How I’d Use 80K Citi ThankYou Points – Maximizing the Citi Premier Card

Citi just launched its best-ever welcome offer, so let’s look at maximizing the Citi Premier Card. What are the key perks and benefits? Does the card offer anything useful long term? And what’s the best way to spend those 80,000 Citi ThankYou points? In this article, we’ll take a deep dive into the Citi Premier card to look at the pluses and minuses of the card, things to know before applying, and also that elevated welcome offer. After we get to know the card, I’ll show you how I would go about maximizing the Citi Premier Card and the points earned from the welcome offer.

Update 6/14/22: The 80K offer is back! We no longer have Citi links so if you wanted to apply be sure to support a website or group you get value from (like our friends at Travel on Point(s)). It is always good to support free content!

Citi Premier Card Benefits

The Citi Premier Card has some lovers and some haters. Before we get into the long-term aspects of the card, here are the important details of the all-time best welcome offer:

- Type of card: personal

- Card issuer: Citi

- Application rules to follow: cannot open this card if you have received a welcome offer/upgraded/downgraded a card in the ThankYou Points family within the last 24 months, 8 days between personal cards with no more than 2 cards in 65 days, and sensitive to recent inquiries (6 in 6 months typically, but lately it’s more like 3 or less in the last 6 months). You can get this welcome offer even if you have received one on this card in the past. See the bank rules here.

- Spending requirements: $4,000 in 3 months

- Welcome offer: 80,000 Citi ThankYou Points

- Annual fee: $95

Citi Premier Card Benefits

- 3X ThankYou Points on grocery stores, gas stations, restaurants, hotels & airfare

- 1X ThankYou Points on All Other Purchases

Other Benefits

- Enjoy $100 off a single hotel stay of $500 or more, excluding taxes and fees, when booked through thankyou.com or 1-800-THANKYOU. This benefit will be available to you once per calendar year.

- The Premier comes with the ability to transfer ThankYou points to partner airlines and hotels.

- You gain access to Citi Private Pass.

- You can now cash out points at 1 cent a piece to your bank account or as a statement credit.

- They will sometimes run promos where you can get more than 1 cent per point on gift cards.

- No foreign transaction fees

Remember that Citi removed many of its travel insurance & protection plans from cards back in 2019. That means you won’t have trip delay/cancellation or car insurance, etc. when using this card.

What I Would Do With 80K Citi ThankYou Points

So…what would I do with 80,000 Citi ThankYou Points? Technically, you’re going to have more than that. After spending $4,000 on the Citi Premier Card, you’re going to have a minimum of 84,000 miles in your account. I’m going to use 84,000 points for trip planning.

ThankYou Points (or TYP) are a flexible currency. This means you can use them for many different things. You can transfer TYP to 15 different airline programs. Unlike earning miles with an airline or a hotel, your points aren’t locked into that program. If I earn Delta SkyMiles, I can’t send those points to a different airline program or transfer them to a hotel program of my choice. With Citi, I can.

So, what can we do if the goal is maximizing the Citi Premier Card? Here we go.

Anywhere In The US For Dirt Cheap With Turkish Airlines

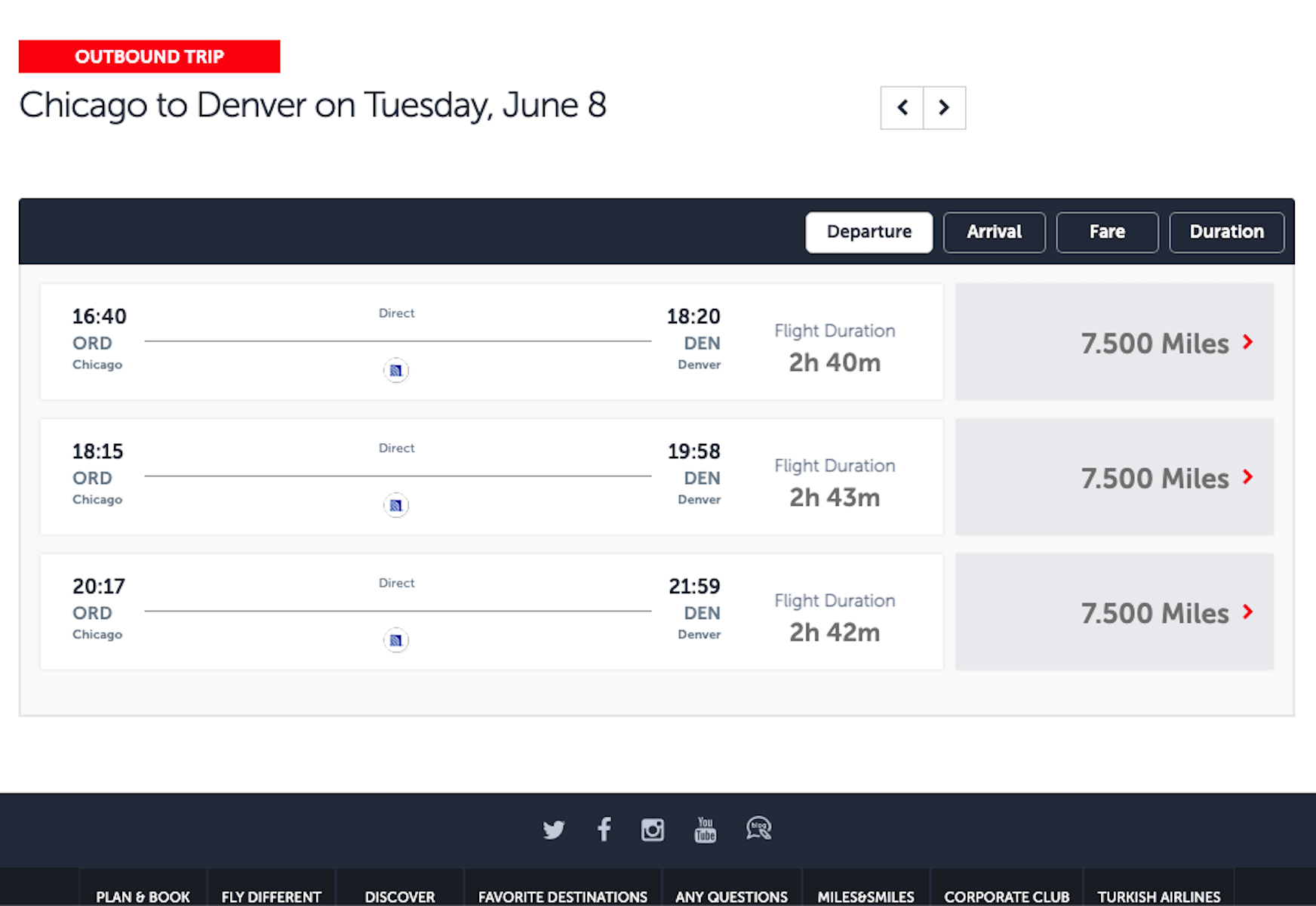

Probably the most famous use of Citi ThankYou Points, hands down. In fact, we call it the best TYP redemption. The Turkish Airlines award regions count all 50 states as one region, which means you could fly anywhere in the U.S. for just 7,500 miles one way in economy. It’s 12,500 miles for business class.

That means you could fly to Hawaii or Alaska for really, really cheap. Or visit far-way relatives you haven’t seen very often! Better yet: spend just 7,500 miles to visit them at Thanksgiving, when the cash price of flights is ridiculous. And since these are domestic flights, you’ll pay just $5.60 in mandatory taxes.

Business Class With 2 Vacations In 1! Hawaii + Central America / Caribbean

Singapore Airlines’ KrisFlyer program is a transfer partner of Citi TYP. Interestingly, the Singapore award chart considers Hawaii and the whole of Mexico/Central America/Caribbean to be all in one zone.

This means that flying from Hawaii to Mexico or the Caribbean is within the same zone!

You could use the above option for Turkish Airlines and fly to Hawaii for 12,500 miles in business class. That’s from anywhere in the U.S., so look at lie-flat options to Hawaii. If you can’t find availability, then you could use Singapore KrisFlyer for 12,000 miles in economy to Hawaii (must be a direct flight).

From Hawaii, we can fly to anywhere in the Mexico-Caribbean-Central America region. We’ll use United, since that is the available partner. That’s a lot of flying, so we’ll go business class. You’ll need only 34,500 miles.

Depending on where home is and where you go around the Caribbean, you’ll have 2 options.

- Turkish Airlines: they consider Mexico to be in the North America region. Coming back to the US will only cost you 15,000 miles in business class.

- Asia Miles: use this oneworld carrier to fly home on American Airlines. Expect to pay 25-30,000 miles for business class, depending on distance.

We flew business class to Hawaii, from there to the Caribbean, and from there back home to the U.S. All things considered, this 2-in-1 vacation will use up around 72,000 miles, depending on your Caribbean locale and how far that is from your home in the U.S.

Lufthansa First Class

Now that you can travel to much of Europe from the U.S., why not fly in style? Take the drooled-over Lufthansa first class to get there. We’ll book with Avianca LifeMiles for a few reasons.

- Their mileage requirements are better than some others.

- They don’t tack on the crazy fees you get when booking Lufthansa through other programs. More on that here.

- The number of miles needed goes down based on an ‘average’ of your flights.

From those 3 items, LifeMiles is the best program to use for Lufthansa first class from the U.S. toEurope. We’ll save hundreds in cash and can be smart in our booking to bring the number of miles down.

The MOST miles you would need is 87,000. That’s for just a long, single flight in first class and then the trip ends. However, with the ‘average’ that LifeMiles uses, adding a connecting flight in business class or even economy will bring the ‘average’ of your flight type down. This reduces the number of miles you need, based on a weighted score of cabin type & distance across the whole trip. Add a connection to elsewhere in Germany or Europe to bring the cost down. And if all else files, LifeMiles has a “points+cash” feature, where you could pay the difference up to that 87,000 miles.

Remember that Lufthansa doesn’t give any first class award space to partners more than 15 days before the flight, so you’ll have to book this last minute.

Final Thoughts On Maximizing the Citi Premier Card

If you’re maximizing the Citi Premier Card and its welcome offer of 80K Citi ThankYou Points, I hope you found some good ideas here. First, we looked at the card–the welcome offer and the long-term benefits. Then, we looked at ideas for maximizing those 80,000 points for some great trips.

Remember that you can do other things with ThankYou Points, as well. You can redeem them for gift cards or cash them out directly. If you also have a Rewards+ card you will get 10% of those points back up to 10,000 points per year.

There’s also our previous guide to great uses of Singapore Airlines miles, which is one of Citi’s partners. Added flexibility comes from the fact that Citi lets you share points with others in your household, and many of their transfer programs let you make bookings for others.

Let me know how you use your new Citi ThankYou Points!

No QATAR business class on list

[…] you are somehow open for Citi card slots, maybe the 80k Citi Premier card is for you: How I’d Use 80K Citi ThankYou Points – Maximizing the Citi Premier Card. Some of the uses in this post are for advanced hobbyists. But still, 80k is hard to bypass. You […]

u mention turkish miles… how do u find availability i use united chart and try to book but none how far in advance do u need and is the other airlines the same tia

You can either call Turkish or search on their website. There’s a good guide here. https://frequentmiler.com/turkish-miles-smiles-complete-guide/#Step-by-step_guide_to_booking_Turkish_Miles_Smiles_award_tickets