that length of credit accounts for 15% of your credit score. Imagine if I close that credit card that’s 5 years old. My average age of credit drops to 2 years now. That can reduce my credit score, which makes getting approved for cards more difficult.

The best way to preserve credit history is downgrading a card. Consider how old this card is when making the decision. Credit cards will affect your history for 7 years, unless you keep them open past that. If you can change to a card with no fee and then hold onto it for a long time, this improves credit age on your credit reports. For most people in this hobby, a short average credit age plagues us, because we open so many new accounts. Weigh this factor into your decision.

Affecting Credit Usage Rate

Less likely to be affected than credit age, but it’s worth considering your credit usage in this decision. If deciding whether to cancel or downgrade a card will change this by several percent, then you need to factor this in. 30% of your credit score is from credit utilization or “how much you owe”. If the total of how much you can charge on your credit cards is $30,000, and across all of them you owe only $3,000, then your credit utilization rate is 10%.

Now imagine that I close a card with a credit limit of $10,000. My utilization rate just shot up from 10% to 15%. If you have a lot of cards with high limits, this likely isn’t a factor. However, do the math as part of this decision.

Upsetting The Bank

I’ve said before that this hobby isn’t a sprint, so thinking long term is important. Avoid upsetting the banks, or you can end up on a black list, get your accounts shut down, etc. If the bank gets mad at you for constantly closing your accounts as soon as you receive the points from your welcome offer, they’re not going to approve you for more cards / welcome offers in the future. They see you as unprofitable. American Express even has a pop-up warning telling you that you can’t get the welcome offer bonus points, and it shows this message to people getting too many bonuses, closing accounts too fast, etc.

The bottom line here is that you want to keep the bank happy–or at least happy enough that they’ll keep letting you sign up for new cards in the future. When deciding what to do with your card, ensure it doesn’t burn a bridge.

Making Space For Other Cards

Another big factor is whether you need to close this card to be able to get others. American Express has a new limit of 4 credit cards and 10 cards without a preset spending limit with them. Bank of America, Capital One & Discover limit how many cards you can have with them. If you have the maximum number already, you need to close a card before you can get another. This might solve the “cancel vs downgrade this credit card” conundrum for you.

Upgrade / Downgrade Cycle

We talked about downgrade options previously, and it’s worth coming back to end here. It can be a good idea to keep cards spread across different card “families” with American Express. What I mean is having a Hilton card, a Delta card, a card that earns Membership Rewards, etc. American Express is known for giving upgrade offers, which can be profitable for you to upgrade for a while, downgrade later, and then hope for another offer to upgrade again.

These are especially great when you aren’t eligible for a “new card” welcome offer from Amex for cards you’ve had before, since the upgrade offer is different and can give you points that way. These offers may be on pause right now, but this is worth considering as part of your decision on whether to cancel or downgrade your credit card to avoid the annual fee.

Final Thoughts On Whether to Cancel or Downgrade a Credit Card

Reducing your out-of-pocket costs related to annual fees is a great way to save money. It also makes make this hobby more lucrative. When the annual fee rolls around, even if you are sure you’ll keep the card, it doesn’t hurt to make a retention call.

If you’re pretty sure you don’t want to pay the fee to keep your credit card, then the decision becomes whether to keep or cancel it. We talked about factors related to your credit score in this decision. Also, we saw times when this decision is made for us (there are no cards to downgrade / product change to). We made sure we won’t lose our points / miles if we close the card. We also looked at the upgrade-downgrade cycle at American Express, so that we can keep earning more points in the future.

After considering all of these important things, you’re ready to make the right decision. Do the math, and always be informed when it comes to your credit.

Great article & tips my biggest mistake before I knew better was cancelling my first no-fee CC, Military Star card for no good reason other then I never used it (big mistake). That card would have had about 30 years of history. Cancelling it destroyed my average card history. I still have a 14 year NavyFed card helping my score but a ton of over cards over the last 4-5 years (when I got in the game) making my over all average less then 3 years which gives me a less then perfect score.

In addition to the overall card utilization % you mentioned, the individual card usage also temp affects the score. I have an upwards of $500k credit but every time I charge $30k each and max my 2% cards, overall it a small total % but my score always drops about 30 points and recovers once I pay them down below 50% utilization.

My lesson learned if you dont ever use the card and have no good reason (fees, chasing bonus or want to add a card) to cancel it just try to downgrade it to no-fee and shred it just to preserve the credit & account history.

Mike – the only thing I’d add is that ‘shredding it’ means you can’t ever use it. Banks are in the habit of closing inactive cards, so use them 2-3 times a year. Amazon $1 reloads into your account are great for this!

Any ideas on whether it’s worth it to keep the CIP since I just got approved for the CSP. I don’t see using them both for travel. And I do have a CIC as well as the other Freedom cards….

Henri – ink preferred has cell phone protection https://milestomemories.com/which-credit-cards-offer-cell-phone-insurance/

It also has some unique earning categories, if you’re using those. Otherwise, it’s not doing anything special to give you extra value from your URs.

If you are so cheap or broke you can’t afford the annual fees you shouldn’t be in this “hobby” (hate that word BTW since nothing about a hobby running payments through credit cards)

Personally I have around $2000 in annual fees (including CSR and Amex Platinum). For me that is an average night in a casino so basically a rounding error in my annual spend. The value I get is week worth it (even with limited travel options now) and not about to drop any of them. Frankly if this is even a thought for financial purposes you have bigger issues than credit cards!

The Brain – I think you didn’t actually read the article. Just being honest.

The point of the article is about cost vs benefit and never talks about being too cheap or not being able to afford something.

AC you never cease to amaze me.

Thanks for a good article Ryan. It’s unfortunate that people like “The Brain” exist in this world. Keep up the good work, and let “The Brain” enjoy his self-centered meaningless existence.

Ah the Karen/Brain is back why are you even here if you dont like “the game” and actual read the articles? Just because you can do something does not mean its smart or you should. Sure I could pay $5k for a flight but if I could get 100% same flight for $2k why pay $5k just because you could? You only do that if your 100% Brain-less.